Supercuts 2008 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2008 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

circumstances. Estimates are considered to be critical if they meet both of the following criteria: (1) the estimate requires assumptions about

material matters that are uncertain at the time the accounting estimates are made, and (2) other materially different estimates could have been

reasonably made or material changes in the estimates are reasonably likely to occur from period to period. Changes in these estimates could have

a material effect on our Consolidated Financial Statements.

Our significant accounting policies can be found in Note 1 to the Consolidated Financial Statements contained in Part II, Item 8 of this

Form 10-K. We believe the following accounting policies are most critical to aid in fully understanding and evaluating our reported financial

condition and results of operations.

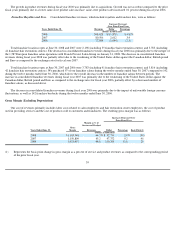

Cost of Product and Services Used and Sold

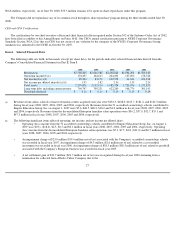

Cost of product used in salon services is determined by applying estimated gross profit margins to service revenues, which are based on

historical factors including product pricing trends and estimated shrinkage. In addition, the estimated gross profit margin is adjusted based on the

results of physical inventory counts performed at least semi-annually and the monthly monitoring of factors that could impact our usage rates

estimates. These factors include mix of service sales, discounting and special promotions. Cost of product sold to salon customers is determined

based on the weighted average cost of product to the Company, adjusted for an estimated shrinkage factor. Product and service inventories are

adjusted based on the results of physical inventory counts. During fiscal year 2008, we performed physical inventory counts between September

and November and May and June, and adjusted our estimated gross profit margin to reflect the results of the observations. Significant changes in

product costs, volumes or shrinkage could have a material impact on our gross margin.

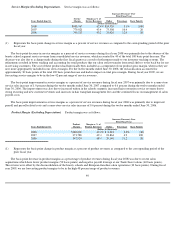

Goodwill

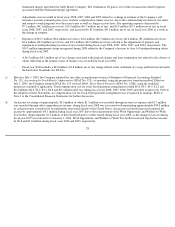

Goodwill is tested for impairment annually or at the time of a triggering event in accordance with the provisions of SFAS No. 142,

Goodwill and Other Intangible Assets . Fair values are estimated based on our best estimate of the expected present value of future cash flows

and compared with the corresponding carrying value of the reporting unit, including goodwill. Where available and as appropriate comparative

market multiples are used to corroborate the results of the present value method. We consider our various concepts to be reporting units when we

test for goodwill impairment because that is where we believe goodwill resides. The Company believes Trade Secret operations have the highest

risk for potential impairment should future revenue growth rates be lower than expected. Our policy is to perform our annual goodwill

impairment test during our third quarter of each fiscal year ending June 30.

During the three months ended March 31 of fiscal years 2008, 2007, and 2006, we performed our annual goodwill impairment analysis on

our reporting units. Based on our testing, a $23.0 million ($19.6 million net of tax) impairment charge was recorded during fiscal year 2007

related to our beauty school business. No impairment charges were recorded during fiscal years 2008 and 2006.

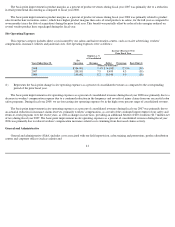

On January 31, 2008, we merged our continental European franchise salon operations with the operations of the Franck Provost Salon

Group. Prior to the merger, our analysis indicated the net book value of our European franchise business approximated the fair value.

The performance challenges and necessary investments in information technology platforms and management that were required to

effectively operate our beauty schools led us to exploring strategic alternatives pertaining to our beauty school operating segment. On August 1,

2007 (fiscal year 2008), we merged our 51 accredited cosmetology schools into EEG, creating the largest beauty school operator in North

America. This transaction leveraged EEG's management expertise, while enabling us to maintain a vested interest in the beauty school industry.

During the three months ended March 31, 2007, the terms of the transaction indicated that the estimated fair value of the accredited cosmetology

31