Supercuts 2008 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2008 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

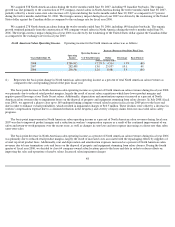

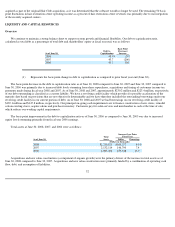

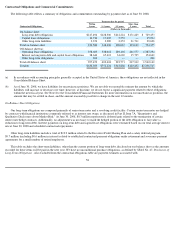

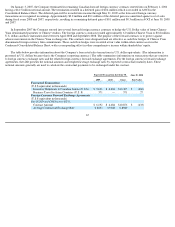

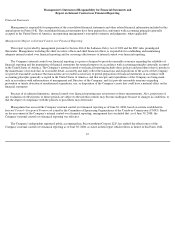

Contractual Obligations and Commercial Commitments

The following table reflects a summary of obligations and commitments outstanding by payment date as of June 30, 2008:

(a)

Payments due by period

Contractual Obligations

Within

1 years

1-3 years

3-5 years

More than

5 years

Total

(Dollars in thousands)

On

-

balance sheet:

Long

-

term debt obligations

$

217,494

$

128,306

$

212,224

$

171,429

$

729,453

Capital lease obligations

12,730

17,005

5,559

—

35,294

Other long

-

term liabilities

2,356

3,289

2,252

21,711

29,608

Total on

-

balance sheet

232,580

148,600

220,035

193,140

794,355

Off

-

balance sheet(a):

Operating lease obligations

358,603

538,012

289,102

201,577

1,387,294

Interest on long

-

term debt and capital lease obligations

38,644

65,612

34,669

15,735

154,660

Other long

-

term obligations

206

—

—

—

206

Total off

-

balance sheet

397,453

603,624

323,771

217,312

1,542,160

Total(b)

$

630,033

$

752,224

$

543,806

$

410,452

$

2,336,515

In accordance with accounting principles generally accepted in the United States of America, these obligations are not reflected in the

Consolidated Balance Sheet.

(b) As of June 30, 2008, we have liabilities for uncertain tax positions. We are not able to reasonably estimate the amount by which the

liabilities will increase or decrease over time; however, at this time, we do not expect a significant payment related to these obligations

within the next fiscal year. See Note 8 to the Consolidated Financial Statements for more information on our uncertain tax positions, the

amount that may be settled in chase, and the amount reasonably possible to change in the next 12 months.

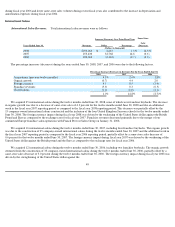

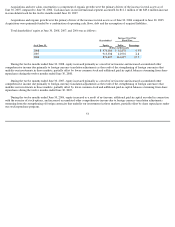

On-Balance Sheet Obligations

Our long-term obligations are composed primarily of senior term notes and a revolving credit facility. Certain senior term notes are hedged

by contracts with financial institutions commonly referred to as interest rate swaps, as discussed in Part II, Item 7A, "Quantitative and

Qualitative Disclosures about Market Risk." At June 30, 2008, $0.3 million represented a deferred gain related to the termination of certain

interest rate hedge contracts. Additionally, no adjustment was necessary to mark the hedged portion of the debt obligation to fair value (a

reduction to long-term debt). Interest payments on long-

term debt and capital lease obligations were estimated based on our total average interest

rate at June 30, 2008 and scheduled contractual repayments.

Other long-term liabilities include a total of $19.9 million related to the Executive Profit Sharing Plan and a salary deferral program,

$9.7 million (including $0.6 million in interest) related to established contractual payment obligations under retirement and severance payment

agreements for a small number of retired employees.

This table excludes the short-term liabilities, other than the current portion of long-term debt, disclosed on our balance sheet as the amounts

recorded for these items will be paid in the next year. We have no unconditional purchase obligations, as defined by SFAS No. 47, Disclosure of

Long

-Term Obligations . Also excluded from the contractual obligations table are payment estimates associated with

58