Spirit Airlines 2012 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2012 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

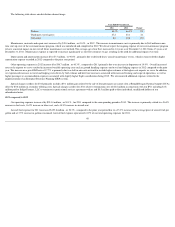

and $1.3 million for the years ended December 31, 2012 , 2011 , and 2010 , respectively. If heavy maintenance costs were amortized within maintenance, material and

repairs expense in the statement of operations, our maintenance, material and repairs expense would have been $58.6 million , $38.1 million, and $29.5 million for the years

ended December 31, 2012 , 2011 , and 2010 , respectively. During the years ended December 31, 2012 , 2011 , and 2010 , we capitalized $61.6 million , $22.1 million , and

$5.2 million of costs for heavy maintenance, respectively. The timing of the next heavy maintenance event is estimated based on assumptions including estimated usage,

FAA-mandated maintenance intervals and average removal times as suggested by the manufacturer. These assumptions may change based on changes in our utilization of

our aircraft, changes in government regulations and suggested manufacturer maintenance intervals. In addition, these assumptions can be affected by unplanned incidents

that could damage an airframe, engine, or major component to a level that would require a heavy maintenance event prior to a scheduled maintenance event. To the extent

our planned usage increases, the estimated life would decrease before the next maintenance event, resulting in additional expense over a shorter period. Heavy maintenance

events are our 6-year and 12-year airframe checks (HMV4 and HMV8, respectively), engine overhauls, and overhauls to major components. Certain maintenance functions

are outsourced under contracts that require payment based on a performance measure such as flight hours. Costs incurred for maintenance and repair under flight hour

maintenance contracts, where labor and materials price risks have been transferred to the service provider, are accrued based on contractual payment terms. Routine cost for

maintaining the airframes and engines and line maintenance are charged to maintenance, materials and repairs expense as performed.

Maintenance Reserves . Some of our master lease agreements provide that we pay maintenance reserves to aircraft lessors to be held as collateral in advance of our

performance of major maintenance activities. These lease agreements provide that maintenance reserves are reimbursable to us upon completion of the maintenance event in

an amount equal to the lesser of (1) the amount of the maintenance reserve held by the lessor associated with the specific maintenance event or (2) the qualifying costs

related to the specific maintenance event. Substantially all of these maintenance reserve payments are calculated based on a utilization measure, such as flight hours or

cycles, and are used solely to collateralize the lessor for maintenance time run off the aircraft until the completion of the maintenance of the aircraft. We paid $31.6 million ,

$38.3 million and $35.7 million in maintenance reserves, net of reimbursement, to our lessors for the years ended December 31, 2012 , 2011 , and 2010 , respectively.

At lease inception and at each balance sheet date, we assess whether the maintenance reserve payments required by the master lease agreements are substantively and

contractually related to the maintenance of the leased asset. Maintenance reserve payments that are substantively and contractually related to the maintenance of the leased

asset are accounted for as maintenance deposits. Maintenance deposits expected to be recovered from lessors are reflected as prepaid maintenance deposits in the

accompanying balance sheets. When it is not probable we will recover amounts currently on deposit with a lessor, such amounts are expensed as supplemental rent. Because

we we are required to pay maintenance reserves for our operating leased aircraft, and we chose to apply the deferral method for maintenance accounting, management

expects that the final heavy maintenance events will be amortized over the remaining lease term rather than over the next estimated heavy maintenance event. As a result,

our maintenance costs in the last few years of leases could be significantly in excess of the costs in earlier periods. In addition these late periods could include additional

costs from unrecoverable maintenance reserve payments required in the late years of the lease. We expensed $2.0 million , $1.5 million , and $0.0 million of maintenance

reserves as supplemental rent during 2012 , 2011 , and 2010 , respectively.

As of December 31, 2012 , 2011 , and 2010 , we had prepaid maintenance deposits of $198.5 million , $168.8 million and $132.0 million, respectively, on our

balance sheets. We have concluded that these prepaid maintenance deposits are probable of recovery primarily due to the rate differential between the maintenance reserve

payments and the expected cost for the related next maintenance event that the reserves serve to collateralize.

These master lease agreements also provide that most maintenance reserves held by the lessor at the expiration of the lease are nonrefundable to us and will be retained

by the lessor. Consequently, we have determined that any usage-based maintenance reserve payments after the last major maintenance event are not substantively related to

the maintenance of the leased asset and therefore are accounted for as contingent rent. We accrue contingent rent beginning when it becomes probable and reasonably

estimable we will incur such nonrefundable maintenance reserve payments. We make certain assumptions at the inception of the lease and at each balance sheet date to

determine the recoverability of maintenance deposits. These assumptions are based on various factors such as the estimated time between the maintenance events, the cost of

future maintenance events and the number of flight hours the aircraft is estimated to be utilized before it is returned to the lessor. Maintenance reserves held by lessors that

are refundable to us at the expiration of the lease are accounted for as prepaid maintenance deposits on the balance sheet when they are paid.

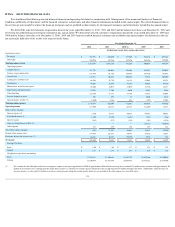

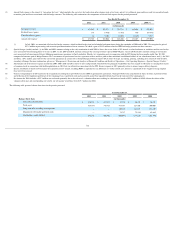

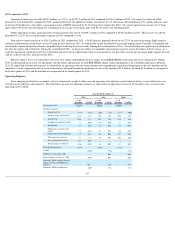

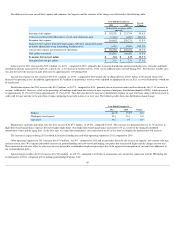

RESULTS OF OPERATIONS

In 2012 , we achieved a 13.2% operating margin, down by 0.3 points compared to 2011 , mostly driven by approximately

43