Square Enix 2011 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2011 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

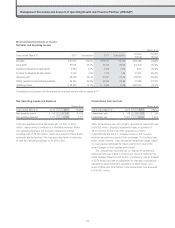

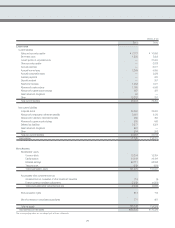

and fixtures (net) from ¥2,410 million to ¥1,808 million, and a

decrease in amusement equipment (net) from ¥2,832 million to

¥2,304 million.

Intangible Assets

Total intangible assets as of March 31, 2011 amounted to ¥10,324

million, down ¥11,299 million, mainly reflecting impairment of goodwill.

Investments and Other Assets

Total investments and other assets decreased ¥2,325 million, to

¥14,382 million, at the end of the fiscal year under review, primarily

as a result of declines in rental deposits and construction support

deposits.

■ Liabilities

As of March 31, 2011, total liabilities amounted to ¥71,192 million,

a decrease of ¥45,079 million compared with the previous fiscal

year-end.

The main factors contributing to this change were as follows:

Current Liabilities

Total current liabilities decreased ¥46,753 million, to ¥28,504

million. This improvement was largely the result of a ¥37,000

million redemption of yen-denominated zero coupon bonds with

warrants, which matured in November 2010. Other key factors

included a decrease in notes and accounts payable from ¥10,666

million to ¥7,777 million, a decrease in short-term loans from

¥2,808 million to ¥1,338 million, a decrease in accrued income

taxes from ¥4,090 million to ¥2,269 million, and a decrease in

allowance for sales returns from ¥4,046 million to ¥1,780 million.

Non-Current Liabilities

Total non-current liabilities declined ¥1,674 million to ¥42,687

million, owing primarily to asset retirement obligations of ¥657 million

that resulted from the Company’s application of “Accounting

Standard for Asset Retirement Obligations” (ASBJ Statement No. 18).

Another principal factor was an increase in the allowance for

employees’ retirement benefits from ¥2,170 million to ¥3,061 million.

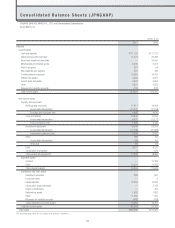

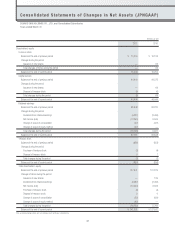

■ Shareholders’ Equity/Net Assets

As of March 31, 2011, total shareholders’ equity amounted to ¥141,501

million, a decrease of ¥16,140 million compared with the previous

fiscal year-end. This reflected the shift to a net loss, as well as the

payment of a year-end dividend for the previous fiscal year (¥25 per

share) and an interim dividend for the fiscal year under review (¥10

per share).

