Salesforce.com 2016 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2016 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

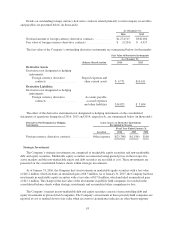

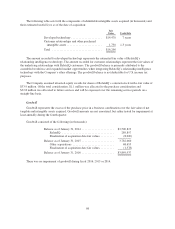

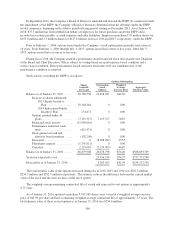

the Company had capitalized $125.3 million of construction costs, based on the construction costs incurred to date

by the landlord, and recorded a corresponding noncurrent financing obligation liability of $125.3 million. The total

expected financing obligation associated with this lease upon completion of the construction of the building,

inclusive of the amounts currently recorded, is $334.0 million, including interest (see Note 10 “Commitments” for

future commitment details). The obligation will be settled through monthly lease payments to the landlord once the

office space is ready for occupancy. To the extent that operating expenses for 350 Mission are material, the

Company, as the deemed accounting owner, will record the operating expenses. In April 2015, the building was

placed into service and depreciation commenced.

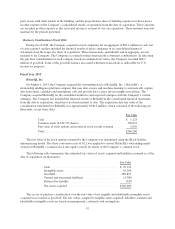

4. Business Combinations

50 Fremont

In February 2015, the Company acquired 50 Fremont Street, a 41 -story building totaling approximately

817,000 rentable square feet located in San Francisco, California (“50 Fremont”). At the time of the acquisition,

the Company was leasing approximately 500,000 square feet of the available space in 50 Fremont. As of

January 31, 2016, the Company occupied approximately 567,000 square feet. The Company acquired 50 Fremont

for the purpose of expanding its global headquarters in San Francisco. Pursuant to the acquisition agreement, the

Company also acquired existing third-party leases and other intangible property, terminated the Company’s

existing office leases with the seller and assumed the seller’s outstanding loan on 50 Fremont. In accordance with

Accounting Standards Codification 805 (“ASC 805”), Business Combinations, the Company accounted for the

building purchase as a business combination.

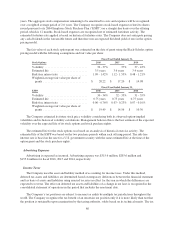

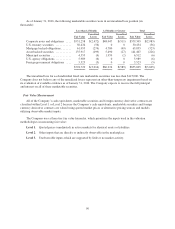

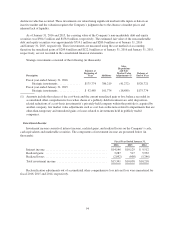

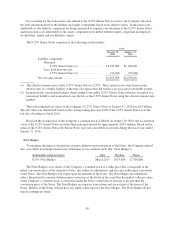

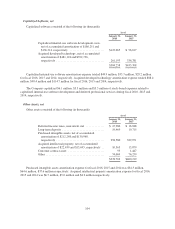

The purchase consideration for the corporate headquarters building was as follows (in thousands):

Fair Value

Cash .................................................... $435,189

Loan assumed on 50 Fremont ................................ 200,000

Prorations due to ownership transfer midmonth .................. 2,411

Total purchase consideration ................................. $637,600

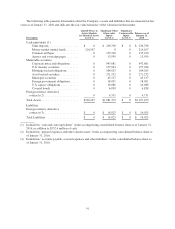

The following table summarizes the fair values of net tangible and intangible assets acquired (in thousands):

Fair Value

Building ................................................. $435,390

Land .................................................... 183,888

Termination of salesforce operating lease ....................... 9,483

Acquired lease intangibles ................................... 7,590

Loan assumed on 50 Fremont fair market value adjustment ......... 1,249

Total .................................................... $637,600

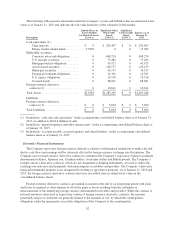

To fund the purchase of 50 Fremont, the Company used $115.0 million of restricted cash that the Company

had on the balance sheet as of January 31, 2015.

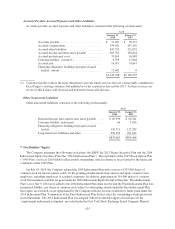

In connection with the purchase, the Company recognized a net non-cash gain totaling approximately

$36.6 million on the termination of the lease signed in January 2012. This amount reflects a gain of $46.1 million

for the reversal of tenant incentives provided from the previous landlord at the inception of the lease and a loss of

$9.5 million related to the termination of the Company’s operating lease. The tax impact as a result of the

difference between tax and book basis of the building is insignificant after considering the impact of the

Company’s valuation allowance. The amounts above have been included in the Company’s consolidated

statements of operations and consolidated balance sheet. The Company has included the rental income from third

96