Salesforce.com 2016 Annual Report Download - page 67

Download and view the complete annual report

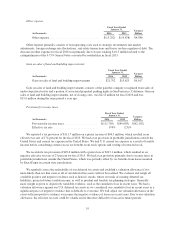

Please find page 67 of the 2016 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our working capital accounts consist of accounts receivables and prepaid assets and other current assets.

Claims against working capital include accounts payable, accrued expenses and other current liabilities and our

convertible notes. Our working capital may be impacted by factors in future periods, certain amounts and timing

of which are seasonal, such as billings to customers for subscriptions and support services and the subsequent

collection of those billings.

As described above in “Seasonal Nature of Deferred Revenue and Accounts Receivable,” our fourth quarter

has historically been our strongest quarter for new business and renewals. The year on year compounding effect

of this seasonality in both billing patterns and overall business causes the value of invoices that we generate in

the fourth quarter to increase as a proportion of our total annual billings.

We generally invoice our customers for our subscription and services contracts in advance in annual

installments. We typically issue renewal invoices in advance of the renewal service period, and depending on

timing, the initial invoice for the subscription and services contract and the subsequent renewal invoice may

occur in different quarters. Such invoice amounts are initially reflected in accounts receivable and deferred

revenue, which is reflected on the balance sheet. The operating cash flow benefit of increased billing activity

generally occurs in the subsequent quarter when we collect from our customers. As such, our first quarter is our

largest collections and operating cash flow quarter.

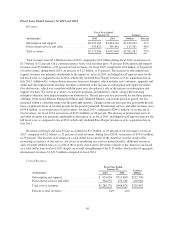

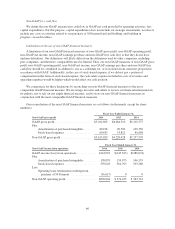

Net cash used in investing activities was $1.5 billion during fiscal 2016 and $698.4 million during the same

period a year ago. The net cash used in investing activities during fiscal 2016 primarily related to capital

expenditures, including strategic investments, business combinations, purchase of 50 Fremont land and building,

new office build-outs, investment of cash balances and strategic investments offset by proceeds from sales and

maturities of marketable securities and proceeds from sales of Mission Bay land, the use of restricted cash to

purchase 50 Fremont land and building. Net cash used in investing activities during fiscal 2016 increased by

approximately $789.5 million over the same period a year ago primarily due to cash used for the acquisition of

50 Fremont land and building and strategic investments.

Net cash provided by financing activities was $132.6 million during fiscal 2016 as compared to net cash used

in financing activities of $310.5 million during the same period a year ago. Net cash provided by financing activities

during fiscal 2016 consisted primarily of $455.5 million from proceeds from equity plan offset by $82.3 million of

principal payments on capital leases and $300.0 million payment of our revolving credit facility. Net cash flows

used in financing activities during fiscal 2015 changed $443.1 million from the same period a year ago primarily

due to $568.9 million payment on convertible senior notes, $285.0 million payment on term loan, offset by

$297.3 million proceeds from revolving credit facility and $309.0 million of proceeds from our equity plans.

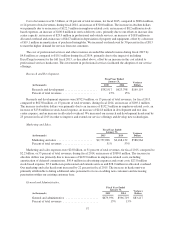

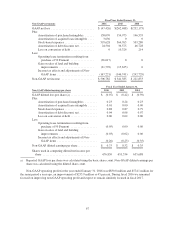

In January 2010, we issued $575.0 million of 0.75% convertible senior notes due January 15, 2015 (the

“0.75% Senior Notes”) and concurrently entered into convertible notes hedges (the “0.75% Note Hedges”) and

separate warrant transactions (the “0.75% Warrants”). On January 15, 2015, the 0.75% Senior Notes matured.

Upon maturity of the 0.75% Senior Notes, we delivered cash up to the remaining principal amount of the 0.75%

Senior Notes and shares of our common stock for the excess conversion value greater than the principal amount

of the 0.75% Senior Notes. As a result of the conversions and maturity of the 0.75% Senior Notes during fiscal

2015, the Company exercised its rights on the 0.75% Note Hedges, and the 0.75% Note Hedges expired.

Additionally, in fiscal 2015 the Company entered into agreements with each of the 0.75% Warrant counterparties

to amend and settle the 0.75% Warrants prior to their scheduled expiration beginning in April 2015. As a result,

the Company issued, in the aggregate, approximately 13.3 million shares to the counterparties to settle, via a net

share settlement, the entirety of the 0.75% Warrants.

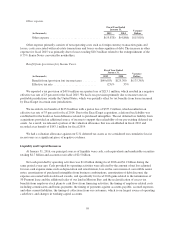

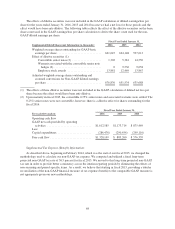

The 0.25% Senior Notes will be convertible if during any 20 trading days during the 30 consecutive trading

days of any fiscal quarter, our common stock trades at a price exceeding 130% of the conversion price of $66.44

per share applicable to the 0.25% Senior Notes. The 0.25% Senior Notes have not yet been convertible at the

holders’ option. The 0.25% Senior Notes are classified as a noncurrent liability on our consolidated balance sheet

60