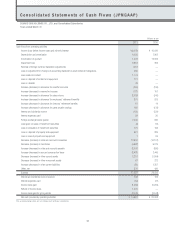

Square Enix 2011 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2011 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

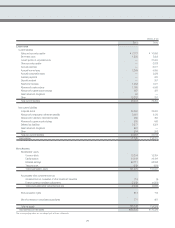

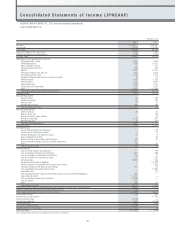

■ Consolidated Statements of Income

Net Sales and Operating Income

Comparisons by segment with the preceding fiscal year are provided on pages 8–11.

Extraordinary Gain and Loss

Under extraordinary loss, the Company recorded an impairment loss

of ¥8,853 million, including impairment losses on goodwill of

¥8,416 million. At the time of the acquisitions of TAITO

CORPORATION and the U.K. company Eidos plc, the Company

recorded goodwill as a result of both purchases. For the fiscal year

under review, however, it has recognized impairment losses, based

on more cautious estimates for future cash flow in view of the

recent changes in the business environment.

The Company also recorded loss on disposal of content and

equipment and loss related to content as a result of restructuring,

which together totaled ¥4,472 million, in addition to loss on disaster

of ¥570 million and loss on adjustment for changes in accounting

standard for asset retirement obligations of ¥462 million. As a

result of these and other factors, total extraordinary loss amounted

to ¥16,007 million.

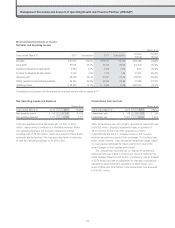

Management Discussion and Analysis of Operating Results and Financial Position (JPNGAAP)

Millions of yen

Years ended March 31 2010 Composition 2011 Composition Amount

change

Percent

change

Net sales ¥192,257 100.0% ¥125,271 100.0% ¥(66,986) (34.8)%

Gross profit 83,721 43.5% 49,424 39.5% (34,297) (41.0)%

Reversal of allowance for sales returns 4,863 2.5% 4,046 3.2% (817) (16.8)%

Provision for allowance for sales returns 4,046 2.1% 1,779 1.4% (2,267) (56.0)%

Net gross profit 84,538 44.0% 51,691 41.3% (32,847) (38.9)%

Selling, general and administrative expenses 56,303 29.3% 44,365 35.4% (11,938) (21.2)%

Operating income ¥ 28,235 14.7% ¥ 7,325 5.8% ¥(20,910) (74.1)%

Non-Operating Income and Expenses

Total non-operating income decreased ¥411 million, to ¥347

million, mainly owing to a reduction in dividends received. Within

non-operating expenses, the Company registered a foreign

exchange loss of ¥2,149 million, mainly as a result of USD and GBP

exchange rate fluctuations. This loss was a key factor contributing

to total non-operating expenses of ¥2,282 million.

Millions of yen

Years ended March 31 2010 2011 Change

Extraordinary gain ¥ 128 ¥ 633 ¥ 505

Extraordinary loss 17,919 16,007 (1,912)

Millions of yen

Years ended March 31 2010 2011 Change

Non-operating income ¥ 758 ¥ 347 ¥ (411)

Non-operating expenses 1,171 2,282 1,111

24