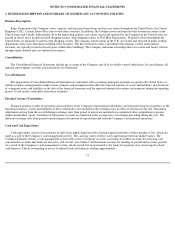

Supercuts 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

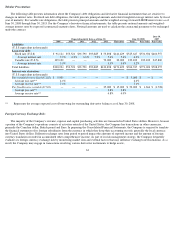

liabilities and purchases denominated in foreign currencies. As of June 30, 2008, the Company has entered into the following financial

instruments to manage its foreign currency exchange risk:

Hedge of the Net Investment in Foreign Subsidiaries:

The Company has numerous investments in foreign subsidiaries, and the net assets of these subsidiaries are exposed to exchange rate

volatility. The Company frequently evaluates its foreign currency exchange risk by monitoring market data and external factors that may

influence exchange rate fluctuations. As a result, the Company may engage in transactions involving various derivative instruments to hedge

assets, liabilities and purchases denominated in foreign currencies.

During September 2006, the Company's cross-currency swap (which had a notional amount of $21.3 million and hedged a portion of the

Company's net investment in its foreign operations) was settled, resulting in a cash outlay of $8.9 million. This cash outlay was recorded within

investing activities within the Consolidated Statement of Cash Flows. The related cumulative tax-effected net loss of $7.9 million was recorded

in accumulated other comprehensive income (AOCI) in fiscal year 2007. This amount will remain deferred within AOCI indefinitely, as the

event which would trigger its release from AOCI and recognition in earnings is the sale or liquidation of the Company's international operations

that the cross-currency swap hedged. The Company currently has no intent to sell or liquidate this portion of its business operations.

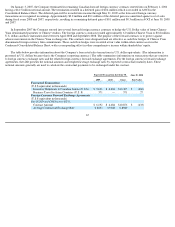

Forward Foreign Currency Contracts:

The Company's exposure to foreign exchange risk includes risks related to fluctuations in the Canadian dollar relative to the U.S. dollar.

The exposure to Canadian dollar exchange rates on the Company's fiscal year 2008 cash flows primarily includes payments in Canadian dollars

from the Company's Canadian salon operations for retail inventory exported from the United States.

The Company seeks to manage exposure to changes in the value of the Canadian dollar. In order to do so, the Company entered into

forward currency contracts during fiscal year 2007 to reduce the risk of significant negative impact on its U.S. dollar cash flows or income. The

Company does not hedge foreign currency exposure in a manner that would entirely eliminate the effect of changes in foreign currency exchange

rates on net income and cash flows. Forward currency contracts to sell Canadian dollars and buy $10.3 million U.S. dollars were outstanding as

of June 30, 2008 to hedge forecasted intercompany foreign currency denominated transactions stemming from monthly product shipments from

the U.S. to Canadian salons. These contracts mature at various dates between July 2008 and May 2010. See Note 5 to the Consolidated Financial

Statements for further discussion.

On May 29, 2007, the Company entered into several forward foreign currency contracts to sell Canadian dollars and buy an aggregate

$16.9 million U.S. dollars, with maturation dates between June 2007 and May 2010. The purpose of the forward contracts is to protect against

adverse movements in the Canadian dollar exchange rate. The contracts were designated and are effective as cash flow hedges of Canadian

dollar denominated forecasted intercompany transactions related to monthly product shipments from the U.S. to Canadian salons. These cash

flow hedges were recorded at fair value within accrued expenses in the Consolidated Balance Sheet, with a corresponding offset in other

comprehensive income within shareholders' equity.

On February 1, 2006, the Company entered into several forward foreign currency contracts to sell Canadian dollars and buy an aggregate

$15.8 million U.S. dollars, with maturation dates between July 2006 and May 2009. The contracts were designated and were effective as cash

flow hedges of Canadian dollar denominated forecasted intercompany transactions. These cash flow hedges were recorded at fair value within

accrued expenses in the Consolidated Balance Sheet, with a corresponding offset in other comprehensive income within shareholders' equity.

64