Square Enix 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

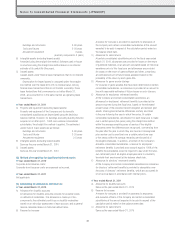

(Impairment loss)

No impairment loss was recognized on leased assets.

Operating lease transactions

Future lease payments on noncancellable leases:

Due within one year ¥1,070 million

Due after one year —

Total ¥1,070 million

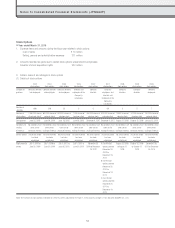

■ Year ended March 31, 2011

Finance lease transactions

(1) Type of leased assets

Same as the year ended March 31, 2010

(2) Depreciation method for leased assets

Same as the year ended March 31, 2010

1. Acquisition cost, accumulated depreciation and net book value of

leased assets:

Millions of yen

Acquisition Accumulated Net book

cost depreciation value

Buildings and structures ¥425 ¥390 ¥34

Tools and fixtures 218 160 58

Total ¥643 ¥550 ¥92

Note: Same as the year ended March 31, 2010

2. Ending balances of future lease payments:

Due within one year ¥67 million

Due after one year 24 million

Total ¥92 million

Note: Same as the year ended March 31, 2010

3. Lease payments and depreciation expense:

Lease payments ¥175 million

Depreciation expense ¥175 million

4. Method of calculation for depreciation

Same as the year ended March 31, 2010

(Impairment loss)

No impairment loss was recognized on leased assets.

Operating lease transactions

Future lease payments on noncancellable leases:

Due within one year ¥655 million

Due after one year 124 million

Total ¥779 million

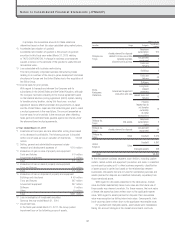

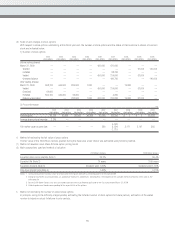

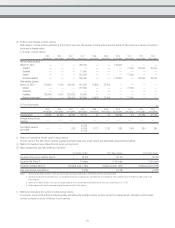

Notes Regarding Financial Instruments

■ Fiscal year ended March 31, 2010

1. Matters concerning financial instruments

(1) Policies regarding financial instruments

With regard to the management of funds, the Group only utilizes

financial instruments with low market risk, such as deposits. With

regard to fund procurement, the Group utilizes the issuance of

corporate bonds and borrowings from financial institutions.

Forward-exchange transactions are carried out within the

amount of foreign currency-denominated transactions conducted

by the Group. It is the Group’s policy not to engage in derivative

transactions for speculative purposes.

(2) Types of financial instruments held, risks associated with those

financial instruments and the risk management system

The Group is exposed to customer credit risk through notes

and accounts receivable, which are trade receivables. The Group

endeavors to reduce this risk by managing the outstanding balance

and due date for each transaction in accordance with internal

rules at each Group company for sales management. Owing to

the Group’s global business operations, a portion of its notes

and accounts receivable are denominated in foreign currencies,

which are exposed to exchange rate fluctuation risk. Although the

Group, in principle, does not engage in derivative transactions,

for the purpose of hedging against the risk of future fluctuations

in foreign-exchange rates, it enters into forward foreign exchange

contracts from time to time. Although forward foreign exchange

contracts involve exposure to exchange rate fluctuation risk, each

counterparty to these transactions is, without exception, a highly

creditworthy bank. Hence, the Group judges that credit risk through

counterparty breach of contract (counterparty risk) is negligible.

With regard to forward foreign exchange transactions, all risk is

centrally managed by the accounting division under the approval

of a representative director and the director assigned to oversee

accounting and finance matters.

Short-term investment securities are held in the form of

negotiable certificates of deposit, and the market price fluctuation

risk associated with these instruments is extremely low. Investment

securities mainly comprise stock market listed shares, and, hence,

exposed to market price fluctuation risk. However, fair values are

monitored and regularly reported to the Board of Directors.

Rental deposits consist of deposits required to be furnished

by the Group when it enters into real estate leases relating to

the Group’s headquarters, other offices and amusement arcade

facilities. Construction support deposits consist of deposits

furnished by the Group in relation to amusement arcade leases.

Although these deposits involve exposure to counterparty credit

risk, for the headquarters and other offices and amusement

arcades, the general affairs division and sales division with

the Group confirm the creditworthiness of the lessors through

regular contact with the respective counterparties. In addition,

the accounting division checks with each of these divisions on the

situation at the end of each fiscal year.

47