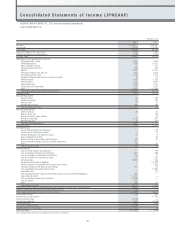

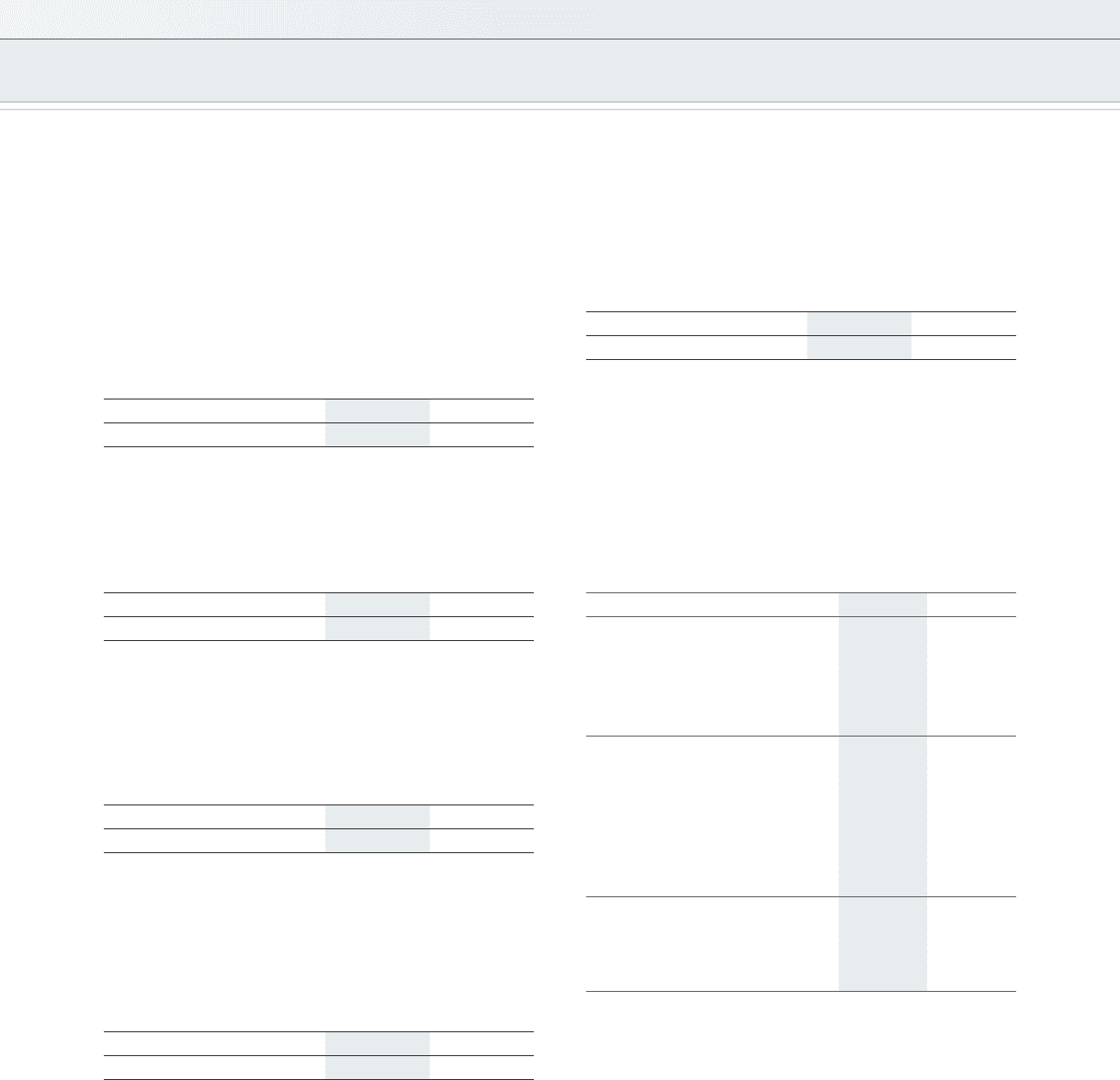

Millions of yen

March 31 2010 2011 Change

¥41,013 ¥42,687 ¥1,674

Millions of yen

March 31 2010 2011 Change

Common stock ¥ 15,204 ¥ 15,204 ¥ —

Capital surplus 44,444 44,444 —

Retained earnings 98,848 82,711 (16,137)

Treasury stock (856) (859) (3)

Total shareholders’ equity 157,641 141,501 (16,140)

Unrealized gain on

revaluation of other

investment securities

(9) (14) (5)

Foreign currency translation

adjustments (4,951) (7,929) (2,978)

Total accumulated other

comprehensive loss (4,960) (7,943) (2,983)

Stock acquisition rights 715 814 99

Minority interests in

consolidated subsidiaries 861 771 (90)

Total net assets ¥154,258 ¥135,143 ¥(19,115)

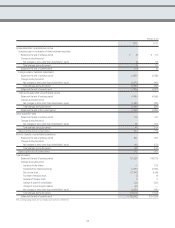

Millions of yen

March 31 2010 2011 Change

¥21,623 ¥10,324 ¥(11,299)

Millions of yen

March 31 2010 2011 Change

¥16,707 ¥14,382 ¥(2,325)

Millions of yen

March 31 2010 2011 Change

¥116,271 ¥71,192 ¥(45,079)

Millions of yen

March 31 2010 2011 Change

¥75,257 ¥28,504 ¥(46,753)

23