Supercuts 2008 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2008 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

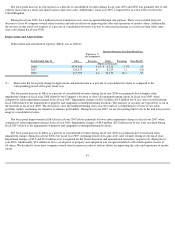

income tax benefits, including interest and penalties. As of June 30, 2008 the Company's unrecognized income tax benefits were $27.6 million.

See Note 8, to the Consolidated Financial Statements, for further information.

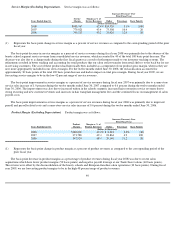

Stock-based Compensation Expense

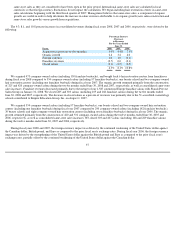

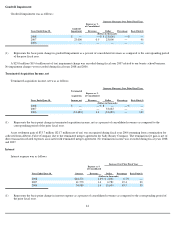

Compensation expense for stock-based compensation is estimated on the grant date using an option-pricing model. During fiscal years

2008, 2007, and 2006, stock-based compensation expense totaled $6.8, $4.9, and $4.9 million, respectively. Our specific weighted average

assumptions for the risk free interest rate, expected term, expected volatility and expected dividend yield are documented in Note 10 to the

Consolidated Financial Statements. Additionally, under SFAS No. 123R, we are required to estimate pre-vesting forfeitures for purposes of

determining compensation expense to be recognized. Future expense amounts for any particular quarterly or annual period could be affected by

changes in our assumptions or changes in market conditions.

Contingencies

We are involved in various lawsuits and claims that arise from time to time in the ordinary course of our business. Accruals are recorded for

such contingencies based on our assessment that the occurrence is probable, and where determinable, an estimate of the liability amount.

Management considers many factors in making these assessments including past history and the specifics of each case. However, litigation is

inherently unpredictable and excessive verdicts do occur, which could have a material impact on our Consolidated Financial Statements.

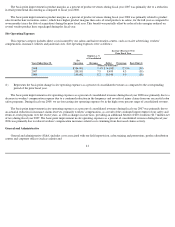

OVERVIEW OF FISCAL YEAR 2008 RESULTS

The following summarizes key aspects of our fiscal year 2008 results:

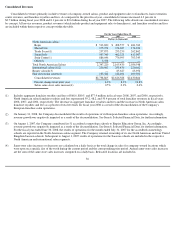

• Revenues increased 4.3 percent to $2.7 billion and consolidated same-store sales increased 0.5 percent during fiscal year 2008.

North American same-store service sales increased 3.8 and 3.3 percent during the third and fourth quarter of the fiscal year, the

Company's largest comparable increases in eight years. An increase in average ticket price was partially offset by the continued

decline in visitation patterns due to fashion trends resulted in an increase in consolidated same-store sales of 0.5 percent. The

revenue increase was partially offset by deconsolidation of accredited cosmetology schools and European franchise salon

operations. The Company expects fiscal year 2009 same-store sales growth to be 0.5 to 2.5 percent.

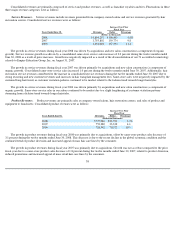

• A long-lived asset impairment charge of $10.5 million was recorded during fiscal year 2008 related to the approval of a plan to

close up to 160 underperforming company-owned salons in fiscal year 2009.

• Total debt at the end of the fiscal year was $764.7 million and our debt-to-capitalization ratio, calculated as total debt as a

percentage of total debt and shareholders' equity at fiscal year end, increased 20 basis points to 43.9 percent as compared to

June 30, 2007.

• Share repurchases of $50.0 million and $79.7 million occurred during fiscal years 2008 and 2007, respectively.

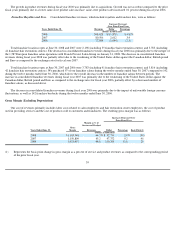

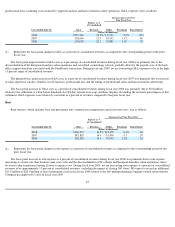

• The effective income tax rate was adversely impacted by $3.0 million tax charge, of which $1.3 million was recorded through

income tax expense and $1.7 million was recorded through other comprehensive income. primarily associated with repatriating

approximately $30.0 million of cash previously considered to be indefinitely reinvested outside of the United States, which

caused a 1.0 percent increase in the rate. The joint venture partnership with Franck Provost Group resulted in higher overall taxes

being paid by Regis due to Regis' income being subject to higher overall tax rates. In addition, Texas passed a new gross margins

tax which, together with a

34