Spirit Airlines 2012 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2012 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Innovative Revenue Generation . We execute our innovative, unbundled pricing strategy to produce significant non-ticket revenue generation, which allows us to

stimulate passenger demand for our product by lowering base fares and enabling passengers to identify, select, and pay for the products and services they want to use. Our

unbundled strategy has enabled us to grow average non-ticket revenue per passenger flight segment from approximately $5 in 2006 to $51 in 2012 by:

Resilient Business Model and Customer Base . By focusing on price-sensitive travelers, we have maintained relatively stable unit revenue and profitability during

volatile economic periods because we are not highly dependent on premium-fare business traffic. We believe our growing customer base is more resilient than the customer

bases of most other airlines because our low fares and unbundled service offering appeal to price-sensitive passengers. For example, in 2009, when premium-fare business

traffic dried up due to the economic recession, our operating revenue per available seat mile (RASM) declined 1.9%, compared to an average U.S. airline industry decline of

over 9%.

Well Positioned for Growth . We have developed a substantial network of destinations in profitable U.S. domestic niche markets, targeted growth markets in the

Caribbean and Latin America, and high-volume routes flown by price-sensitive travelers. In the United States, we also have grown into large markets that, due to higher

fares, have priced out those more price-sensitive travelers. Our strategy to balance growth in large domestic markets, niche markets and opportunities in the Caribbean and

Latin America gives us a significant number of growth opportunities.

Experienced International Operator. We believe we have substantial experience in foreign local aviation, security and customs regulations, local ground operations

and flight crew training required for successful international and overwater flight operations. All of our aircraft are certified for overwater operations. We believe we

compete favorably against other low-cost carriers because we have been conducting international flight operations since 2003 and have developed substantial experience in

complying with the various regulations and business practices in the international markets we serve.

Financial Strength Achieved by Cost Discipline Focus . We believe our ULCC business model has delivered strong financial results in difficult economic times. We

have generated these results by:

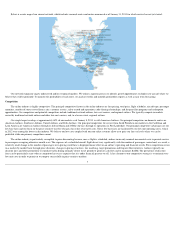

Route Network

As of December 31, 2012 , our route network included 110 markets served by 52 airports throughout North America, Central America, South America and the

Caribbean.

6

• charging for checked and carry-

on baggage;

• passing through all distribution-

related expenses;

•

charging for premium seats and advance seat selection;

•

enforcing ticketing policies, including service charges for changes and cancellations;

• generating subscription revenue from our $9 Fare Club ultra low-

fare subscription service;

• deriving brand-

based revenues from proprietary services, such as our FREE SPIRIT affinity credit card program;

•

selling itinerary attachments, such as hotel and car rental reservations and travel insurance, through our website; and

• selling in-

flight products and onboard advertising.

•

keeping a consistent focus on maintaining low unit operating costs;

•

maintaining disciplined capacity control and fleet size;

•

ensuring our sourcing arrangements with key third parties are continually benchmarked against the best industry standards;

•

maintaining a simple operation that focuses on delivering transportation; and

• generating and maintaining an adequate level of liquidity to insulate against volatility in key cost inputs, such as fuel, and in passenger demand that may occur as a

result of changing general economic conditions.