Spirit Airlines 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

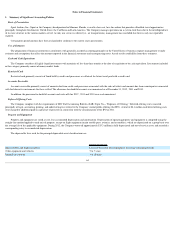

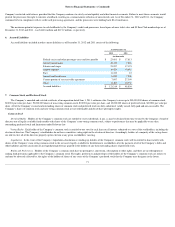

Notes to Financial Statements—(Continued)

(a) offset in accordance with certain right to set-off conditions prescribed by current accounting guidance or (b) subject to an enforceable master netting arrangement or

similar agreement, irrespective of whether they are offset in accordance with current accounting guidance. The amendments to ASU 2011-11 will be effective for the first

interim or annual period beginning on or after January 1, 2013. Management does not expect the adoption of ASU 2011-11 to have a material impact on its financial

statements.

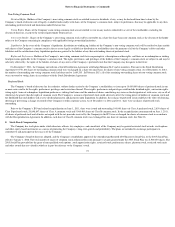

Slot Transaction

In June 2012, the Company transferred four permanent air carrier slots at Ronald Reagan National Airport (“DCA”) to another airline ("buyer") for $9.1 million in

cash, which the Company received in June. Due to FAA regulations, the buyer could not operate the slots until written confirmation of the slot transfer had been received

from the FAA. In accordance with FAA's 80% “use or lose” requirements, the Company continued to operate all four

slots through September 6, 2012. Due to the restriction

preventing operating use of the slots by buyer, the gain of $9.1 million was fully deferred at the time of the sale. The Company recognized the $9.1 million gain within

special charges (credits) in the third quarter of 2012, the period in which the FAA operating restriction lapsed and written confirmation of the slot transfer was received by

the buyer from the FAA.

Secondary Offering Costs

On July 31, 2012, certain existing stockholders affiliated with Oaktree Capital Management ("Oaktree") sold an aggregate of 9,394,927 shares of common stock in an

underwritten public offering. The Company incurred a total of $0.7 million in costs during the year ended December 31, 2012, related to this offering. Upon completion of

this offering, investment funds affiliated with Oaktree owned no shares of common stock of Spirit Airlines. The Company did not receive any proceeds from this offering.

Previously, on January 25, 2012, certain stockholders of the Company, including affiliates of Oaktree and Indigo Partners, LLC ("Indigo") and certain members of the

Company's executive team, sold an aggregate of 12,650,000 shares of common stock in an underwritten public offering. The Company incurred a total of $1.3 million in

costs between 2011 and 2012 related to this offering, of which $0.5 million were incurred during the year ended December 31, 2012, offset by reimbursements from certain

selling shareholders of $0.6 million in accordance with the Fourth Amendment to the Second Amended and Restated Investor Rights Agreement. The Company did not

receive any proceeds from this offering.

Initial Public Offering Costs

In June 2011, the Company issued and sold 15,600,000 shares of common stock in its initial public offering (IPO). The Company incurred contract termination costs

and fees of $2.25 million in connection with the IPO during the year ended December 31, 2011, which included $1.8 million paid to Indigo to terminate its professional

services agreement with the Company and $0.5 million paid to three individual, unaffiliated holders of the Company’s subordinated notes.

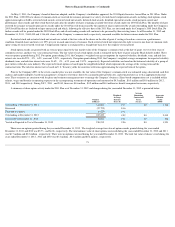

In connection with agreements with certain airports, the Company is required to post letters of credit, which totaled $0.2 million as of both December 31, 2012 and

2011 . The issuing banks require that the Company deposit funds at those banks to cover the amounts that could be drawn under the letters of credit. These funds are

generally invested in money market accounts and are classified as long-term assets within deferred heavy maintenance and other long-term assets. Additionally, as of

December 31, 2012 , the Company had a $10.0 million unsecured standby letter of credit facility, representing an off balance-sheet commitment, of which $7.0 million had

been drawn upon for issued letters of credit.

The Company has agreements with organizations that process credit card transactions arising from the purchase of air travel, baggage charges, and other ancillary

services by customers. As it is standard in the airline industry, the Company's contractual arrangements with credit card processors permit them, under certain circumstances,

to retain a holdback or other collateral, which the Company records as restricted cash, when future air travel and other future services are purchased via credit card

transactions. The required holdback is the percentage of the Company's overall credit card sales that its credit card processors hold to cover refunds to customers if the

Company fails to fulfill its flight obligations.

During 2011, the Company amended its processing agreements with all of its processors. Prior to the amendments, the credit card processors required the Company to

maintain cash collateral equal to approximately 100% of the Company's air traffic liability. The amendments were approved in light of the Company's improved balance

sheet as a result of the IPO, the related recapitalization and the elimination of the holdback held by the credit card processors, effectively eliminating the

70

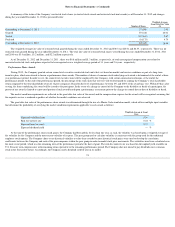

3.

Special Charges and Credits

4.

Letters of Credit

5.

Credit Card Processing Arrangements