Spirit Airlines 2012 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2012 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

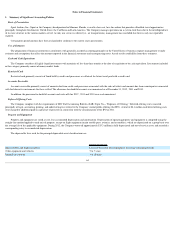

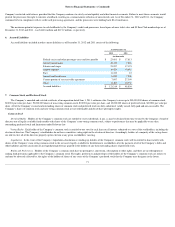

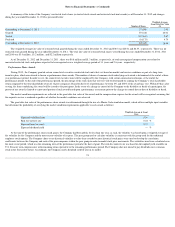

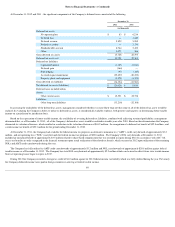

A summary of the status of the Company’s restricted stock shares (restricted stock awards and restricted stock unit awards) as of December 31, 2012 and changes

during the year ended December 31, 2012 is presented below:

The weighted-average fair value of restricted stock granted during the years ended December 31, 2012 and 2010 was $20.01 and $6.39 , respectively. There was no

restricted stock granted during the year ended December 31, 2011 . The total fair value of restricted stock shares vested during the years ended December 31, 2012 , 2011

and 2010 was $3.9 million , $3.2 million , and $2.2 million respectively.

As of December 31, 2012 and December 31, 2011 , there was $6.8 million and $1.3 million , respectively, of total unrecognized compensation cost related to

nonvested restricted stock and options expected to be recognized over a weighted-average period of 3.1 years and 2.6 years , respectively.

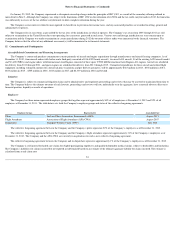

Performance Share Awards

During 2012 , the Company granted certain senior-level executives restricted stock units that vest based on market and service conditions as part of a long-term

incentive plan, which are referred to herein as performance share awards. The number of shares of common stock underlying each award is determined at the end of a three-

year performance period. In order to vest, the senior level executive must still be employed by the Company, with certain contractual exclusions, at the end of the

performance period. At the end of the performance period, the percentage of the stock units that will vest will be determined by ranking the Company’s total shareholder

return compared to the total shareholder return of 12 peer companies. Based on the level of performance, between 0% and 200% of the award may vest. Within 60 days

after

vesting, the shares underlying the award will be issued to the participant. In the event of a change in control of the Company or the disability or death of a participant, the

payout of any award is limited to a pro-rated portion of such award based upon a performance assessment prior to the change-in-control date or date of disability or death.

The market condition requirements are reflected in the grant date fair value of the award, and the compensation expense for the award will be recognized assuming that

the requisite service is rendered regardless of whether the market conditions are achieved.

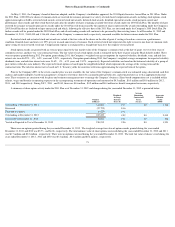

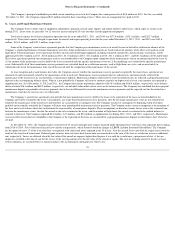

The grant date fair value of the performance share awards was determined through the use of a Monte Carlo simulation model, which utilizes multiple input variables

that determine the probability of satisfying the market condition requirements applicable to each award as follows:

At the time of the performance share award grants, the Company had been public for less than one year; as such, the volatility was based upon a weighted average of

the volatility for the Company and the most recent volatility of its peers. The peer group used to calculate volatility is consistent with the group used for the traditional

employee stock options. The Company chose to use historical volatility to value these awards because historical stock prices were used to develop the correlation

coefficients between the Company and each of the peer companies within the peer group in order to model stock price movements. The volatilities used were calculated over

the most recent period, which was the remaining term of the performance period at the date of grant. The risk-free interest rate was based on the implied yield available on

U.S. Treasury zero-coupon issues with remaining terms equivalent to the remaining performance period. The Company does not intend to pay dividends on its common

stock in the foreseeable future. Accordingly, the Company used a dividend yield of zero in its model.

74

Number of Shares

Weighted-Average

Grant Date Fair Value

($)

Outstanding at December 31, 2011

271,999

1.43

Granted

391,418

20.01

Vested

(197,613

)

2.67

Forfeited

(16,175

)

4.79

Outstanding at December 31, 2012

449,629

16.94

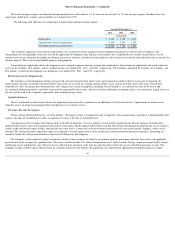

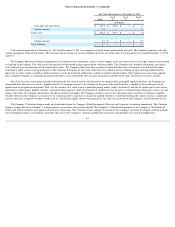

Weighted-Average at Grant

Date

Expected volatility factor

0.39

Risk free interest rate

0.44

%

Expected term (in years)

2.72

Expected dividend yield

—

%