Salesforce.com 2016 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2016 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

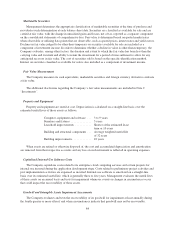

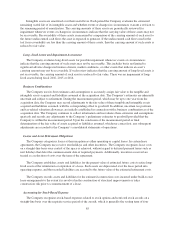

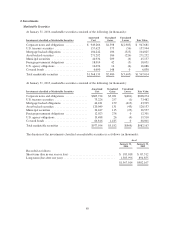

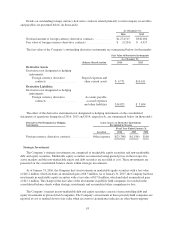

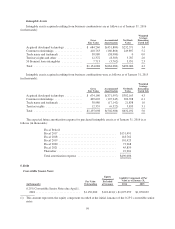

As of January 31, 2016, the following marketable securities were in an unrealized loss position (in

thousands):

Less than 12 Months 12 Months or Greater Total

Fair Value

Unrealized

Losses Fair Value

Unrealized

Losses Fair Value

Unrealized

Losses

Corporate notes and obligations .... $531,258 $(2,472) $48,047 $(511) $579,305 $(2,983)

U.S. treasury securities ........... 50,434 (56) 0 0 50,434 (56)

Mortgage backed obligations ....... 61,055 (274) 4,780 (49) 65,835 (323)

Asset backed securities ........... 135,917 (199) 5,490 (27) 141,407 (226)

Municipal securities .............. 4,553 (4) 1,959 (2) 6,512 (6)

U.S. agency obligations ........... 5,989 (6) 0 0 5,989 (6)

Foreign government obligations .... 5,523 (5) 0 0 5,523 (5)

$794,729 $(3,016) $60,276 $(589) $855,005 $(3,605)

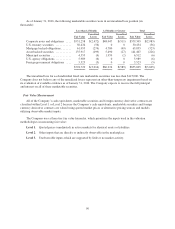

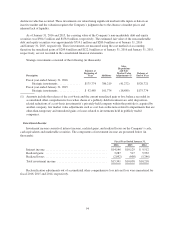

The unrealized loss for each individual fixed rate marketable securities was less than $115,000. The

Company does not believe any of the unrealized losses represent an other-than-temporary impairment based on

its evaluation of available evidence as of January 31, 2016. The Company expects to receive the full principal

and interest on all of these marketable securities.

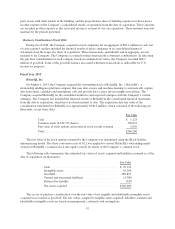

Fair Value Measurement

All of the Company’s cash equivalents, marketable securities and foreign currency derivative contracts are

classified within Level 1 or Level 2 because the Company’s cash equivalents, marketable securities and foreign

currency derivative contracts are valued using quoted market prices or alternative pricing sources and models

utilizing observable market inputs.

The Company uses a three-tier fair value hierarchy, which prioritizes the inputs used in the valuation

methodologies in measuring fair value:

Level 1. Quoted prices (unadjusted) in active markets for identical assets or liabilities.

Level 2. Other inputs that are directly or indirectly observable in the marketplace.

Level 3. Unobservable inputs which are supported by little or no market activity.

90