Square Enix 2011 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2011 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

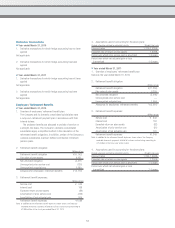

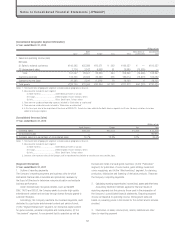

(2) Scale of and changes in stock options

With respect to stock options outstanding at this fiscal year-end, the number of stock options and the status of their exercise to shares of common

stock are indicated below:

1) Number of stock options

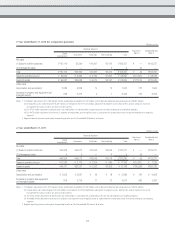

2) Price information Yen

2002

stock options

2004

stock options

2005

stock options

2005

stock options

2007

stock options

2007

stock options

2008

stock options

2009

stock options

2009

stock options

Exercise price ¥2,152 ¥2,981 ¥3,365 ¥3,360 ¥3,706 ¥3,706 ¥ 1 ¥ 1 ¥2,293

Average share price at exercise 2,260————————

Fair market value on grant date — — — — 526

A. 526

B. 594

C. 715

3,171 2,107 385

4. Method of estimating the fair value of stock options

The fair value of the 2009 Stock Options granted during the fiscal year under review was estimated using following method.

(1) Method of valuation used: Black-Scholes option pricing model

(2) Main assumptions used and method of valuation

2009 Stock Options 2009 Stock Options

Expected share price volatility (Note 1) 33.3% 36.4%

Expected life (Note 2) 10 years 3.45 years

Expected dividend (Note 3) Dividend yield 1.26% Dividend yield 1.50%

Risk-free interest rate (Note 4) 1.40% 0.31%

Notes: 1. Calculated based on historical share price data prior to the grant date over a period equivalent to the expected life.

2. Owing to insufficient accumulated data, an appropriate estimate is problematic. Consequently, the midpoint of the available exercise period has been used as the

estimated life.

3. For the 2009 Stock Options, this was calculated based on the actual dividend applicable to the fiscal year ended March 31, 2009.

4. Yield of government bonds corresponding to the expected life of the options.

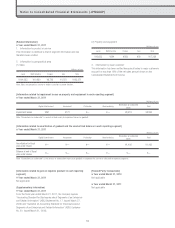

5. Method of estimating the number of vested stock options

In principle, owing to the difficulty of appropriately estimating the forfeited number of stock options for future periods, estimation of the vested

number is based on actual forfeitures in prior periods.

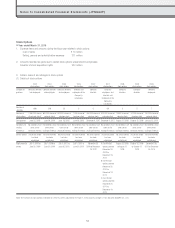

2002

stock options

2004

stock options

2005

stock options

2005

stock options

2007

stock options

2007

stock options

2008

stock options

2009

stock options

2009

stock options

Before vesting (shares)

March 31, 2009 — — — — 450,000 670,000 — — —

Granted — — — — — — — 57,000 140,000

Forfeited — — — — — 28,700 — — —

Vested — — — — 450,000 214,600 — 57,000 —

Unvested balance — — — — — 426,700 — — 140,000

After vesting (shares)

March 31, 2009 868,700 446,000 825,000 1,000 — — 19,800 — —

Vested — — — — 450,000 214,600 — 57,000 —

Exercised 64,600 — — — — — — — —

Forfeited 804,100 446,000 33,000 — — 4,300 — — —

Balance unexercised — — 792,000 1,000 450,000 210,300 19,800 57,000 —

55