Spirit Airlines 2012 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2012 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

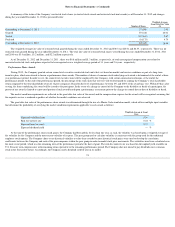

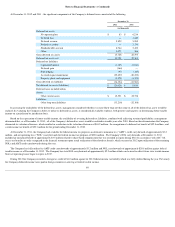

Cash and cash equivalents at December 31, 2012 and December 31, 2011 are comprised of liquid money market funds and cash. The Company maintains cash with

various high-quality financial institutions. The Company had no transfers of assets or liabilities between any of the above levels during the years ended December 31, 2012

and 2011 .

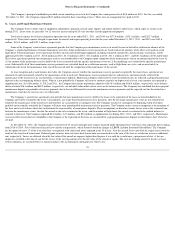

The Company did not elect hedge accounting on any of the derivative instruments, and as a result, changes in the fair values of these fuel hedge contracts are recorded

each period in fuel expense. Fair values of the instruments are determined using standard option valuation models. The Company also considers counterparty risk and its

own credit risk in its determination of all estimated fair values. The Company offsets fair value amounts recognized for derivative instruments executed with the same

counterparty under a master netting arrangement. The Company determines the fair value of fuel derivative option contracts utilizing an option pricing model based on

inputs that are either readily available in public markets or can be derived from information available in publicly quoted markets. The Company has consistently applied

these valuation techniques in all periods presented and believes it has obtained the most accurate information available for the types of derivative contracts it holds.

Due to the fact that certain inputs utilized to determine the fair value of aircraft fuel derivatives are unobservable (principally implied volatility), the Company has

categorized these derivatives as Level 3. Implied volatility of an option contract is the volatility of the price of the underlying that is implied by the market price of the

option based on an option pricing model. Thus, it is the volatility that, when used in a particular pricing model, yields a theoretical value for the option equal to the current

market price of that option. Implied volatility, a forward-looking measure, differs from historical volatility because the latter is calculated from known past returns. At each

balance sheet date, the Company substantiates and adjusts unobservable inputs. The Company routinely assesses the valuation model's sensitivity to changes in implied

volatility. Based on the Company's assessment of the valuation model's sensitivity to changes in implied volatility, it noted that holding other inputs constant, a significant

increase (decrease) in implied volatility would result in a significantly higher (lower) determination of fair value measurement for the Company's aircraft fuel derivatives.

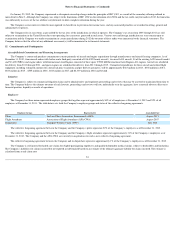

The Company's Valuation Group is made up of individuals from the Company's Risk Management, Treasury and Corporate Accounting departments. The Valuation

Group is responsible for the Company's valuation policies, procedures and execution thereof. The Company's Valuation Group reports to the Company's Chief Financial

Officer and Audit Committee who approve all derivative transactions. The Valuation Group compares the results of the Company's internally developed valuation methods

with counterparty reports at each balance sheet date and assesses the Company's valuation methods for accurateness and identifies any needs for modification.

