Spirit Airlines 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

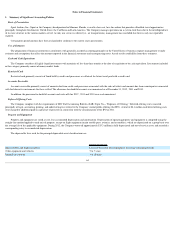

Notes to Financial Statements—(Continued)

Company's restricted cash balance, provided that the Company continues to satisfy certain liquidity and other financial covenants. Failure to meet these covenants would

provide the processors the right to reinstate a holdback, resulting in a commensurate reduction of unrestricted cash. As of December 31, 2012 and 2011 , the Company

continued to be in compliance with its credit card processing agreements, and the processors were holding back $0 of remittances.

The maximum potential exposure to cash holdbacks by the Company's credit card processors, based upon advance ticket sales and $9 Fare Club memberships as of

December 31, 2012 and 2011 , was $144.8 million and $115.2 million , respectively.

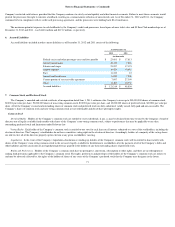

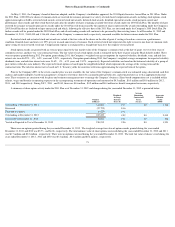

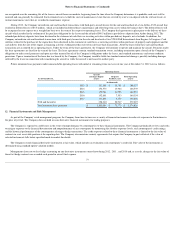

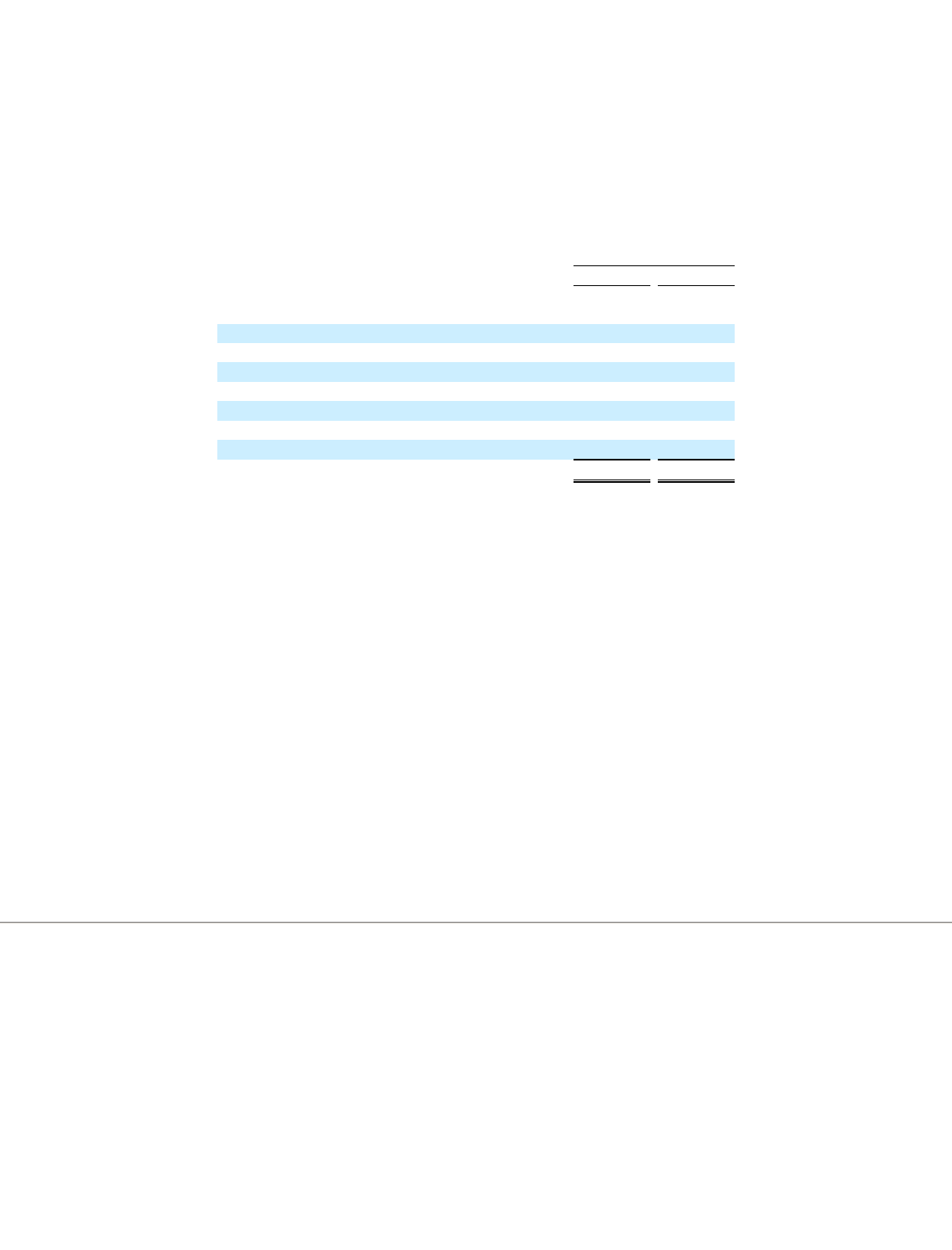

Accrued liabilities included in other current liabilities as of December 31, 2012 and 2011 consist of the following:

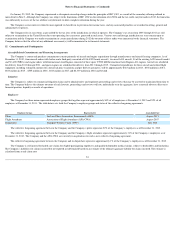

The Company’s amended and restated certificate of incorporation dated June 1, 2011, authorizes the Company to issue up to 240,000,000 shares of common stock,

$0.0001 par value per share, 50,000,000 shares of non-voting common stock, $0.0001 par value per share, and 10,000,000 shares of preferred stock, $0.0001 par value per

share. All of the Company’s issued and outstanding shares of common stock and preferred stock are duly authorized, validly issued, fully paid and non-assessable. The

Company’s shares of common stock and non-voting common stock are not redeemable and do not have preemptive rights.

Common Stock

Dividend Rights . Holders of the Company’s common stock are entitled to receive dividends, if any, as may be declared from time to time by the Company’s board of

directors out of legally available funds ratably with shares of the Company’s non-voting common stock, subject to preferences that may be applicable to any then

