Spirit Airlines 2012 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2012 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

for an immaterial error in the original estimation of the liability. This adjustment reduced the liability with an offset to additional paid in capital.

The term of the TRA will continue until the first to occur of (a) the full payment of all amounts required under the agreement with respect to utilization or expiration of

all of the Pre-IPO NOLs, (b) the end of the taxable year including the tenth anniversary of the IPO or (c) a change in control of the Company. The amount and timing of

payments under the TRA will depend upon a number of factors, including, but not limited to, the amount and timing of taxable income generated in the future and any

future

limitations that may be imposed on the Company's ability to use the Pre-IPO NOLs. The Company paid $27.2 million , or 90% of the tax savings realized from the

utilization of NOLs in 2011, including $0.3 million of applicable interest in 2012 related to the TRA. As of December 31, 2012 an estimated remaining cash benefit of $8.0

million is expected to be paid to the Pre-IPO Stockholders under the terms of the TRA in 2013.

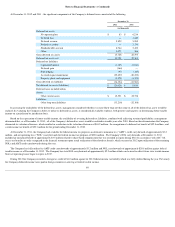

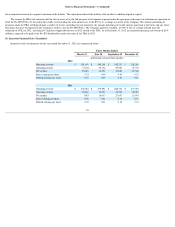

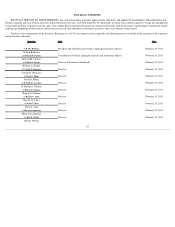

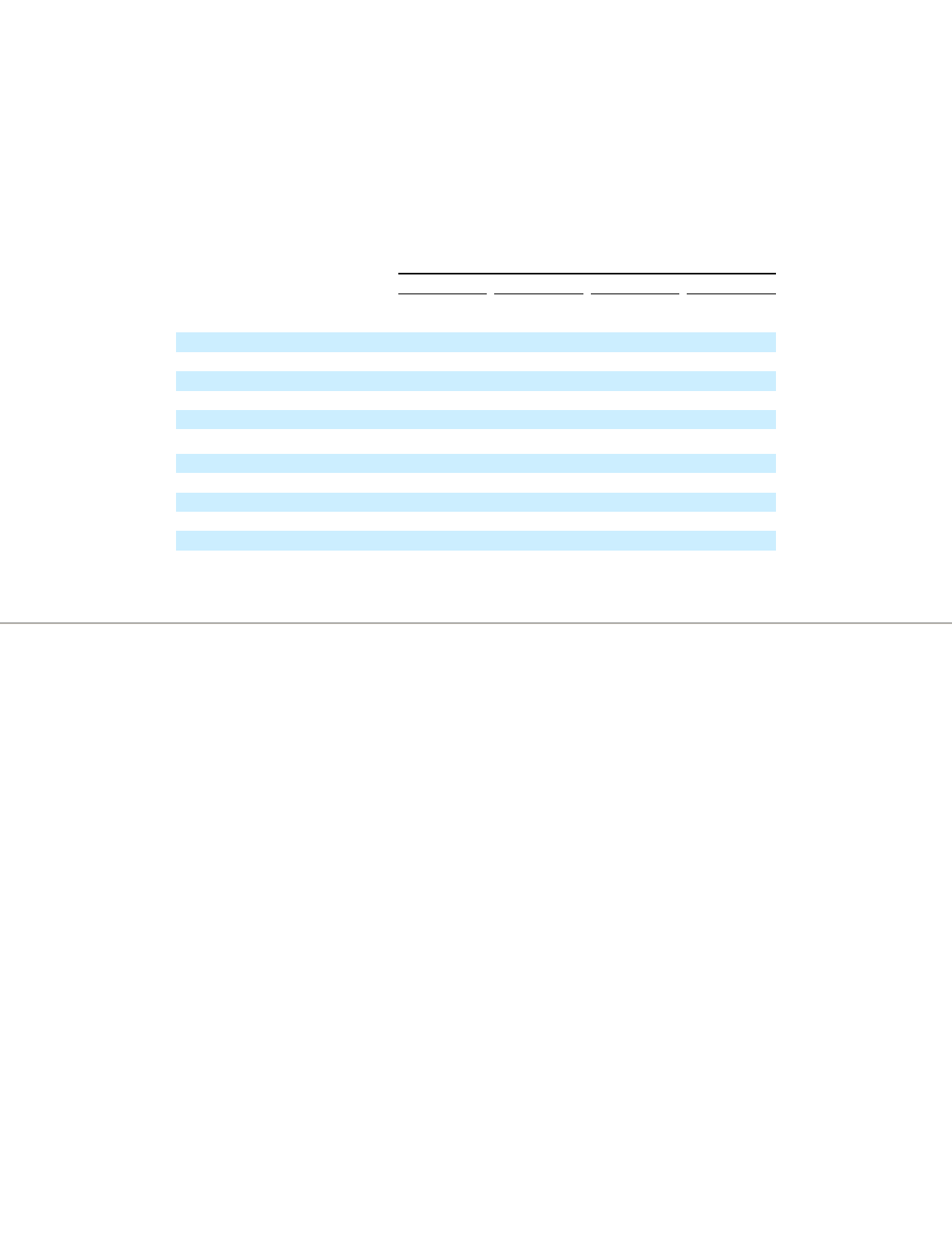

19. Quarterly Financial Data (Unaudited)

Quarterly results of operations for the year ended December 31, 2012 are summarized below:

85

Three Months Ended

March 31

June 30

September 30

December 31

(in thousands, except per share amounts)

2012

Operating revenue

$

301,495

$

346,308

$

342,317

$

328,268

Operating income

37,244

55,132

49,681

31,933

Net income

23,419

34,591

30,884

19,566

Basic earnings per share

0.32

0.48

0.43

0.27

Diluted earnings per share

0.32

0.48

0.43

0.27

2011

Operating revenue

$

232,662

$

275,891

$

288,714

$

273,919

Operating income

26,844

34,959

44,556

38,023

Net income

7,883

16,917

27,657

23,991

Basic earnings per share

0.30

0.41

0.38

0.33

Diluted earnings per share

0.30

0.41

0.38

0.33