Square Enix 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

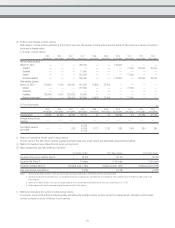

4. Class and number of shares given to stock acquisition rights

A total of 87,000 shares of common stock.

5. Exercise price

One (1) yen per share.

6. Exercise period

From July 22, 2011 through July 21, 2031.

7. Increases in common stock and capital surplus in the event

shares are issued through the exercise of stock acquisition

rights

a) The amount by which common stock increases through the issuance

of shares upon the exercise of stock acquisition rights will be half the

Supplementary Schedule

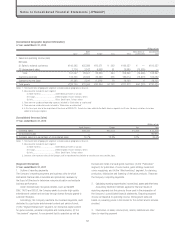

[Corporate Bonds Issued]

Outstanding Outstanding

balance as of balance as of

March 31, 2010 March 31, 2011 Coupon

Company Bond type Issuance date (Millions of yen) (Millions of yen) (%) Security Maturity date

SQUARE ENIX HOLDINGS Five-year yen-denominated November 25, November 25,

CO., LTD. bonds with warrants*2 2005 ¥37,000 — — None 2010

(UK time) (37,000) (UK time)

SQUARE ENIX HOLDINGS euro yen zero coupon February 4, February 4,

CO., LTD. convertible bonds 2010 ¥35,000 ¥35,000 — None 2015

due 2015*3, 4 (UK time) (UK time)

Total ¥72,000 ¥35,000

(37,000)

Notes: 1. The amounts shown in parentheses in the column for “Outstanding balance as of March 31, 2010” indicate the amount of corporate bonds maturing within one year.

2. Information relating to yen-denominated zero-coupon warrant bonds maturing in 2010 is as follows.

(As of March 31, 2011)

Issuance price 100% of face value

Aggregate amount of issuance ¥50.0 billion

Warrants applicable to Common shares

Exercise price (yen) ¥3,400

Period for exercise of warrants November 28, 2005 to November 11, 2010 (local time where funds are deposited)

Issuance price of shares upon exercise of

warrants and amount capitalized (yen)

Issuance price ¥3,400

Amount capitalized ¥1,700

Conditions for exercise of warrants Warrants cannot be exercised partially

Note: Based on the conversion price revision clause set forth in bond terms and conditions for these bonds with stock acquisition rights, the Company executed an adjustment to the

exercise price on November 21, 2008. The exercise price before adjustment was 3,439.8 yen.

3. Information relating to euro yen zero-coupon convertible bonds maturing in 2015 is as follows.

(As of March 31, 2011)

Issuance price 100% of face value

Aggregate amount of issuance ¥35.0 billion

Warrants applicable to Common shares

Exercise price (yen) ¥2,500

Period for exercise of warrants February 19, 2010 to January 20, 2015 (local time where funds are deposited)

Issuance price of shares upon exercise of

warrants and amount capitalized (yen)

Issuance price ¥2,500

Amount capitalized ¥1,250

Conditions for exercise of warrants Warrants cannot be exercised partially

Notes to Consolidated Financial Statements (JPNGAAP)

maximum increase of common stock, as calculated in accordance

with Article 17, Paragraph 1, of the Corporate Accounting Rules, and

any fraction less than one (1) yen that results from such calculation

will be rounded up to the nearest whole yen.

b) The amount by which capital surplus increases through the issuance

of shares upon the exercise of stock acquisition rights will be the

amount that remains after the aforementioned maximum increase

in common stock is subtracted from the aforementioned capital

increase.

66