outstanding preferred stock and limitations under Delaware law.

Voting Rights . Each holder of the Company’s common stock is entitled to one vote for each share on all matters submitted to a vote of the stockholders, including the

election of directors. The Company’s stockholders do not have cumulative voting rights in the election of directors. Accordingly, holders of a majority of the voting shares

are able to elect all of the directors properly up for election at any given stockholders’ meeting.

Liquidation . In the event of the Company’s liquidation, dissolution or winding up, holders of the Company's common stock will be entitled to share ratably with

shares of the Company’s non-voting common stock in the net assets legally available for distribution to stockholders after the payment of all of the Company’s debts and

other liabilities and the satisfaction of any liquidation preference granted to the holders of any then outstanding shares of preferred stock.

Rights and Preferences . Holders of the Company’s common stock have no preemptive, conversion, subscription or other rights, and there are no redemption or

sinking fund provisions applicable to the Company’s common stock. The rights, preferences and privileges of the holders of the Company’s common stock are subject to

and may be adversely affected by, the rights of the holders of shares of any series of the Company’s preferred stock that the Company may designate in the future.

71

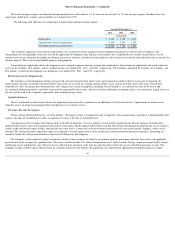

6.

Accrued Liabilities

As of December 31,

2012

2011

(in thousands)

Federal excise and other passenger taxes and fees payable

$

23,401

$

17,813

Aircraft maintenance

22,319

7,816

Salaries and wages

21,057

17,123

Airport expenses

16,024

10,682

Fuel

11,219

87

Aircraft and facility rent

8,020

7,206

Current portion of tax receivable agreement

7,987

27,399

Other

11,287

10,730

Accrued liabilities

$

121,314

$

98,856

7.

Common Stock and Preferred Stock