Salesforce.com 2016 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2016 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

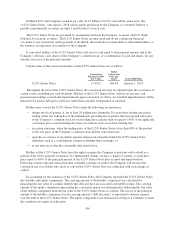

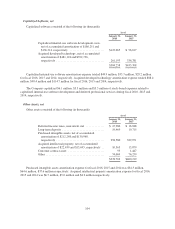

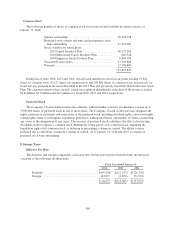

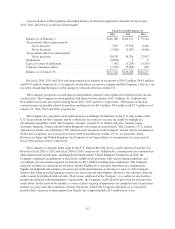

Capitalized Software, net

Capitalized software consisted of the following (in thousands):

As of

January 31,

2016

January 31,

2015

Capitalized internal-use software development costs,

net of accumulated amortization of $186,251 and

$136,314, respectively ........................ $123,065 $ 96,617

Acquired developed technology, net of accumulated

amortization of $481,118 and $392,736,

respectively ................................. 261,193 336,781

$384,258 $433,398

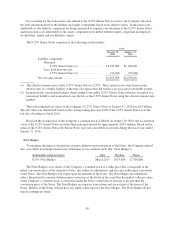

Capitalized internal-use software amortization expense totaled $49.9 million, $35.7 million, $29.2 million

for fiscal 2016, 2015 and 2014, respectively. Acquired developed technology amortization expense totaled $88.4

million, $98.4 million and $114.7 million for fiscal 2016, 2015 and 2014, respectively.

The Company capitalized $6.1 million, $5.3 million and $3.5 million of stock-based expenses related to

capitalized internal-use software development and deferred professional services during fiscal 2016, 2015 and

2014, respectively.

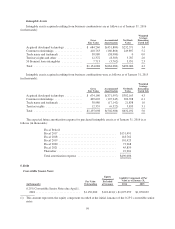

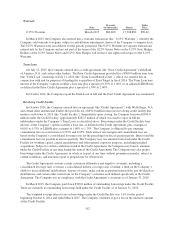

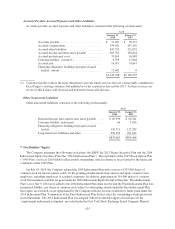

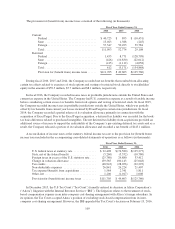

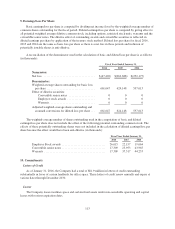

Other Assets, net

Other assets consisted of the following (in thousands):

As of

January 31,

2016

January 31,

2015

Deferred income taxes, noncurrent, net ............. $ 15,986 $ 16,948

Long-term deposits ............................. 19,469 19,715

Purchased intangible assets, net of accumulated

amortization of $212,248 and $130,968,

respectively ................................. 258,580 329,971

Acquired intellectual property, net of accumulated

amortization of $22,439 and $15,695, respectively . . 10,565 15,879

Customer contract asset ......................... 93 1,447

Other ........................................ 74,069 76,259

$378,762 $460,219

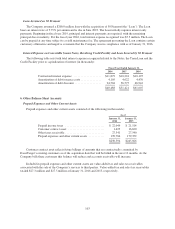

Purchased intangible assets amortization expense for fiscal 2016, 2015 and 2014 was $81.3 million,

$64.6 million, $37.6 million respectively. Acquired intellectual property amortization expense for fiscal 2016,

2015 and 2014 was $6.7 million, $5.0 million and $4.2 million respectively.

104