Supercuts 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

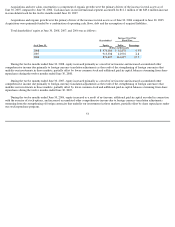

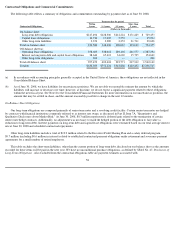

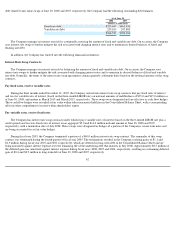

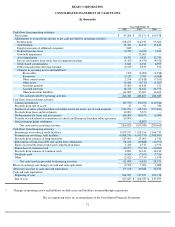

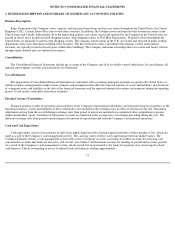

Tabular Presentation:

The following table presents information about the Company's debt obligations and derivative financial instruments that are sensitive to

changes in interest rates. For fixed rate debt obligations, the table presents principal amounts and related weighted-

average interest rates by fiscal

year of maturity. For variable rate obligations, the table presents principal amounts and the weighted

-average forward LIBOR interest rates as of

June 30, 2008 through June 30, 2013. For the Company's derivative financial instruments, the table presents notional amounts and weighted-

average interest rates by expected (contractual) maturity dates. Notional amounts are used to calculate the contractual payments to be exchanged

under the contract.

**

Expected maturity date as of June 30,

June 30, 2008

June 30,

2007

2009 2010 2011 2012 2013

Thereafter

Total

Fair Value

Fair Value

Liabilities

(U.S.$ equivalent in thousands)

Long

-

term debt:

Fixed rate (U.S.$)

$

91,124

$

53,521

$

91,790

$

93,885

$

53,898

$

141,429

$

525,647

$

531,924

$

460,557

Average interest rate

7.1

%

6.0

%

6.0

%

7.0

%

5.4

%

5.6

%

6.2

%

Variable rate (U.S.$)

139,100

—

—

—

70,000

30,000

239,100

239,100

247,800

Average interest rate

3.0

%

3.3

%

3.4

%

3.2

%

Total liabilities

$

230,224

$

53,521

$

91,790

$

93,885

$

123,898

$

171,429

$

764,747

$

771,024

$

708,357

Interest rate derivatives

(U.S.$ equivalent in thousands)

Pay variable/receive fixed (U.S.$)

$

5,000

—

—

—

—

—

$

5,000

$

—

$

—

Average pay rate**

4.6

%

4.6

%

Average receive rate**

7.1

%

7.1

%

Pay fixed/receive variable (U.S.$)

—

—

—

—

35,000

$

15,000

$

50,000

$

1,366

$

(1,728

)

Average pay rate**

2.8

%

2.8

%

Average receive rate**

4.8

%

4.9

%

Represents the average expected cost of borrowing for outstanding derivative balances as of June 30, 2008.

Foreign Currency Exchange Risk:

The majority of the Company's revenue, expense and capital purchasing activities are transacted in United States dollars. However, because

a portion of the Company's operations consists of activities outside of the United States, the Company has transactions in other currencies,

primarily the Canadian dollar, British pound and Euro. In preparing the Consolidated Financial Statements, the Company is required to translate

the financial statements of its foreign subsidiaries from the currency in which they keep their accounting records, generally the local currency,

into United States dollars. Different exchange rates from period to period impact the amounts of reported income and the amount of foreign

currency translation recorded in accumulated other comprehensive income. As part of its risk management strategy, the Company frequently

evaluates its foreign currency exchange risk by monitoring market data and external factors that may influence exchange rate fluctuations. As a

result, the Company may engage in transactions involving various derivative instruments to hedge assets,

63