Square Enix 2011 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2011 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

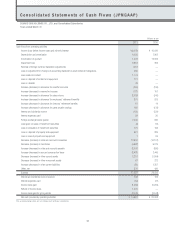

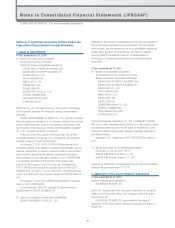

Statements” (Cabinet Office Ordinance No. 5, issued March 24,

2009), based on the “Accounting Standard for Consolidated Financial

Statements” (ASBJ Statement No. 22, December 26, 2008).

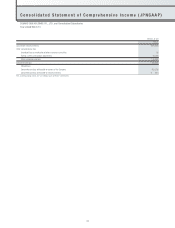

As a result, “Loss before minority interests” is presented in the

accompanying Consolidated Statements of Income and Consolidated

Statement of Comprehensive Income.

Listed separately until the fiscal year ended March 31, 2010,

“Severance payments associated with business restructuring” was

¥75 million in the fiscal year ended March 31, 2011, falling below

10 percent of total extraordinary loss and is now presented as part of

“Other” within “Extraordinary loss.”

Listed separately until the fiscal year ended March 31, 2010,

“Loss associated with business restructuring” was ¥39 million in the

fiscal year ended March 31, 2011, falling below 10 percent of total

extraordinary loss and is now presented as part of “Other” within

“Extraordinary loss.”

Additional Information

■ Year ended March 31, 2010

Not applicable

■ Year ended March 31, 2011

From the fiscal year ended March 31, 2011, the Company applies

“Accounting Standard for Presentation of Comprehensive Income”

(ASBJ Statement No. 25, issued June 30, 2010). The Company

presents “Accumulated other comprehensive loss” and “Total

accumulated other comprehensive loss” as of March 31, 2010 and

2011, in the accompanying Balance Sheet, which had previously been

presented as “Valuation and transaction adjustments” and “Total

valuation and transaction adjustments” as of March 31, 2010.

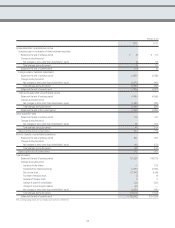

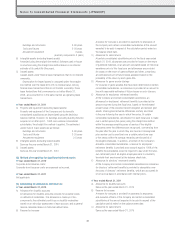

Notes to Consolidated Balance Sheets

■ Year ended March 31, 2010

*1 Investments in non-consolidated subsidiaries and affiliates:

Investments and other assets ¥69 million

■ Year ended March 31, 2011

*1 Investments in non-consolidated subsidiaries and affiliates:

Investments and other assets ¥51 million

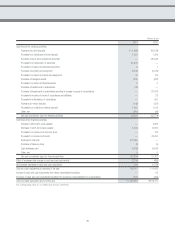

Notes to Consolidated Statements of Income

■ Year ended March 31, 2010

*1 Inventories at fiscal year-end are stated after writing down based

on its decrease in profitability. The following amount is included

within cost of sales as loss on valuation of inventories. ¥6,640

million

*2 Selling, general and administrative expenses include research and

development expenses of ¥1,243 million

*3 Breakdown of gain on sale of property and equipment

Buildings and structures ¥ 31 million

Tools and fixtures 0 million

Amusement equipment 1 million

Other 0 million

Total ¥ 33 million

*4 Breakdown of loss on sale of property and equipment

Tools and fixtures ¥ 52 million

Buildings and structures 16 million

Amusement equipment 0 million

Total ¥ 69 million

*5 Breakdown of loss on disposal of property and equipment

Buildings and structures ¥ 78 million

Tools and fixtures 34 million

Amusement equipment 268 million

Software 4 million

Other 3 million

Total ¥389 million

*6 Loss on evaluation of investment securities was due to a significant

decline in market prices of marketable securities.

*7 Impairment loss

In the fiscal year ended March 31, 2010, the Group posted

impairment loss on the following groups of assets:

Millions of yen

Impairment

Location Usage Category amount

Kawasaki-shi, Idle assets Land ¥ 43

Kanagawa

Kita-Karuizawa, Assets planned Land and 9

Nagano for disposal buildings

Tokushima-shi, Assets planned Land 119

Tokushima for disposal

Shibuya-ku, Tokyo, Idle assets Telephone 9

and others subscription rights

Shibuya-ku, Tokyo, Assets planned Amusement 74

and others for disposal equipment

Total ¥255

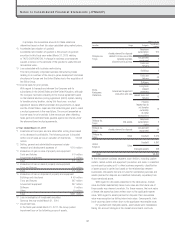

In the fiscal year ended March 31, 2010, due to the inclusion of

Eidos Ltd. and its consolidated subsidiaries within the Company’s

scope of consolidation, the Group revised its method of grouping

assets. In the Amusement business segment, each business

location is classified as one asset-grouping unit. In other business

segments, classification of asset groups is carried out based on the

relationships between businesses. Idle assets that are not used for

operational purposes and assets planned for disposal are classified

individually, separately from those mentioned above.

With regard to idle assets presented in the table above, market

value had fallen substantially below book value and the future use

of these assets was deemed uncertain. For these reasons, the book

value of these idle assets has been written down to the applicable

market value. With regard to assets planned for disposal, their

recoverable value was recognized as falling below book value.

Consequently, their book value has been written down to the

applicable recoverable value.

41