Square Enix 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

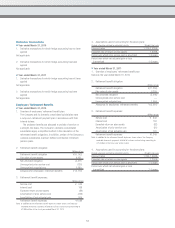

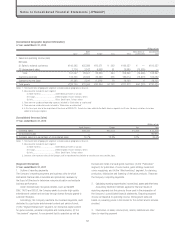

Loss on evaluation of investments in securities 456

Non-deductible portion of allowance for doubtful accounts 67

Non-deductible portion of excess expenses on lump-sum

depreciable assets 219

Loss carried forward, etc., at overseas subsidiaries 1,720

Allowance for game arcade closings 238

Loss carried forward 173

Other 443

Valuation allowance (2,936)

Offset to deferred tax liabilities (non-current) (1,792)

Total 1,082

Total deferred tax assets 5,576

Deferred tax liabilities

(1) Current liabilities

Accrued expenses and other cost calculation details 190

Other 0

Offset to deferred tax assets (non-current assets) (191)

Total —

(2) Non-current liabilities

Non-current assets 1,544

Tax effects from intangible non-current assets

relating to business combinations 2,076

Other 749

Offset to deferred tax assets (non-current) (1,792)

Total 2,577

Total deferred tax liabilities 2,577

Balance: Net deferred tax assets 2,998

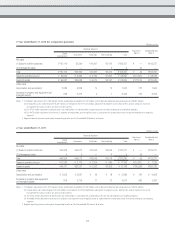

2. A reconciliation of the statutory tax rate and the effective tax rate is

as follows:

No breakdown of key components is presented for the fiscal year

ended March 31, 2011 because the Company posted a loss before

income taxes and minority interests.

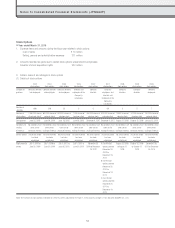

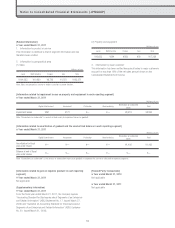

Business Combinations

■ Year ended March 31, 2010

Application of the purchase method

1. Name of the company acquired and business operations subject

to the business combination, main purpose of the business

combination, date of business combination, legal form of business

combination, and name of the company and percentage of voting

rights held subsequent to business combination

(1) Name of the company acquired and its principal business

operations

Name of company: Eidos plc (hereinafter “Eidos”)

Type of business: Games (interactive entertainment products)

(2) Purpose of the business combination

This acquisition was carried out based on the judgment that, by

combining the hit products of Eidos with the products of SQUARE

ENIX Group, it would further strengthen the position of the

SQUARE ENIX Group as one of the global leaders in the interactive

entertainment industry.

(3) Date of business combination

April 22, 2009

(4) Legal form of the business combination and name of the post-

combination company

Legal form of the business combination: Share acquisition

Post-combination name of the acquired company: Eidos Ltd.

(5) Percentage of voting rights acquired: 100%

2. Period for which the acquired company’s operating results have

been included in the Company’s consolidated financial statements

April 22, 2009 to March 31, 2010

3. Acquisition cost of the company subject to business combination

and breakdown thereof

Acquisition price Eidos shares GBP84,418,536.85

(¥12,217 million)

Acquisition cost GBP84,418,536.85 (¥12,217 million)

The yen amount shown above was calculated using the exchange

rate prevailing on April 22, 2009.

4. Amount of goodwill recognized, reasons for recognition, and

method and period of amortization

(1) Amount of goodwill recognized: GBP45,205,785.17

(¥6,542 million)

The yen amount shown above was calculated using the

exchange rate prevailing on April 22, 2009.

(2) Reasons for recognition of goodwill

Principally, in the regions where Eidos conducts its games

business, a portion of the excess earnings power its major

game titles are expected to generate could not be identified with

specific assets, and this amount was recognized as goodwill.

(3) Method and period of amortization of goodwill

Amortized by the straight-line method over 10 years

5. Breakdown of principal assets received and liabilities assumed as

of the date of business combination

Millions of yen

Current assets ¥ 7,786

Non-current assets 19,543

Total assets 27,329

Current liabilities 14,654

Total liabilities 14,850

59