Square Enix 2011 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2011 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

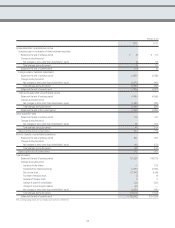

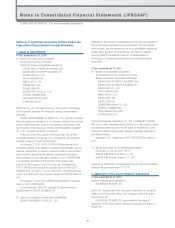

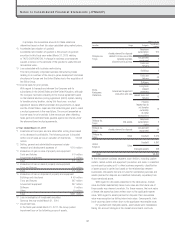

New Accounting Standards

■ Year ended March 31, 2010

(Application of Partial Amendments to Accounting Standard for

Retirement Benefits (Part 3))

Effective from this fiscal year, the Company has applied “Partial

Amendments to Accounting Standard for Retirement Benefits (Part 3),”

(ASBJ Statement No. 19, July 31, 2008).

This change had no material impact on operating income, recurring

income or income before income taxes and minority interests.

No retirement benefit obligation difference was recognized as a

result of the application of this accounting standard.

■ Year ended March 31, 2011

(Application of Accounting Standard for Asset Retirement

Obligations)

From the fiscal year ended March 31, 2011, the Company applies

“Accounting Standard for Asset Retirement Obligations” ASBJ Statement

No. 18, issued March 31, 2008) and “Guidance on Accounting Standards

for Asset Retirement Obligations” (ASBJ Guidance No. 21, March 31,

2008).

Consequently, operating income and recurring income decreased

by ¥165 million, respectively, and loss before income taxes increased

by ¥627 million.

(Application of Accounting Standard for Equity Method of

Accounting for Investments and Practical Solution on

Unification of Accounting Policies Applied to Associates

Accounted for Using the Equity Method)

From the fiscal year ended March 31, 2011, the Company applies

“Accounting Standard for Equity Method of Accounting for Investments”

(ASBJ Statement No. 16, issued March 10, 2008), and “Practical

Solution on Unification of Accounting Policies Applied to Associates

Accounted for Using the Equity Method” (ASBJ Practical Issues Task

Force No. 24, issued March 10, 2008).

This change had no impact on operating income, recurring income

or loss before income taxes and minority interests.

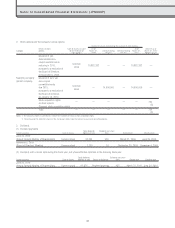

Reclassifications

■ Year ended March 31, 2010

(Consolidated Balance Sheets)

Until the fiscal year ended March 31, 2009, “income taxes receivable”

was presented as part of “other” within current assets. From the fiscal

year ended March 31, 2010, “income taxes receivable” is presented as

a separate item as a result of an increase in materiality.

In the fiscal year ended March 31, 2009, “income taxes

receivable” amounted to ¥1,422 million.

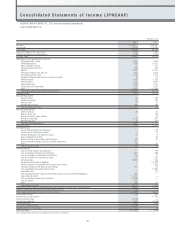

(Consolidated Statements of Income)

Until the fiscal year ended March 31, 2009, “gain on sale of property

and equipment” was presented as part of “other” within extraordinary

gain. From the fiscal year ended March 31, 2010, “gain on sale of

property and equipment” is presented as a separate item due to

composition exceeding 10 percent of total extraordinary gain.

In the fiscal year ended March 31, 2009, “gain on sale of property

and equipment” amounted to ¥4 million.

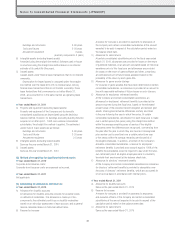

■ Year ended March 31, 2011

(Consolidated Balance Sheets)

Listed separately until the fiscal year ended March 31, 2010, “Long-

term loans” was ¥12 million in the fiscal year ended March 31, 2011,

less than five percent of total assets, and due to diminished materiality

is now presented as part of “Other” within “Investments and other

assets.”

Listed separately until the fiscal year ended March 31, 2010,

“Construction Cooperation Fund” was ¥880 million in the fiscal year

ended March 31, 2011, less than five percent of total assets, and due

to diminished materiality is now presented as part of “Other” within

“Investments and other assets.”

Listed separately until the fiscal year ended March 31, 2010,

“Claims in bankruptcy” was ¥178 million in the fiscal year ended March

31, 2011, less than five percent of total assets, and due to diminished

materiality is now presented as part of “Other” within “Investments and

other assets.”

Listed separately until the fiscal year ended March 31, 2010,

“Other accounts payable” was ¥3,348 million in the fiscal year ended

March 31, 2011, less than five percent of combined liabilities and net

assets, and due to diminished materiality is now presented as part of

“Other” within “Current liabilities.”

Listed separately until the fiscal year ended March 31, 2010,

“Accrued expenses” was ¥4,802 million in the fiscal year ended March

31, 2011, less than five percent of combined liabilities and net assets,

and due to diminished materiality is now presented as part of “Other”

within “Current liabilities.”

Listed separately until the fiscal year ended March 31, 2010,

“Accrued consumption taxes” was ¥180 million in the fiscal year ended

March 31, 2011, less than five percent of combined liabilities and net

assets, and due to diminished materiality is now presented as part of

“Other” within “Current liabilities.”

Listed separately until the fiscal year ended March 31, 2010,

“Advance payments received” was ¥3,672 million in the fiscal year

ended March 31, 2011, less than five percent of combined liabilities

and net assets, and due to diminished materiality is now presented as

part of “Other” within “Current liabilities.”

Listed separately until the fiscal year ended March 31, 2010,

“Deposits received” was ¥407 million in the fiscal year ended March

31, 2011, less than five percent of combined liabilities and net assets,

and due to diminished materiality is now presented as part of “Other”

within “Current liabilities.”

(Consolidated Statements of Income)

From the fiscal year ended March 31, 2011, the Company applies

“Regulation for Terminology, Forms and Presentation of Financial

Notes to Consolidated Financial Statements (JPNGAAP)

40