Salesforce.com 2016 Annual Report Download - page 95

Download and view the complete annual report

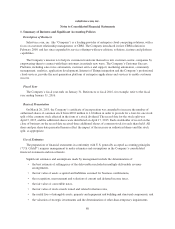

Please find page 95 of the 2016 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.in exchange for those goods or services. The standard also provides guidance on the recognition of costs related to

obtaining and fulfilling customer contracts. The FASB deferred the effective date for the new revenue reporting

standard for entities reporting under U.S. GAAP for one year. In accordance with the deferral, ASU 2014-09 will be

effective for fiscal 2019, including interim periods within that reporting period. The Company is currently in the

process of assessing the adoption methodology, which allows the amendment to be applied retrospectively to each

prior period presented, or with the cumulative effect recognized as of the date of initial application. The Company is

also evaluating the impact of the adoption of ASU 2014-09 on its condensed consolidated financial statements and

has not determined whether the effect will be material to either its revenue results or its deferred commissions

balances.

In September 2015, the FASB issued Accounting Standards Update No. 2015-16, “Simplifying the

Accounting for Measurement-Period Adjustments (Topic 805)” (“ASU 2015-16”) which eliminates the

requirement to restate prior period financial statements for measurement period adjustments in business

combinations. ASU 2015-16 requires that the cumulative impact of a measurement period adjustment (including

the impact on prior periods) be recognized in the reporting period in which the adjustment is identified. The new

standard is effective for interim and annual periods beginning after December 15, 2015 and early adoption is

permitted. The Company is evaluating the impact of the adoption of ASU 2015-16 on its consolidated financial

statements.

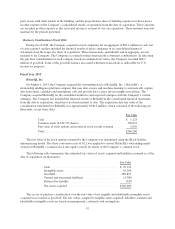

In November 2015, the FASB issued Accounting Standards Update No. 2015-17, “Income Taxes

(Topic 740): Balance Sheet Classification of Deferred Taxes” (“ASU 2015-17”) which requires all deferred

income taxes to be classified as noncurrent on the balance sheet. The amendments would be effective for annual

periods beginning after December 15, 2016. The Company early adopted this standard retrospectively for all

prior periods and reclassified all current deferred tax assets and liabilities to noncurrent deferred tax assets and

liabilities on the consolidated balance sheets for all periods presented.

In February 2016, the FASB issued Accounting Standards Update No. 2016-02, “Leases (Topic 842)”

(“ASU 2016-02”), which requires lessees to put most leases on their balance sheets but recognize the expenses

on their income statements in a manner similar to current practice. ASU 2016-02 states that a lessee would

recognize a lease liability for the obligation to make lease payments and a right-to-use asset for the right to use

the underlying asset for the lease term. The new standard is effective for interim and annual periods beginning

after December 15, 2018 and early adoption is permitted. The Company is currently evaluating the impact to its

consolidated financial statements.

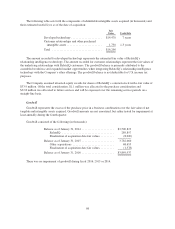

Reclassifications

Certain reclassifications to the fiscal 2015 balances were made to conform to the current period presentation

in the Balance Sheet. These reclassifications include strategic investments and other assets, net.

88