Spirit Airlines 2012 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2012 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

On January 25, 2012, the Company experienced a subsequent ownership change under the principles of IRC §382, as a result of the secondary offering outlined in

more detail in Note 3. Although the Company was subject to the limitations of IRC §382 on the utilization of its NOL and the tax credit carryforwards in 2012, the limitation

was sufficiently in excess of the tax attribute carryforwards to allow complete utilization during the year.

The Company accrues interest related to unrecognized tax benefits in its provision for income taxes, and any associated penalties are recorded in selling, general and

administrative expenses.

The Company files its tax returns as prescribed by the tax laws of the jurisdictions in which it operates. The Company's tax years from 2005 through 2011 are still

subject to examination in the United States due to net operating loss carryovers generated in such years. Various state and foreign jurisdiction tax years remain open to

examination and the Company was under examination in certain jurisdictions during 2012 the outcome of these audits were immaterial to the financial statements. The

Company believes that the effect of any additional assessment(s) will be immaterial to its financial statements.

Aircraft-Related Commitments and Financing Arrangements

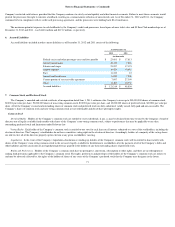

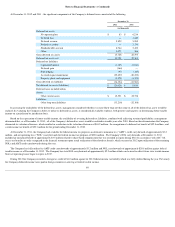

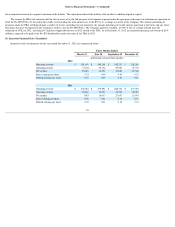

The Company’s contractual purchase commitments consist primarily of aircraft and engine acquisitions through manufacturers and aircraft leasing companies. As of

December 31, 2012 , firm aircraft orders with Airbus and a third party consisted of 106 A320 family aircraft ( two used A319 aircraft, 54

of the existing A320 aircraft model

and 50 A320 NEOs) and engine orders with International Aero Engines consisted of three spare V2500 IAE International Aero Engines AG engines. Aircraft are scheduled

for delivery from 2013 through 2021 , and spare engines are scheduled for delivery from 2013 through 2015 . Committed expenditures for these aircraft and related flight

equipment, including estimated amounts for contractual price escalations and pre-delivery payments, will be approximately $323 million in 2013 , $354 million in 2014 ,

$523 million in 2015 , $505 million in 2016 , $613 million in 2017 and $2,339 million in 2018 and beyond .

Litigation

The Company is subject to commercial litigation claims and to administrative and regulatory proceedings and reviews that may be asserted or maintained from time to

time. The Company believes the ultimate outcome of such lawsuits, proceedings and reviews will not, individually or in the aggregate, have a material adverse effect on its

financial position, liquidity or results of operations.

Employees

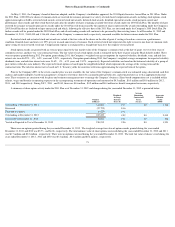

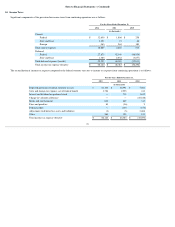

The Company has three union-represented employee groups that together represent approximately 54% of all employees at December 31, 2012 and 52% of all

employees at December 31, 2011 . The table below sets forth the Company's employee groups and status of the collective bargaining agreements.

The collective bargaining agreement between the Company and the Company’s pilots represents 22% of the Company’s employees as of December 31, 2012 .

The collective bargaining agreement between the Company and the Company’s flight attendants represents approximately 31% of the Company’s employees as of

December 31, 2012 . The Company and the AFA-CWA are currently in negotiations to reach a new collective bargaining agreement.

The collective bargaining agreement between the Company and its dispatchers represents approximately 1% of the Company’s employees as of December 31, 2012 .

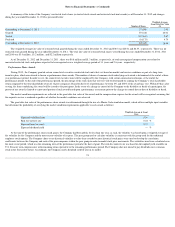

The Company is self-insured for health care claims for eligible participating employees and qualified dependent medical claims, subject to deductibles and limitations.

The Company’s liabilities for claims incurred but not reported are determined based on an estimate of the ultimate aggregate liability for claims incurred. The estimate is

calculated from actual claim rates

81

15.

Commitments and Contingencies

Employee Groups

Representative

Amendable Date

Pilots

Air Line Pilots Association, International (ALPA)

August 2015

Flight Attendants

Association of Flight Attendants (AFA-CWA)

August 2007

Dispatchers

Transport Workers Union (TWU)

July 2012