Spirit Airlines 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

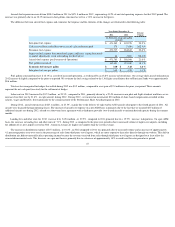

retained $2.1 million as a result of excess tax benefits related to share-based payments, and received cash as a result of exercised stock options. Additional cash used in

financing activities consisted of cash used to purchase treasury stock. As of December 31, 2012 , an estimated remaining cash benefit of $8.0 million

is expected to be paid

to our Pre-IPO Stockholders under the terms of the TRA in 2013.

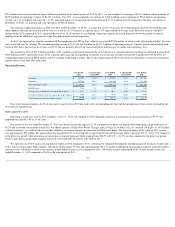

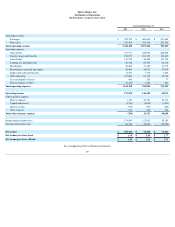

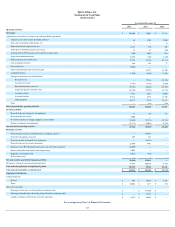

Commitments and Contractual Obligations

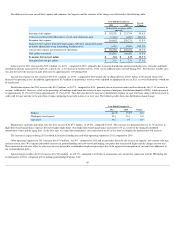

The following table discloses aggregate information about our contractual obligations as of December 31, 2012 and the periods in which payments are due (in

millions):

(1) Does not include contractual payments to the Pre-IPO Stockholders under the Tax Receivable Agreement (estimated to

be approximately $8.0 million as of December 31, 2012 ). Please see “—Our Income Taxes.”

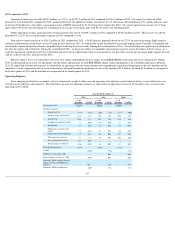

Some of the Company’s master lease agreements provide that the Company pays maintenance reserves to aircraft lessors to be held as collateral in advance of the

Company’s required performance of major maintenance activities. Some maintenance reserve payments are fixed contractual amounts, while others are based on actual

flight hours. Fixed maintenance reserve payments for these aircraft and related flight equipment, including estimated amounts for contractual price escalations, will be

approximately $10.3 million in 2013 , $10.6 million in 2014 , $11.0 million in 2015 , $11.4 million in 2016 , $11.1 million in 2017 , and $40.4 million in 2018 and beyond

.

Additionally, the Company is contractually obligated to pay the following minimum guaranteed payments to the provider of its reservation system as of December 31,

2012 : $3.1 million in 2013 , $3.7 million in 2014 , $3.7 million in 2015 , $3.7 million in 2016 , $3.7 million in 2017 and $2.5 million in 2018 and thereafter .

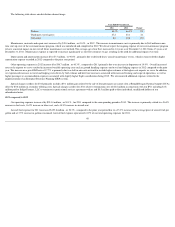

Off-Balance Sheet Arrangements

We have significant obligations for aircraft as all 45 of our aircraft are operated under operating leases and therefore are not reflected on our balance sheets. These

leases expire between 2016 to 2024 . Aircraft rent payments were $140.8 million and $116.6 million for 2012 and 2011 , respectively. Our aircraft lease payments for 40 of

our aircraft are fixed-rate obligations. Five of our leases provide for variable rent payments, which fluctuate based on changes in LIBOR (London Interbank Offered Rate).

Our contractual purchase commitments consist primarily of aircraft and engine acquisitions through manufacturers and aircraft leasing companies. As of

December 31,

2012 , our firm orders consisted of 106 A320 family aircraft ( two used A319 aircraft, 54 of the existing A320 aircraft model, and 50 A320 NEOs) with Airbus and a third

party, and engine orders with International Aero Engines consisted of three spare V2500 IAE International Aero Engines AG engines. Aircraft are scheduled for delivery

from 2013 through 2021 , and spare engines are scheduled for delivery from 2013 through 2015 . Committed expenditures for these aircraft and related flight equipment,

including estimated amounts for contractual price escalations and aircraft pre-delivery deposits, will be approximately $323 million for 2013 , $354 million in 2014 , $523

million in 2015 , $505 million in 2016 , $613 million in 2017 and $2,339 million in 2018 and beyond .

As of December 31, 2012 , we had lines of credit related to corporate credit cards of $18.6 million from which we had drawn $3.2 million . As of December 31, 2011

,

we had lines of credit related to corporate credit cards of $8.6 million from which we had drawn $2.4 million .

In addition, the Company has lines of credit with counterparties to our jet fuel derivatives in the amount of $18.0 million as of December 31, 2012 . Of the $18.0

million in lines of credit, $5.0 million is provided exclusively for jet fuel derivatives, $10.0 million is provided exclusively for physical fuel delivery, and the remaining $3.0

million is provided for either purpose. As of December 31, 2012 , we had drawn $11.2 million for physical fuel delivery and had not drawn on the remaining lines. As of

December 31, 2011 , we had lines of credit with counterparties in the amount of $8.0 million exclusively for jet fuel derivatives, and as of December 31, 2011 , we had not

drawn on the lines of credit. We are required to post collateral for any

54

2013

2014 - 2015

2016 - 2017

2018 and

beyond

Total

Operating lease obligations

$

168

$

331

$

296

$

379

$

1,174

Flight equipment purchase obligations

324

877

1,118

2,339

4,658

Total future payments on contractual

obligations (1)

$

492

$

1,208

$

1,414

$

2,718

$

5,832