Square Enix 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

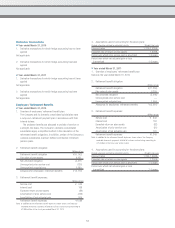

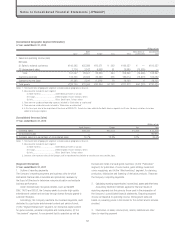

Tax Effect Accounting

■ Year ended March 31, 2010

1. Significant components of deferred tax assets and liabilities are

summarized as follows:

Millions of yen

Deferred tax assets

1) Current assets

Enterprise tax payable ¥ 270

Business office tax payable 31

Reserve for bonuses 644

Accrued expenses 281

Allowance for sales returns 460

Non-deductible portion of allowance for

doubtful accounts 337

Loss on write-offs of content production account 3,815

Loss on inventory revaluation 407

Allowance for game arcade closings 135

Other 67

Valuation allowance (10)

Offset to deferred tax liabilities (current) (209)

Total 6,231

2) Non-current assets

Non-deductible portion of allowance for employees’

retirement benefits 959

Allowance for directors’ retirement benefits 90

Expense for stock-based compensation 296

Non-deductible depreciation expense of property

and equipment 214

Impairment loss 508

Loss on investments in securities 482

Non-deductible portion of allowance for doubtful accounts 57

Loss carried forward, etc., at overseas subsidiaries 527

Research and development expense 112

Allowance for game arcade closings 272

Loss carried forward 756

Other 311

Valuation allowance (2,376)

Offset to deferred tax liabilities (non-current) (530)

Total 1,682

Total deferred tax assets 7,913

Deferred tax liabilities

(1) Current liabilities

Accrued expenses and other cost calculation details 162

Enterprise taxes receivable 46

Offset to deferred tax assets (non-current assets) (209)

Total —

(2) Non-current liabilities

Non-current assets 190

Tax effects from intangible non-current assets

relating to business combinations 2,487

Other 206

Offset to deferred tax assets (non-current) (530)

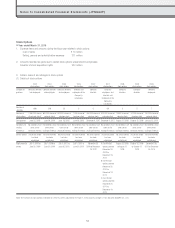

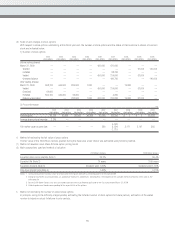

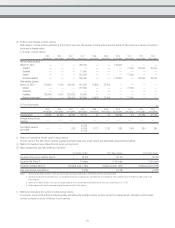

Notes to Consolidated Financial Statements (JPNGAAP)

Total 2,354

Total deferred tax liabilities 2,354

Balance: Net deferred tax assets ¥5,559

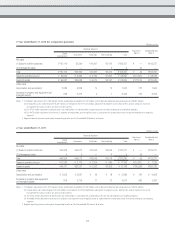

2. A reconciliation of the statutory tax rate and the effective tax rate is

as follows:

Statutory tax rate 40.70%

Permanent differences relating to entertainment

expense, etc., excluded from non-taxable expenses 3.81

Permanent differences relating to dividends

received, etc., excluded from non-taxable expenses (1.39)

Valuation allowance 5.14

Taxation on a per capita basis for inhabitants’ tax 0.39

Amortization of goodwill 55.79

Use of tax loss carried forward (116.93)

Taxes for prior fiscal years, etc. 14.12

Differences in tax rate from the parent

company’s statutory tax rate 1.44

Other 1.34

Effective tax rate 4.68%

■ Year ended March 31, 2011

1. Significant components of deferred tax assets and liabilities are

summarized as follows:

Millions of yen

Deferred tax assets

1) Current assets

Enterprise tax payable 212

Business office tax payable 46

Reserve for bonuses 440

Accrued expenses 659

Allowance for sales returns 200

Non-deductible portion of allowance for

doubtful accounts 88

Tax credits 503

Loss on write-offs of content production account 2,237

Loss on inventory revaluation 645

Allowance for game arcade closings 197

Loss carried forward 171

Other 145

Valuation allowance (863)

Offset to deferred tax liabilities (current) (191)

Total 4,493

2) Non-current assets

Non-deductible portion of allowance for employees’

retirement benefits 1,252

Allowance for directors’ retirement benefits 96

Expense for stock-based compensation 336

Non-deductible depreciation expense of property

and equipment 200

Asset retirement obligations 181

Impairment loss 424

58