Supercuts 2008 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2008 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

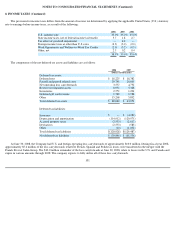

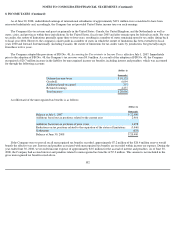

8. INCOME TAXES (Continued)

It is reasonably possible that the amount of the unrecognized tax benefit with respect to certain of our unrecognized tax positions will

increase or decrease during the next twelve months; however, we do not expect the change to have a significant effect on our results of

operations or our financial position.

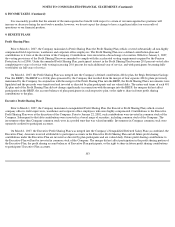

9. BENEFIT PLANS

Profit Sharing Plan:

Prior to March 1, 2007, the Company maintained a Profit Sharing Plan (the Profit Sharing Plan) which covered substantially all non-highly

compensated field supervisors, warehouse and corporate office employees. The Profit Sharing Plan was a defined contribution plan and

contributions to it were at the discretion of the Company. Contributions were invested in a broad range of securities. Effective January 1, 2007,

the vesting provisions of the Profit Sharing Plan were amended to comply with the accelerated vesting requirements required by the Pension

Protection Act of 2006. Under the amended Profit Sharing Plan, participants' interest in the Profit Sharing Plan become 20.0 percent vested after

completing two years of service with vesting increasing 20.0 percent for each additional year of service, and with participants becoming fully

vested after six full years of service.

On March 1, 2007, the Profit Sharing Plan was merged into the Company's defined contribution 401(k) plan, the Regis Retirement Savings

Plan (the RRSP). The RRSP is a 401(k) plan sponsored by the Company that resulted from the merger of four separate 401(k) plans previously

maintained by the Company. In conjunction with the merger of the Profit Sharing Plan into the RRSP, the Profit Sharing Plan's investments were

liquidated and the proceeds were transferred and invested as directed by plan participants and are valued daily. The nature and terms of each 401

(k) plan and of the Profit Sharing Plan did not change significantly in connection with the merger into the RRSP; the mergers did not affect

participation in the RRSP, the account balances of plan participants in each respective plan, or the right to share in future profit sharing

contributions to the plan.

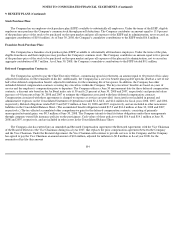

Executive Profit Sharing Plan:

Prior to March 1, 2007, the Company maintained a nonqualified Profit Sharing Plan (the Executive Profit Sharing Plan) which covered

company officers, field supervisors, warehouse and corporate office employees who were highly compensated. Contributions to the Executive

Profit Sharing Plan were at the discretion of the Company. Prior to January 22, 2002, such contributions were invested in common stock of the

Company. Subsequent to that date contributions were invested in a broad range of securities, including common stock of the Company. The

investments other than Company common stock were in a pooled trust that was valued monthly. Investments in Company common stock were

separately credited to participant accounts.

On March 1, 2007, the Executive Profit Sharing Plan was merged into the Company's Nonqualified Deferred Salary Plan (as combined, the

Executive Plan). Amounts received attributable to participant accounts in the Executive Profit Sharing Plan and all future profit sharing

contributions under the Executive Plan are invested as directed by plan participants and are valued daily. Future profit sharing contributions to

the Executive Plan will not be invested in common stock of the Company. The merger did not affect participation in the profit sharing portion of

the Executive Plan, the profit sharing account balances of Executive Plan participants, or the right to share in future profit sharing contributions

to participants' Executive Plan accounts.

103