Square Enix 2011 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2011 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

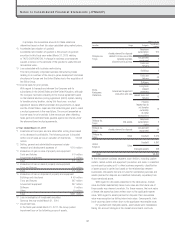

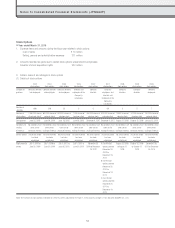

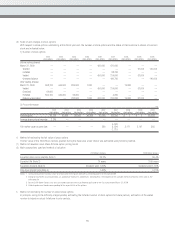

3. Planned redemption amounts subsequent to the consolidated

balance sheet date for monetary claims and investment securities

that have a maturity date

Millions of yen

Within one

year

More than

one year

but within

five years

More than

five years

but within

10 years

More than

10 years

Deposits

¥109,494 ¥ — ¥ — ¥ —

Notes and accounts

receivable

30,682 — — —

Short-term investment

securities

Available-for-sale

securities with maturity

(Negotiable certificates

of deposit)

35,000 — — —

Rental deposits

3,410 2,021 7,359 740

Construction support

deposits

603 64 457 —

Claims in bankruptcy

202 — — —

Total

¥179,392 ¥2,085 ¥7,816 ¥740

4. Planned repayment amounts subsequent to the consolidated

balance sheet date for corporate bonds.

Please refer to the “Corporate Bonds Issued” tables within the

Supplementary Schedule section of the Notes to Consolidated

Financial Statements.

(Additional information)

From the fiscal year ended March 31, 2010, the Company has

applied “Accounting Standard for Financial Instruments” (ASBJ

Statement No. 10, March 10, 2008) and “Guidance on Disclosures

about Fair Value of Financial Instruments” (ASBJ Guidance No. 19)

(March 10, 2008).

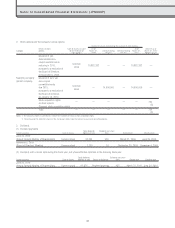

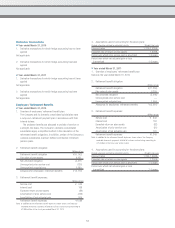

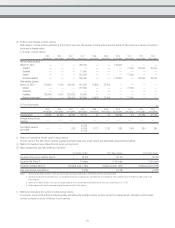

■ Year ended March 31, 2011

1. Matters concerning financial instruments

(1) Policies regarding financial instruments

With regard to the management of funds, the Group only utilizes

financial instruments with low market risk, such as deposits. With

regard to fund procurement, the Group utilizes the issuance of

corporate bonds and borrowings from financial institutions.

Forward-exchange transactions are carried out within the

amount of foreign currency-denominated transactions conducted

by the Group. It is the Group’s policy not to engage in derivative

transactions for speculative purposes.

(2) Types of financial instruments held, risk associated with these

financial instruments and the risk management system

The Group is exposed to customer credit risk through notes

and accounts receivable, which are trade receivables. The Group

endeavors to reduce this risk by managing the outstanding balance

and due date for each transaction in accordance with internal

(3) Short-term investment securities

Short-term investment securities comprise negotiable certificates of deposit.

Owing to their short-term maturity, fair value is recognized as equivalent to

book value. Book value is therefore recorded as fair value.

(4) Investment securities

Investment securities comprise stock market listed shares and fair value

is the stock-market trading price. For information relating to each of the

holding purposes of securities, please refer to the note titled “Securities.”

(5) Rental deposits, and (6) Construction support deposits

The fair values of these items are the net present value, which has been

discounted at a rate that appropriately reflects the length of time the

deposits are expected to be held for and the credit risk of the deposit

holder.

(7) Claims in bankruptcy and claims under reorganization

For claims in bankruptcy and claims under reorganization, the Company

calculates an allowance for doubtful claims based on the expected recovery

amount. Consequently, the fair values of these claims are recognized as

equivalent to the book value as of the balance sheet date less allowance for

doubtful claims, and recorded as this amount.

Liabilities

(1) Notes and accounts payable, (2) Short-term loans, (3) Current portion

of corporate bonds, (4) Other accounts payable, (5) Accrued expenses, (6)

Accrued corporate taxes, (7) Accrued consumption taxes, and (8) Deposits

received

Since these items are settled on a short-term basis, book value is used on

the assumption that fair value is principally equivalent to book value.

(9) Corporate bonds

The fair value of corporate bonds issued by the Company is the price quoted

by the correspondent financial institutions.

2. Financial instruments for which it is extremely difficult to estimate

fair value

Millions of yen

Item Book value

Unlisted shares ¥87

These items are not included in “(4) Investment securities” above

owing to the recognition of their lack of market prices and the

extreme difficulty in estimating fair value based on such methods

as estimated future cash flows.

49