Square Enix 2011 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2011 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To Our Shareholders

the aforementioned difference. These losses were recorded as

we decided to refocus our attention on fewer, stronger titles.

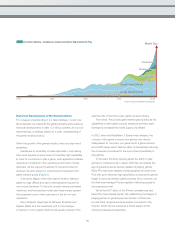

While the balance of the content production account

increased from ¥16.0 billion to ¥19.9 billion, the composition is

changing dramatically as we pursue global development. At

present, already more than 40% is recorded at development

studios outside Japan (Figure1).

Including taxes of ¥2.0 billion yields a total of about 90% of

the difference explained above.

While I regret concerns that may have been caused by our

swing to a loss during the fiscal year ended March 31, 2011,

the real nature of the loss is as described above. Finally, the vast

majority of the decline in total assets was due to goodwill and

the planned payback of capital for corporate bond redemptions,

while extraordinary loss items were related to valuations and did

not materially impact capital flows. As a result, our cash

balances have not fallen (Figure 2).

Financial treatment is important, however, in the end this is

accounting for the past. It goes without saying that our business

and how we energize our vital human resources are more

important. In addition to reorganization and a review of the

chain of command, we also improved our internal communication

methods from those based on a hierarchical organization to a

system in which management can communicate directly with

all employees as a tool for conveying Group vision as well as

business directives. Moreover, in order to promote the active

and honest exchange of views among employees, we have

begun holding workshops on various topics and information

exchange events. I believe that the transformation of our

Group’s culture is our most critical issue and the fastest road

to success.

New Signs

While fundamentally changing Group culture is not an easy task,

we have already started to see some teams leading the way

with good results. At the E3 game show held in June 2011, the

quality of our various titles earned extremely high praise (Figure 3).

With enhancing brand value a top priority for the Group, these

are certainly very encouraging examples.

In addition, we are starting to see the fruits of our labor in

the creation of new genres. Our browser game launched in

August 2010 called “SENGOKU IXA” has already grown to

become a significant earnings generator. In addition, several of

our social game releases have also achieved success in the

market. Using the feedback we are receiving in these new

genres, we are further strengthening our development

capabilities.

Content Production Account by Region

(Billions of yen)

Japan Europe/North America

20.0

15.0

10.0

5.0

0

2004 2005 2006 2007 2008 2009 2010 2011

10.1

15.5

7.3

11.9

14.8

18.4

16.0

19.9

5.9

10.1

9.2

10.7

Years ended March 31

Figure 1 Comparison of Total Assets

Figure 2 E3 Expo, U.S. (June 2011)

Future Titles Earn Wide Acclaim

Figure 3

Total assets

¥270.5 billion

Total assets

¥206.3 billion

As of March 31, 2010 As of March 31, 2011

Cash and

deposits

(111.2)

Current portion of

corporate bonds

(37.0)

Corporate bonds

(35.0)

Corporate bonds

(35.0)

Other liabilities

(44.2)

Other liabilities

(36.2)

Total net

assets

(154.3)

Total net

assets

(135.1)

Accounts receivable

(30.7)

Other assets

(83.4)

Other assets

(79.7)

Investment securities

(35.0)

Goodwill

(10.2)

Accounts

receivable

(15.5)

Cash and

deposits

(111.1)

(Announced June 30, 2011)

(Due: December 2011 Japan; January 2012 N. America; Early 2012 Europe)

“FINAL FANTASY XIIIɅ2”

1 Award, 12 Nominations

“TOMB RAIDER”

21 Awards, 68 Nominations

Best Action Game (IGN), etc.

(Due: Autumn 2012)

“HITMAN ABSOLUTION”

19 Awards, 50 Nominations

Best of Show (GameSpot), etc.

(Due: 2012)

(Due: August 2011 N. America/Europe; September 2011 Japan)

“DEUS EX: HUMAN REVOLUTION”

4 Awards, 19 Nominations

04