Supercuts 2008 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2008 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

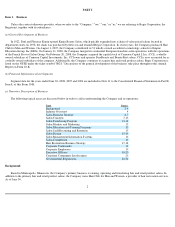

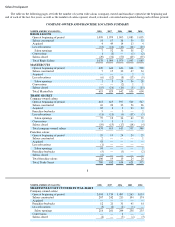

fiscal years 2008, 2007, and 2006, the percentage of company-owned service revenues attributable to each of these services was as

follows:

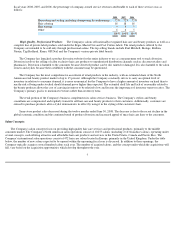

High Quality, Professional Products.

The Company's salons sell nationally recognized hair care and beauty products as well as a

complete line of private label products sold under the Regis, MasterCuts and Cost Cutters labels. The retail products offered by the

Company are intended to be sold only through professional salons. The top selling brands include Paul Mitchell, Biolage, Redken,

Nioxin, Tigi Bedhead, Kenra, OPI Nail and the Company's various private label brands.

The Company has launched a product diversion website for the entire industry to use as a measurement tool to track diversion.

Diversion involves the selling of salon exclusive hair care products to unauthorized distribution channels such as discount retailers and

pharmacies. Diversion is harmful to the consumer because diverted product can be old, tainted or damaged. It is also harmful to the salon

owners and stylists because their credibility with the consumer may be questioned.

The Company has the most comprehensive assortment of retail products in the industry, with an estimated share of the North

American retail beauty product market of up to 15 percent. Although the Company constantly strives to carry an optimal level of

inventory in relation to consumer demand, it is more economical for the Company to have a higher amount of inventory on hand than to

run the risk of being under stocked should demand prove higher than expected. The extended shelf life and lack of seasonality related to

the beauty products allows the cost of carrying inventory to be relatively low and lessens the importance of inventory turnover ratios. The

Company's primary goal is to maximize revenues rather than inventory turns.

The retail portion of the Company's business complements its salon services business. The Company's stylists and beauty

consultants are compensated and regularly trained to sell hair care and beauty products to their customers. Additionally, customers are

enticed to purchase products after a stylist demonstrates its effect by using it in the styling of the customer's hair.

Same-store product sales decreased during the twelve months ended June 30, 2008. The decrease is due to the recent decline in the

global economic condition and the continued trend of product diversion and increased appeal of mass hair care lines to the consumer.

Salon Concepts:

The Company's salon concepts focus on providing high quality hair care services and professional products, primarily to the middle

consumer market. The Company's North American salon operations consist of 10,273 salons (including 2,163 franchise salons), operating under

several concepts, each offering attractive and affordable hair care products and services in the United States, Canada and Puerto Rico. The

Company's international salon operations consist of 472 hair care salons located in Europe, primarily in the United Kingdom. Under the table

below, the number of new salons expected to be opened within the upcoming fiscal year is discussed. In addition to these openings, the

Company typically acquires several hundred salons each year. The number of acquired salons, and the concept under which the acquisitions will

fall, vary based on the acquisition opportunities which develop throughout the year.

7

2008

2007

2006

Haircutting and styling (including shampooing & conditioning)

72

%

72

%

72

%

Hair coloring

18

18

18

Hair waving

4

4

5

Other

6

6

5

100

%

100

%

100

%