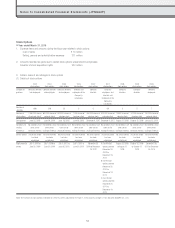

Square Enix 2011 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2011 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

taking into consideration the materiality of the amount involved and

the likelihood of recovery.

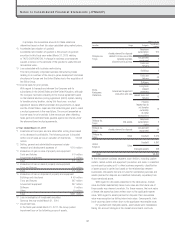

■ Year ended March 31, 2011

1. Held-for-sale securities

Not applicable

2. Held-to-maturity securities with market value

Not applicable

3. Other investment securities with market value:

Millions of yen

Type Book value Acquisition

cost

Difference

Securities with

book value

exceeding

acquisition cost

(1) Stocks ¥4 ¥2 ¥1

(2) Bonds

a. Government

bonds and

municipal

bonds

—— —

b. Corporate

bonds —— —

c. Other —— —

(3) Other —— —

Subtotal 42 1

Securities with

acquisition cost

exceeding book

value

(1) Stocks 330 352 (22)

(2) Bonds

a. Government

bonds and

municipal

bonds

—— —

b. Corporate

bonds —— —

c. Other —— —

(3) Other —— —

Subtotal 330 352 (22)

Total ¥334 ¥355 ¥(21)

Notes to Consolidated Financial Statements (JPNGAAP)

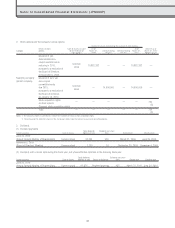

4. Securities sold during the fiscal year ended March 31, 2011

Millions of yen

Item

Proceeds Aggregate gain

on sale

Aggregate loss

on sale

(1) Stocks ¥0 ¥0 ¥—

(2) Bonds

a. Government bonds

and municipal

bonds

—— —

b. Corporate bonds —— —

c. Other —— —

(3) Other —— —

Total ¥0 ¥0 ¥—

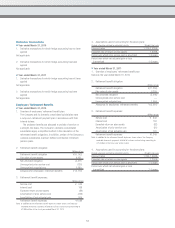

5. Investment securities subject to impairment

In the fiscal year under review, other investment securities (shares)

were subject to impairment amounting to ¥175 million.

With regard to the impairment of shares, shares whose fair value

has fallen to below 50% of the acquisition price are fully impaired,

and shares whose fair value has fallen to between 30% and 50% of

the acquisition price are impaired by an appropriate amount after

taking into consideration the materiality of the amount involved and

the likelihood of recovery.

52