Supercuts 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. BUSINESS DESCRIPTION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

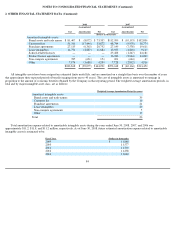

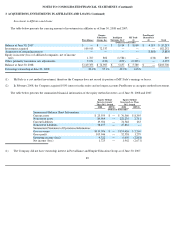

in compensation expense did not impact basic or diluted earnings per share in fiscal year 2008. In fiscal years 2007 and 2006, the increase in

compensation expense reduced both basic and diluted earnings per share by $0.01 and $0.04, respectively. Compensation expense recorded

during fiscal years 2008, 2007 and 2006 includes $6.5, $3.9 and $2.3 million, respectively, related to awards issued subsequent to July 1, 2003

and $0.4, $1.0 and $2.7 million, respectively, related to unvested awards previously being accounted for on the intrinsic value method of

accounting.

Total compensation cost for stock-based payment arrangements totaled $6.8, $4.9 and $4.9 million ($4.2 and $3.2 and $3.2 million after

tax) for the fiscal years ended June 30, 2008, 2007 and 2006, respectively. SFAS No. 123R requires that the cash retained as a result of the tax

deductibility of increases in the value of stock-based arrangements be presented as a cash inflow from financing activity in the Consolidated

Statement of Cash Flows. The amount presented as a financing activity for fiscal years 2008, 2007 and 2006 was $1.4, $4.5 and $4.6 million,

respectively. Prior to fiscal year 2006, and the Company's adoption of SFAS No. 123R, the tax benefit realized upon the exercise of stock

options was presented as an operating activity (included within accrued expenses) and totaled $9.0 million for fiscal year 2005.

Recent Accounting Pronouncements:

In September 2006, the FASB issued Statement of Financial Accounting Standard (SFAS) No. 157, Fair Value Measures (SFAS No. 157).

SFAS No. 157 defines fair value, establishes a framework for measuring fair value and enhances disclosures about fair value measures required

under other accounting pronouncements, but does not change existing guidance as to whether or not an instrument is carried at fair value. SFAS

No. 157 is effective for fiscal years beginning after November 15, 2007 (i.e., the Company's first quarter of fiscal year 2009). In February 2008,

the FASB deferred SFAS No. 157's effective date for all non-financial assets and liabilities, except those items recognized or disclosed at fair

value on an annual or more frequently recurring basis, until years beginning after November 15, 2008 (i.e. the Company's first quarter of fiscal

year 2010). The Company is currently evaluating the impact of SFAS No. 157 on its Consolidated Financial Statements.

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and Financial Liabilities (SFAS No. 159).

SFAS No. 159 permits companies to choose to measure many financial instruments and certain other items at fair value. The objective is to

improve financial reporting by providing companies with the opportunity to mitigate volatility in reported earnings caused by measuring related

assets and liabilities differently without having to apply complex hedge accounting provisions. SFAS No. 159 is effective for fiscal years

beginning after November 15, 2007. Companies are not allowed to adopt SFAS No. 159 on a retrospective basis unless they choose early

adoption. The Company does not expect it will elect to adopt the provisions of SFAS No. 159.

In December 2007, the FASB issued SFAS No. 141(R), Business Combinations (SFAS No. 141(R)). SFAS No. 141(R) replaces SFAS

No. 141,

Business Combinations . SFAS No. 141(R) establishes principles and requirements for how an acquirer recognizes and measures in its

financial statements the identifiable assets acquired, the liabilities assumed, any noncontrolling interests in the acquiree and the goodwill

acquired. Some of the key changes under SFAS No. 141(R) will change the accounting treatment for certain specific acquisition related items

including: (1) accounting for acquired in process research and development as an indefinite-lived intangible asset until approved or discontinued

rather than as an immediate expense; (2) expensing acquisition costs rather than adding them to the cost of an acquisition; (3) expensing

restructuring costs in connection with an acquisition rather than adding

81