Supercuts 2008 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2008 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285

|

|

Hair Restoration Business Strategy:

In December 2004, the Company acquired Hair Club for Men and Women (Hair Club), the largest U.S. provider of hair loss solutions and

the only company offering a comprehensive menu of proven hair loss products and services. The Company leverages its strong brand, best-in-

class service model and comprehensive menu of hair restoration alternatives to build an increasing base of repeat customers that generate

recurring cash flow for the Company. From its traditional non-surgical hair replacement systems, to hair transplants, hair therapies and hair care

products and services, Hair Club offers a solution for anyone experiencing or anticipating hair loss. The Company's operations consist of

92 locations (35 franchise) in the United States and Canada. The domestic hair restoration market is estimated to generate over $4 billion

annually. The competitive landscape is highly fragmented and comprised of approximately 4,000 locations. Hair Club and its franchisees have

the largest market share, with approximately five percent based on customer count.

In an effort to provide privacy to its customers, Hair Club offices are located primarily in office and professional buildings within larger

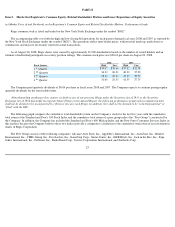

metropolitan areas. Following is a summary of the company-owned and franchise hair restoration centers in operation at June 30, 2008, 2007,

and 2006:

Hair Restoration Growth Opportunities. The Company's hair restoration center expansion strategy focuses on organic growth

(successfully converting new leads into customers at existing centers, broadening the menu of services and products at each location and to a

lesser extent, new center construction) and acquisition growth.

Organic Growth. The hair restoration centers' business model is driven by productive lead generation that ultimately produces

recurring customers. The primary marketing vehicle is direct response television in the form of infomercials that create leads into the hair

restoration centers' telemarketing center. Call center employees receive calls and schedule a consultation at a local hair restoration

company-owned or franchise center. At the consultation, sales consultants assess

17

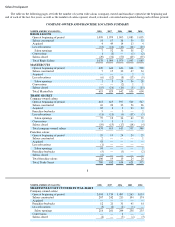

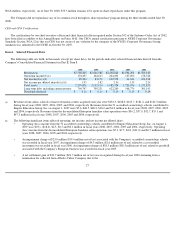

2008

2007

2006

Company

-

owned hair restoration centers:

Open at beginning of period

49

48

41

Constructed

3

—

1

Acquired

—

1

1

Franchise buybacks

6

1

7

Less relocations

(1

)

—

(

1

)

Site openings

8

2

8

Sites closed

—

(

1

)

(1

)

Total company

-

owned hair restoration centers

57

49

48

Franchise hair restoration centers:

Open at beginning of period

41

42

49

Acquired

2

3

—

Franchise buybacks

(6

)

(1

)

(7

)

Less Relocations

(2

)

(2

)

—

Site openings

(6

)

—

(

7

)

Sites closed

—

(

1

)

—

Total franchise hair restoration centers

35

41

42

Total hair restoration centers

92

90

90