Spirit Airlines 2012 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2012 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the terms and conditions of our future CBAs may be affected by the results of collective bargaining negotiations at other airlines that may have a greater ability to bear

higher costs under their business models. If we are unable to reach agreement with any of our unionized work groups in current or future negotiations regarding the terms of

their CBAs, we may be subject to work interruptions or stoppages, such as the strike by our pilots in June 2010. A strike or other significant labor dispute with our unionized

employees is likely to adversely affect our ability to conduct business.

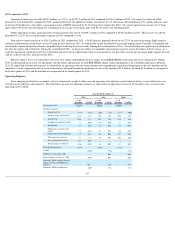

Maintenance Expense . Maintenance expense grew through 2012 , 2011 and 2010 mainly as a result of the increasing age of our fleet (approximately 4.6 years on

average at December 31, 2012 ) and growing fleet. As the fleet ages, we expect that maintenance costs will increase in absolute terms. The amount of total maintenance

costs and related amortization of heavy maintenance expense is subject to many variables such as future utilization rates, average stage length, the size and makeup of the

fleet in future periods and the level of unscheduled maintenance events and their actual costs. Accordingly, we cannot reliably quantify future maintenance expenses for any

significant period of time. However, we believe, based on our scheduled maintenance events, current maintenance expense and maintenance-related amortization expense in

2013 will be approximately $90 million .

As a result of a significant portion of our fleet being acquired over a relatively short period of time, significant maintenance scheduled on each of our planes will occur

at roughly the same time, meaning we will incur our most expensive scheduled maintenance obligations across our current fleet around the same time. These more

significant maintenance activities will result in out-of-service periods during which our aircraft will be dedicated to maintenance activities and unavailable to fly revenue

service. In addition, management expects that the final heavy maintenance events will be amortized over the remaining lease term rather than until the next estimated heavy

maintenance event, because we account for heavy maintenance under the deferral method. Please see “—Critical Accounting Policies and Estimates—Aircraft Maintenance,

Materials, Repair Costs and Related Heavy Maintenance Amortization.” This will result in significantly higher depreciation and amortization expense related to heavy

maintenance.

Maintenance Reserve Obligations

. The terms of some of our aircraft lease agreements require us to pay supplemental rent, also known as maintenance reserves, to the

lessor in advance of and as collateral for the performance of major maintenance events, resulting in our recording significant prepaid deposits on our balance sheet. As a

result, the cash costs of scheduled major maintenance events are paid well in advance of the recognition of the maintenance event in our results of operations. Please see “—

Critical Accounting Policies and Estimates—Aircraft Maintenance, Materials, Repair Costs and Related Heavy Maintenance Amortization” and “—Maintenance Reserves.”

Critical Accounting Policies and Estimates

The following discussion and analysis of our financial condition and results of operations is based on our consolidated financial statements, which have been prepared

in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates and judgments

that affect the reported amount of assets and liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities at the date of our financial

statements. Note 1 to our financial statements provides a detailed discussion of our significant accounting policies.

Critical accounting policies are defined as those policies that reflect significant judgments or estimates about matters that are both inherently uncertain and material to

our financial condition or results of operations.

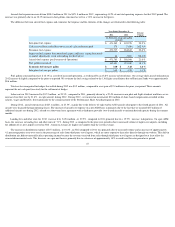

Revenue Recognition. Revenues from tickets sold are initially deferred as ATL. Passenger revenues are recognized when transportation is provided. An unused non-

refundable ticket expires at the date of scheduled travel and is recognized as revenue for the expired ticket value at the date of scheduled travel.

Our most significant non-ticket revenues include revenues generated from air travel-related services paid for baggage, bookings through our call center or third-party

vendors, advance seat selection, itinerary changes and loyalty programs, and are recognized at the time products are purchased or ancillary services are provided. These

revenues also include commissions from the sales of hotel rooms, trip insurance and rental cars recognized at the time the service is rendered.

Customers may elect to change their itinerary prior to the date of departure. A service charge is assessed and recognized on the date the change is initiated and is

deducted from the face value of the original purchase price of the ticket, and the original ticket becomes invalid. The amount remaining after deducting the service charge is

called a credit shell which expires 60 days from the date the credit shell is created and can be used towards the purchase of a new ticket and the Company’s other service

offerings. The amount of credits expected to expire is recognized as revenue upon issuance of the credit and is estimated based on historical experience. Estimating the

amount of credits that will go unused involves some level of subjectivity and judgment.

Non-ticket revenues include revenues from our subscription-based $9 Fare Club, recognized on a straight-line basis over

41