Supercuts 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

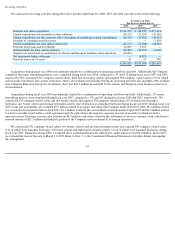

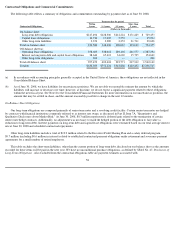

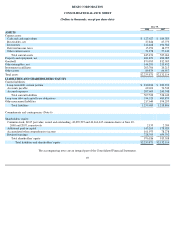

employee health and workers' compensation claims for which we are self-insured. The majority of our recorded liability for self-insured

employee health and workers' compensation losses represents estimated reserves for incurred claims that have yet to be filed or settled.

The Company has unfunded deferred compensation contracts covering certain management and executive personnel. The deferred

compensation contracts are offered to key executives based on their accomplishments within the Company. Because we cannot predict the

timing or amount of our future payments related to these contracts, such amounts were not included in the table above. Related obligations

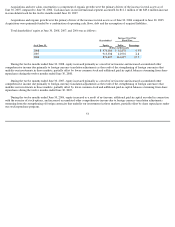

totaled $20.2, $20.1, and $15.3 million at June 30, 2008, 2007, and 2006, respectively, and are included in other noncurrent liabilities in the

Consolidated Balance Sheet. Refer to Note 9 of the Consolidated Financial Statements for additional information. The obligations are funded by

insurance contracts.

Off-Balance Sheet Arrangements

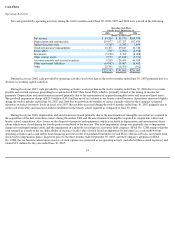

Operating leases primarily represent long-term obligations for the rental of salon and hair restoration center premises, including leases for

company-owned locations, as well as future salon franchisee lease payments of approximately $156.8 million, which are reimbursed to the

Company by franchisees. Regarding the franchisee subleases, we generally retain the right to the related salon assets net of any outstanding

obligations in the event of a default by a franchise owner. Management has not experienced and does not expect any material loss to result from

these arrangements.

Other long-term obligations represent our guarantees, primarily entered into during previous fiscal years, on a limited number of equipment

lease agreements between our salon franchisees and leasing companies. If the franchisee should fail to make payments in accordance with the

lease, we will be held liable under such agreements and retain the right to possess the related salon operations. We believe the fair value of the

salon operations exceeds the maximum potential amount of future lease payments for which we could be held liable. The existing guaranteed

lease obligations, which have an aggregate undiscounted value of $0.2 million at June 30, 2008, terminate within fiscal year 2009. The Company

has not experienced and does not expect any material loss to result from these arrangements.

We have interest rate swap contracts and forward foreign currency contracts. See Part II, Item 7A, "Quantitative and Qualitative Disclosures

about Market Risk," for a detailed discussion of our derivative instruments. Future net settlements under these agreements are not included in the

table above.

We are a party to a variety of contractual agreements under which we may be obligated to indemnify the other party for certain matters,

which indemnities may be secured by operation of law or otherwise, in the ordinary course of business. These contracts primarily relate to our

commercial contracts, operating leases and other real estate contracts, financial agreements, agreements to provide services, and agreements to

indemnify officers, directors and employees in the performance of their work. While our aggregate indemnification obligation could result in a

material liability, we are not aware of any current matter that we expect to result in a material liability.

We do not have other unconditional purchase obligations or significant other commercial commitments such as commitments under lines of

credit and standby repurchase obligations or other commercial commitments.

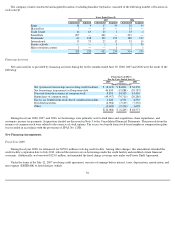

Under the terms of the July 12, 2007 revolving credit facility, our ratio of earnings before interest, taxes, depreciation, amortization and rent

expense (EBITDAR) to fixed charges (which includes rent and interest expenses) may not drop below 1.50 on a rolling four quarter basis. We

were in compliance with all covenants and other requirements of our credit agreements and senior notes during fiscal year 2008 and are currently

in fiscal 2009. Additionally, the credit agreements do not include rating triggers or subjective clauses that would accelerate maturity dates.

59