Spirit Airlines 2012 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2012 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

during the year ended December 31, 2012 related to this offering. Upon completion of this secondary offering, investment funds affiliated with Oaktree owned no shares of

our common stock.

Previously, on January 25, 2012, certain stockholders of the Company, including affiliates of Oaktree and Indigo Partners, LLC ("Indigo") and certain members of the

Company's executive team, sold an aggregate of 12,650,000 shares of common stock in an underwritten public offering. The Company incurred a total of $1.3 million in

costs between 2011 and 2012 related to this secondary offering, offset by reimbursements from certain selling shareholders of $0.6 million in accordance with the Fourth

Amendment to the Second Amended and Restated Investor Rights Agreement.

The Company did not receive any proceeds from either of these secondary offerings.

In the second quarter of 2011, we incurred $2.3 million of termination costs in connection with the IPO comprised of amounts paid to Indigo to terminate its

professional services agreement with us and fees paid to three individual, unaffiliated holders of our subordinated notes.

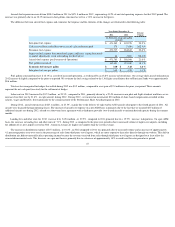

Our Other Expense (Income)

Interest Expense. Paid-in-kind interest on notes due to related parties and preferred stock dividends due to related parties account, on average, for over 80% of interest

expense incurred for the years 2011 and 2010 . Non-related party interest expense accounted for the remainder of interest expense in these periods. All of the notes and

preferred stock were repaid or redeemed, or exchanged for common stock, in connection with the 2011 Recapitalization. Interest expense in 2012

primarily relates to interest

on pre-delivery deposits.

Capitalized Interest. Capitalized interest represents interest cost to finance purchase deposits for future aircraft and the opportunity cost (interest) incurred during the

acquisition period of an aircraft that theoretically could have been avoided had we not made PDPs for that aircraft. These amounts are recorded as part of the cost of the

aircraft upon delivery. Capitalization of interest ceases when the asset is ready for service.

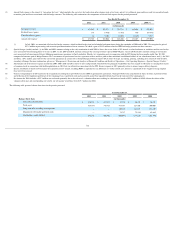

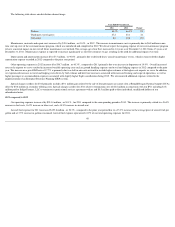

Our Income Taxes

We account for income taxes using the liability method. We record a valuation allowance to reduce the deferred tax assets reported if, based on the weight of the

evidence, it is more likely than not that some portion or all of the deferred tax assets will not be realized. Deferred taxes are recorded based on differences between the

financial statement basis and tax basis of assets and liabilities and available tax loss and credit carryforwards. In assessing the realizability of the deferred tax assets, we

consider whether it is more likely than not that some or all of the deferred tax assets will be realized. In evaluating the ability to utilize our deferred tax assets, we consider

all available evidence, both positive and negative, in determining future taxable income on a jurisdiction by jurisdiction basis.

Immediately prior to the IPO, we entered into the Tax Receivable Agreement and thereby distributed to the Pre-IPO Stockholders the right to receive such

stockholders’ pro rata share of the future payments to be made by us under the Tax Receivable Agreement. Under the Tax Receivable Agreement, we are obligated to pay to

the Pre-IPO Stockholders an amount equal to 90% of the cash savings in federal income tax realized by us by virtue of our future use of the federal net operating loss,

deferred interest deductions and alternative minimum tax credits held by us as of March 31, 2011, which we refer to as the Pre-IPO NOL. “Deferred interest deductions”

means interest deductions that have accrued as of March 31, 2011, but have been deferred under rules applicable to related party debt. Cash tax savings generally will be

computed by comparing our actual federal income tax liability to the amount of such taxes that we would have been required to pay had such Pre-IPO NOLs not been

available to us. Upon consummation of the IPO and execution of the TRA, the Company recorded a liability with an offsetting reduction to additional paid in capital.

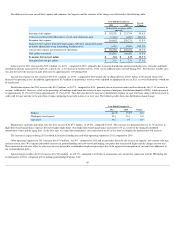

The term of the TRA will continue until the first to occur of (a) the full payment of all amounts required under the agreement with respect to utilization or expiration of

all of the Pre-IPO NOLs, (b) the end of the taxable year including the tenth anniversary of the IPO or (c) a change in control of the Company. The amount and timing of

payments under the TRA will depend upon a number of factors, including, but not limited to, the amount and timing of taxable income generated in the future and any future

limitations that may be imposed on the Company's ability to use the Pre-IPO NOLs. The Company paid $27.2 million , or 90% of the tax savings realized from the

utilization of NOLs in 2011, including $0.3 million of applicable interest in 2012 related to the TRA. As of December 31, 2012 an estimated remaining cash benefit of $8.0

million is expected to be paid in 2013 to our Pre-IPO Stockholders under the terms of the TRA.

Trends and Uncertainties Affecting Our Business

We believe our operating and business performance is driven by various factors that affect airlines and their markets, trends affecting the broader travel industry, and

trends affecting the specific markets and customer base that we target. The

39