83

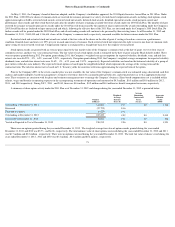

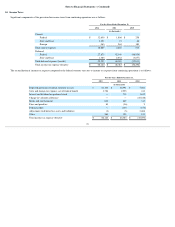

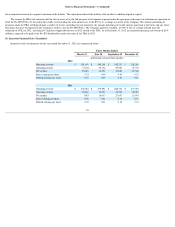

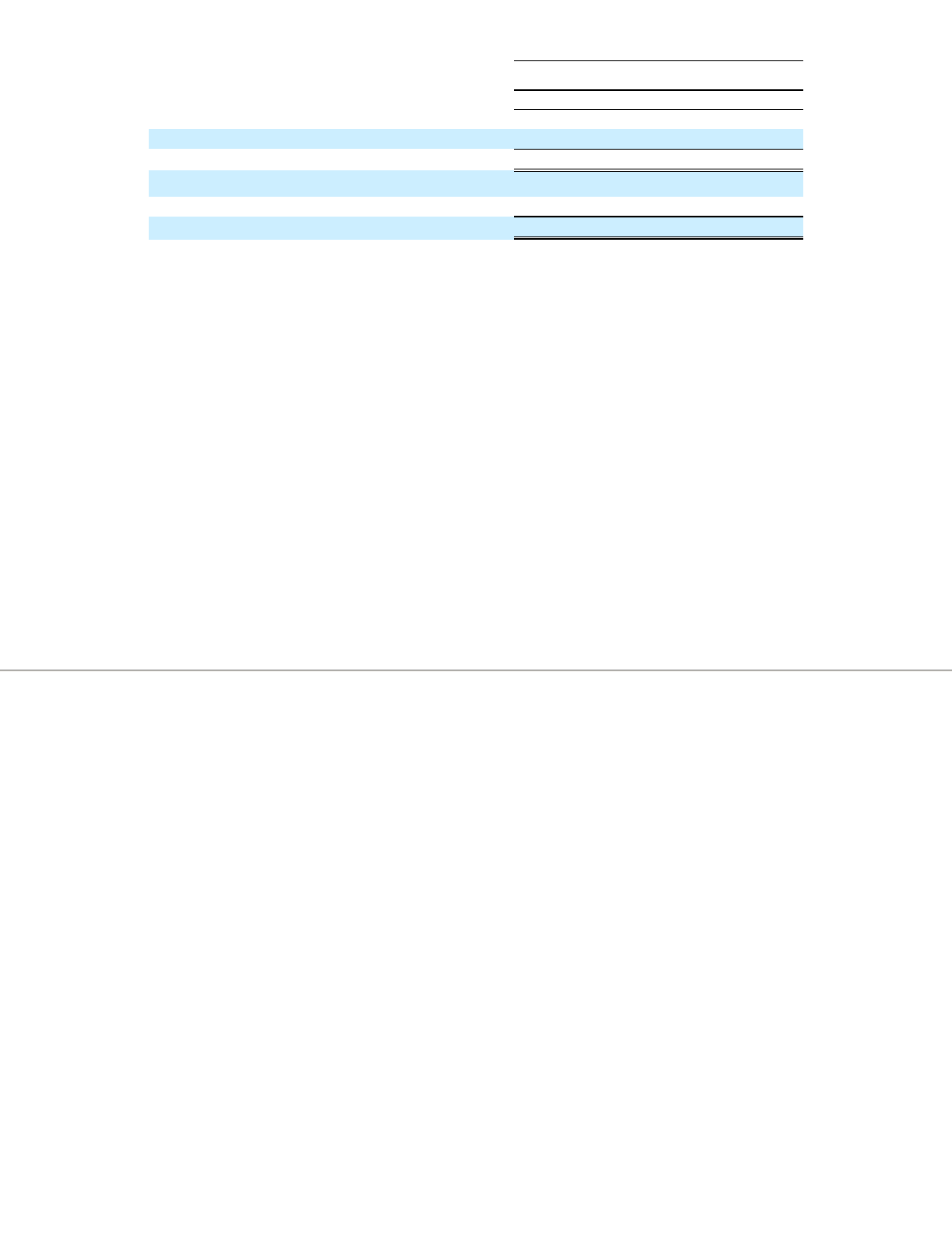

Fair Value Measurements as of December 31, 2011

Total

Level

1

Level

2

Level

3

(in millions)

Cash and cash equivalents

$

343.3

$

343.3

$

—

$

—

Option contracts

1.0

—

—

1.0

Total assets

$

344.3

$

343.3

$

—

$

1.0

Option contracts

0.7

$

—

$

—

$

0.7

Total liabilities

$

0.7

$

—

$

—

$

0.7