Supercuts 2008 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2008 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

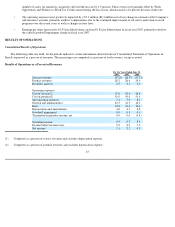

terminated merger agreement for Sally Beauty Company. The termination fee gain is net of direct transaction-related expenses

associated with the terminated merger agreement.

•

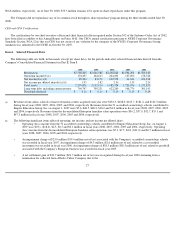

Adjustments were recorded in fiscal years 2008, 2007, 2006 and 2005 related to a change in estimate of the Company's self

-

insurance accruals, primarily prior years' workers' compensation claims reserves, due to the continued improvement of our safety

and return-to-work programs over the recent years as well as changes in state laws. Site operating expenses decreased by

$7.1 million ($4.3 million net of tax), $10.2 million ($6.7 million net of tax), and $2.3 million ($1.3 million net of tax) in fiscal

years 2008, 2007, and 2005, respectively, and increased by $1.0 million ($0.6 million net of tax) in fiscal year 2006 as a result in

the change in estimate.

•

Expenses of $10.5 million ($6.4 million net of tax), $6.8 million ($4.5 million net of tax), $8.4 million ($5.4 million net of tax),

$3.6 million ($2.0 million net of tax), and $3.2 million ($2.0 million net of tax) related to the impairment of property and

equipment at underperforming locations were recorded during fiscal years 2008, 2007, 2006, 2005, and 2004, respectively. The

$10.5 million impairment charge recognized during 2008 related to the Company's decision to close 160 underperforming salons

during fiscal year 2009.

•

A $6.5 million ($4.2 million net of tax) charge associated with disposal charges and lease termination fees related to the closure of

salons other than in the normal course of business was recorded in fiscal year 2006.

•

Fiscal year 2006 includes a $2.8 million ($1.8 million net of tax) charge related to the settlement of a wage and hour lawsuit under

the Fair Labor Standards Act (FLSA).

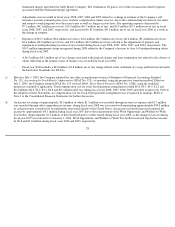

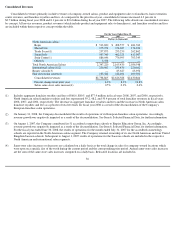

c) Effective July 1, 2003, the Company adopted the fair value recognition provisions of Statement of Financial Accounting Standard

No. 123, Accounting for Stock-Based Compensation (SFAS No. 123), as amended, using the prospective transition method. Effective

July 1, 2005, the Company adopted SFAS No. 123 (revised 2004), Share-Based Payment (SFAS No. 123R), using the modified

prospective method of application. Total compensation cost for stock-based payment arrangements totaled $6.8, $4.9, $4.9, $1.2 and

$0.2 million ($4.2, $3.2, $3.2, $0.8 and $0.1 million after tax) during fiscal years 2008, 2007, 2006, 2005 and 2004, respectively. Prior to

the adoption of these Statements, no compensation cost for stock-based payment arrangements was recognized in earnings. Refer to

Note 1 to the Consolidated Financial Statements for further discussion.

d)

An income tax charge of approximately $3.0 million of which $1.3 million was recorded through income tax expense and $1.7 million

was recorded through other comprehensive income. during fiscal year 2008 was associated with repatriating approximately $30.0 million

of cash previously considered to be indefinitely reinvested outside of the United States. An income tax benefit increased reported net

income by approximately $4.1 million during fiscal year 2007 due to the reinstatement of the Work Opportunity and Welfare-to-Work

Tax Credits. Approximately $1.3 million of this benefit related to credits earned during fiscal year 2006, as the change in tax law during

fiscal year 2007 was retroactive to January 1, 2006. Work Opportunity and Welfare-to-Work Tax Credits increased reported net income

by $0.8 and $1.8 million during fiscal years 2006 and 2005, respectively.

28