Square Enix 2011 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2011 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

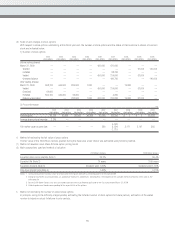

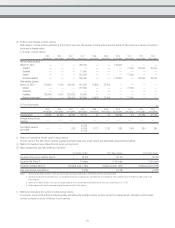

Notes to Consolidated Financial Statements (JPNGAAP)

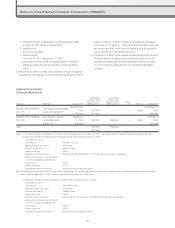

In addition, by integrating the business operated by TAITO

SOFT CORPORATION related to game software for home game

consoles into the games business operated by SQUARE ENIX

CO., LTD., the Group aims to enhance the efficiency and

profitability of these businesses.

2. Outline of the accounting treatment

The transaction was treated as a common control transaction pursuant

to “Accounting Standard for Business Combinations” (Business

Accounting Council, issued on October 31, 2003) and “Implementation

Guidance on Accounting Standard for Business Combinations and

Accounting Standard for Business Divestitures” (Accounting Standards

Board of Japan Guidance No. 10, revised on November 15, 2007).

These transactions, namely the aforementioned absorption-type

company split and absorption-type company merger, have no impact on

the Consolidated Financial Statements.

■ Year ended March 31, 2011

Not applicable

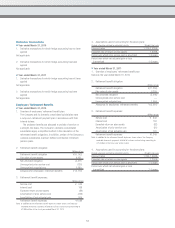

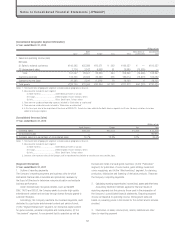

Asset Retirement Obligations

■ Year ended March 31, 2011

Balance Sheet Amount for Asset Retirement Obligations

a) Summary of applicable asset retirement obligations

Asset retirement obligations include the duty of restoration

arising from contractual requirements set forth in real estate

leases for buildings, including offices at the headquarters, as

well as amusement facility arcades.

b) Assumptions used in calculating applicable asset retirement

obligations

Asset retirement obligations on buildings, including offices at

the headquarters, are based on estimated useful life, generally

ranging between 10 and 24 years, and a discount rate generally

set between 1.300% and 2.240%.

For amusement facility arcades, asset retirement obligations

are based on an estimated useful life of 10 years—the average

operating period for arcades that have been closed—and a

discount rate between 0.955% and 1.355%.

c) Changes to aggregate asset retirement obligations applicable to

the fiscal year ended March 31, 2011

Millions of yen

Beginning balance (See note) ¥649

Increase due to procurement of property and equipment 1

Accretion expense 8

Decrease due to fulfillment of asset retirement obligations (9)

Other 71

Ending balance ¥721

Note: From the fiscal year ended March 31, 2011, the Group applies “Accounting

Standard for Asset Retirement Obligations” (ASBJ Statement No. 18, issued on

March 31, 2008) and “Guidance on Accounting Standard for Asset Retirement

Obligations” (ASBJ Guidance No. 21, issued on March 31, 2008). As a result,

the Group recognized asset retirement obligations at beginning of the fiscal year

ended March 31, 2011.

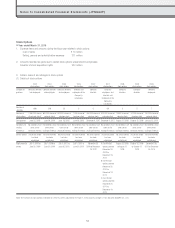

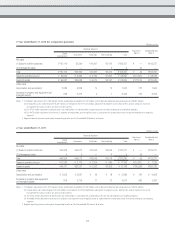

6. Estimated impact on the Consolidated Statements of Income in this

fiscal year calculated based on the assumption that the business

combination was completed on the first day of the fiscal year

Millions of yen

Net sales ¥ 0

Recurring loss 447

Net loss 447

These estimates were not subject to audit certification.

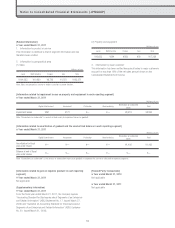

Common control transactions

1. Outline of the business combination

(1) Name of the company acquired and business operations subject

to the business combination

In February 2010, the Company’s wholly owned subsidiary

TAITO CORPORATION (hereinafter “the splitting company”)

transferred all its rights and obligations relating to the amusement

business to ES1 CORPORATION (hereinafter “the succeeding

company”), also a wholly owned subsidiary of the Company, in

an absorption-type company split. Simultaneously, the corporate

name of the splitting company was changed to TAITO SOFT

CORPORATION and the corporate name of the succeeding

company was changed to TAITO CORPORATION.

Prior to the aforementioned absorption-type company split,

SPC-NO. 1 CO., LTD. (“SPC1”), the succeeding company’s

100% parent company and a wholly owned subsidiary of the

Company, and the succeeding company were merged by way of

an absorption-type merger, with SPC1 being the absorbed entity

and the succeeding company being the surviving entity.

Subsequently, in March 2010, TAITO SOFT CORPORATION

was subject to an absorption-type company merger. The

Company’s wholly owned subsidiary SQUARE ENIX CO., LTD., is

the surviving entity.

(2) Legal form of the business combination

An absorption-type company split in which TAITO CORPORATION

is the splitting company and ES1 CORPORATION is the succeeding

company. In addition, an absorption-type company merger in

which TAITO SOFT CORPORATION is the extinguished entity and

SQUARE ENIX CO., LTD., is the surviving entity.

(3) Name of the post-combination company

Absorption-type company split: TAITO CORPORATION

The corporate name of the splitting company was changed

to TAITO SOFT CORPORATION and the corporate name of the

surviving company was changed to TAITO CORPORATION.

Absorption-type company merger: SQUARE ENIX CO., LTD.

(4) Outline of the transaction including purpose of the transaction

The purpose of the transaction is to aggregate the Group’s

business units responsible for operating its amusement-related

businesses, and hence improve efficiency and profitability

by transferring the amusement business from TAITO SOFT

CORPORATION as the splitting company to ES1 as the succeeding

company, which has operated arcade facilities prior to the

transaction.

60