Spirit Airlines 2012 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2012 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

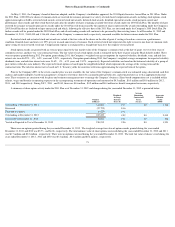

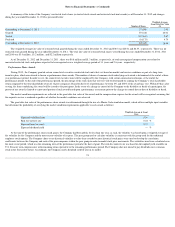

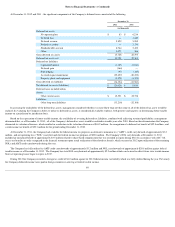

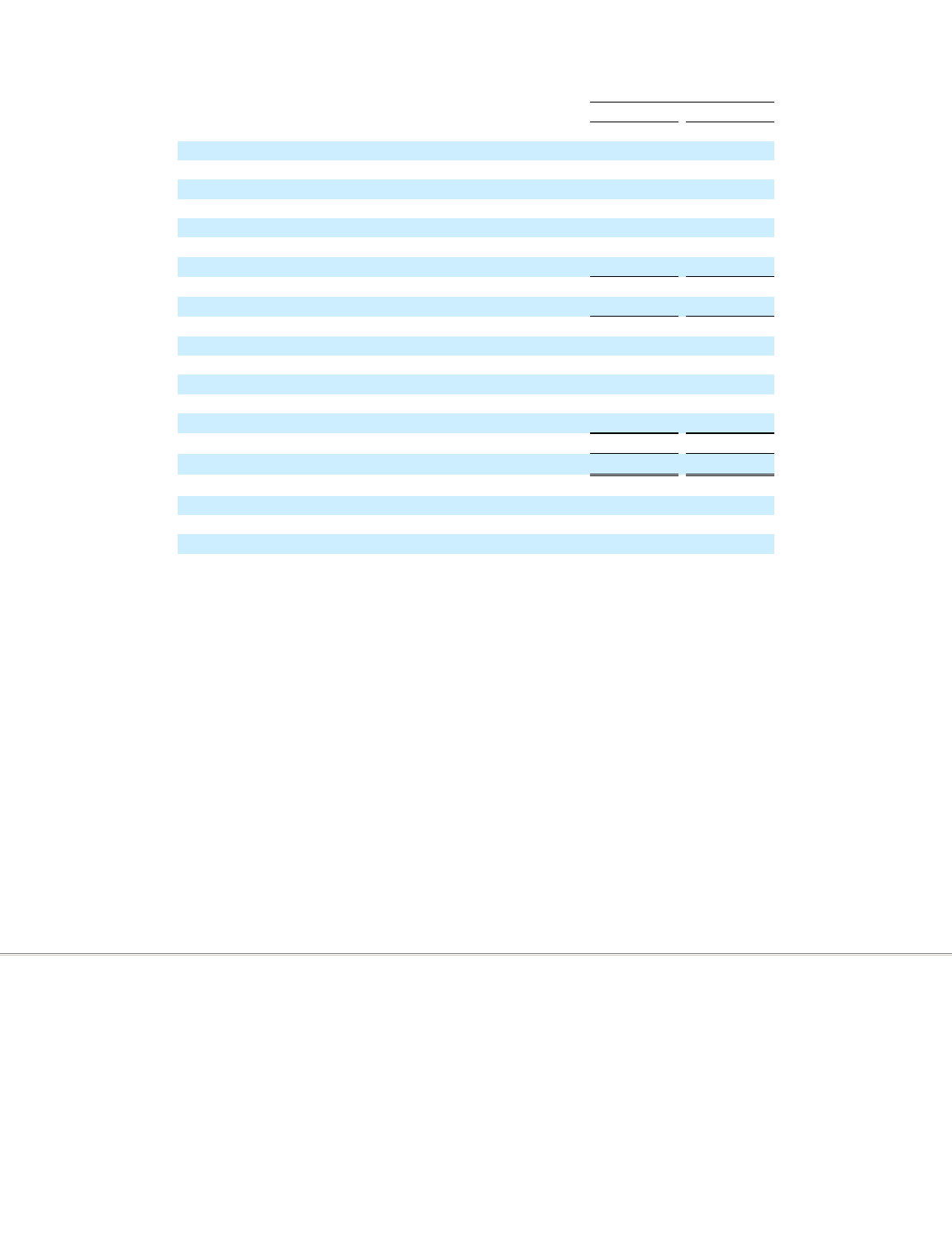

At December 31, 2012 and 2011 , the significant components of the Company's deferred taxes consisted of the following:

In assessing the realizability of the deferred tax assets, management considered whether it is more likely than not that some or all of the deferred tax assets would be

realized. In evaluating the Company's ability to utilize its deferred tax assets, it considered all available evidence, both positive and negative, in determining future taxable

income on a jurisdiction by jurisdiction basis.

Based on the expectation of future taxable income, the availability of reversing deferred tax liabilities, combined with achieving sustained profitability, management

determined that, as of December 31, 2010 , all of the Company's deferred tax assets would be realized in taxable years after 2010. Based on this determination the Company

eliminated its valuation allowance, which resulted in a reduction to the valuation allowance of $65.2 million , the recognition of a deferred tax benefit of $52.8 million , and

a total income tax benefit of $52.3 million for the period ending December 31, 2010 .

At December 31, 2011, the Company had available for federal income tax purposes an alternative minimum tax (“AMT”) credit carryforward of approximately $3.2

million , and net operating loss (“NOL”) carryforwards for federal income tax purposes of $20.8 million . The Company's NOL carryforwards at December 31, 2011

included an unrealized benefit of approximately $3.5 million related to share-based compensation that was recorded in equity during 2012. In accordance with ASC 718,

excess tax benefits are only recognized in the financial statements upon actual realization of the related tax benefit, which occurred in 2012 upon utilization of the remaining

NOLs and AMT credit carryforwards during the year.

The Company has fully utilized its AMT credit carryforwards of approximately $3.2 million and NOL carryforwards of approximately $20.8 million against federal

taxable income as of December 31, 2012 . The Company has state NOL carryforwards of approximately $2.2 million

which can be used to offset future state taxable income.

State net operating losses begin to expire in 2017.

During 2012 the Company recorded a foreign tax credit of $1.0 million

against its 2012 federal income tax liability which was fully utilized during the year. Previously

the Company deducted income taxes paid in foreign countries in arriving at federal taxable income.

80

December 31,

2012

2011

(in thousands)

Deferred tax assets:

Net operating loss

$

83

$

6,234

Deferred loss

—

1,440

Deferred revenue

5,829

5,985

Federal tax credits

—

3,176

Nondeductible accruals

6,744

5,452

Other

1,072

306

Gross deferred tax assets

13,728

22,593

Deferred tax assets, net

13,728

22,593

Deferred tax liabilities:

Capitalized interest

(1,125

)

(2,041

)

Deferred gain

(364

)

—

Fuel hedging

(97

)

(115

)

Accrued engine maintenance

(29,497

)

(10,232

)

Property, plant, and equipment

(3,271

)

(1,575

)

Gross deferred tax liabilities

(34,354

)

(13,963

)

Net deferred tax assets (liabilities)

$

(20,626

)

$

8,630

Deferred taxes included within:

Assets:

Other current assets

$

12,591

$

20,738

Liabilities:

Other long-term liabilities

(33,216

)

(12,108

)