Square Enix 2011 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2011 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

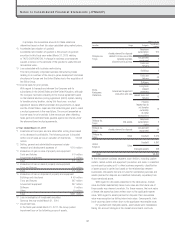

(5) Rental deposits

The fair values of these items are the net present value, which has been

discounted at a rate that appropriately reflects the length of time the

deposits are expected to be held for and the credit risk of the deposit holder.

Liabilities

(1) Notes and accounts payable, (2) Short-term loans and (3) Accrued

corporate taxes

Since these items are settled on a short-term basis, book value is used on

the assumption that fair value is principally equivalent to book value.

(4) Corporate bonds

The fair value of corporate bonds issued by the Company is the price quoted

by the correspondent financial institutions.

2. Financial instruments for which it is extremely difficult to estimate

fair value

Millions of yen

Item Book value

Unlisted shares ¥51

These items are not included in “(4) Investment securities” above

owing to the recognition of their lack of market prices and the

extreme difficulty in estimating fair value based on such methods

as estimated future cash flows.

3. Planned redemption amounts subsequent to the consolidated

balance sheet date for monetary claims and investment securities

that have a maturity date

Millions of yen

Within one

year

More than

one year

but within

five years

More than

five years

but within

10 years

More than

10 years

Deposits

¥109,618 ¥ — ¥ — ¥ —

Notes and accounts

receivable

15,474 — — —

Income taxes receivable

6,907 — — —

Rental deposits

3,788 4,392 4,013 121

Total

¥135,664 ¥4,392 ¥4,013 ¥121

4. Planned repayment amounts subsequent to the consolidated

balance sheet date for corporate bonds

Please refer to the “Corporate Bonds Issued” tables within the

Supplementary Schedule section of the Notes to Consolidated

Financial Statements.

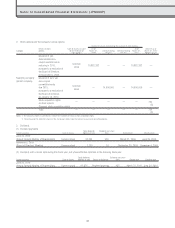

Securities

■ Year ended March 31, 2010

1. Held-for-sale securities

Not applicable

2. Held-to-maturity securities with market value

Not applicable

3. Other investment securities with market value:

Millions of yen

Type Book value Acquisition

cost

Difference

Securities with

book value

exceeding

acquisition cost

(1) Stocks ¥ 86 ¥ 54 ¥ 32

(2) Bonds

a. Government

bonds and

municipal

bonds

—— —

b. Corporate

bonds —— —

c. Other —— —

(3) Other —— —

Subtotal 86 54 32

Securities with

acquisition cost

exceeding book

value

(1) Stocks 393 441 (47)

(2) Bonds

a. Government

bonds and

municipal

bonds

—— —

b. Corporate

bonds —— —

c. Other —— —

(3) Other 35,000 35,000 —

Subtotal 35,393 35,441 (47)

Total ¥35,480 ¥35,495 ¥(15)

4. Securities sold during the fiscal year ended March 31, 2010

Millions of yen

Item

Proceeds Aggregate gain

on sale

Aggregate loss

on sale

(1) Stocks ¥7 ¥2 ¥0

(2) Bonds

a. Government bonds

and municipal

bonds

—— —

b. Corporate bonds —— —

c. Other 00—

(3) Other —— —

Total ¥7 ¥2 ¥0

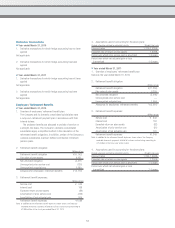

5. Investment securities subject to impairment

In the fiscal year under review, other investment securities (shares)

were subject to impairment amounting to ¥166 million.

With regard to the impairment of shares, shares whose fair value

has fallen to below 50% of the acquisition price are fully impaired,

and shares whose fair value has fallen to between 30% and 50% of

the acquisition price are impaired by an appropriate amount after

51