Salesforce.com 2016 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2016 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

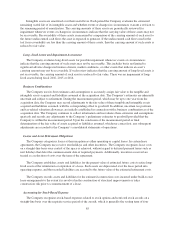

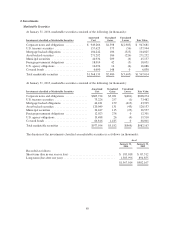

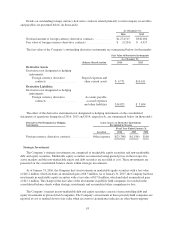

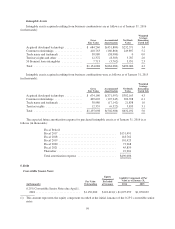

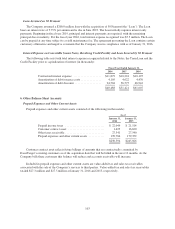

3. Property and Equipment

Property and equipment, net consisted of the following (in thousands):

As of January 31,

2016 2015

Land ............................................... $ 183,888 $ 0

Buildings ........................................... 614,081 125,289

Computers, equipment and software ...................... 1,281,766 1,171,762

Furniture and fixtures ................................. 82,242 71,881

Leasehold improvements ............................... 473,688 376,761

2,635,665 1,745,693

Less accumulated depreciation and amortization ............ (919,837) (619,827)

$1,715,828 $1,125,866

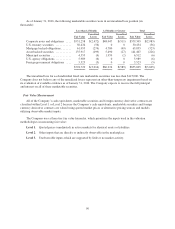

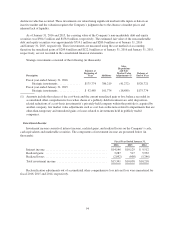

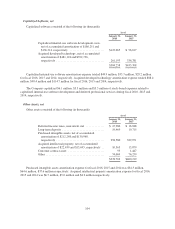

Depreciation and amortization expense totaled $302.0 million, $246.6 million and $185.9 million during

fiscal 2016, 2015 and 2014, respectively.

Computers, equipment and software at January 31, 2016 and 2015 included a total of $747.1 million and

$734.7 million acquired under capital lease agreements, respectively. Accumulated amortization relating to

computers, equipment and software under capital leases totaled $310.3 million and $206.7 million, respectively,

at January 31, 2016 and 2015. Amortization of assets under capital leases is included in depreciation and

amortization expense.

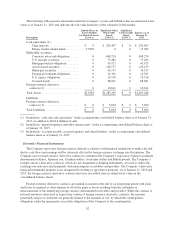

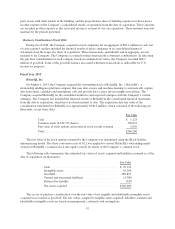

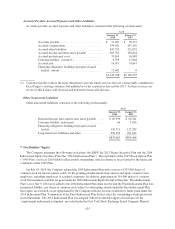

Land

In August 2014, the Company sold approximately 3.7 net acres of its undeveloped real estate, which had

been classified as held for sale, for a total of $72.5 million. The Company recognized a gain of $7.8 million, net

of closing costs, on the sale of this portion of the Company’s land and building improvements.

Separately, in September 2014, the Company sold approximately 1.5 net acres of its remaining undeveloped

real estate, which had been classified as held for sale, and the remaining portion of the perpetual parking rights,

for a total of $125.0 million. The Company recognized a gain of $7.8 million, net of closing costs, on the sale of

this portion of the Company’s land, building improvements and perpetual parking rights.

In October 2015, the Company sold approximately 8.8 net acres of undeveloped real estate and the

associated perpetual parking rights in San Francisco, California, which were classified as held for sale. The total

proceeds from the sale were $157.1 million, of which the Company received $127.1 million in October 2015 and

previously received a nonrefundable deposit in the amount of $30.0 million during April 2014. The Company

recognized a gain of $21.8 million, net of closing costs, on the sale of this portion of the Company’s land and

building improvements and perpetual parking rights.

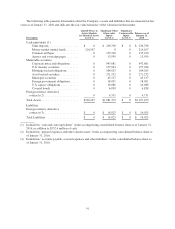

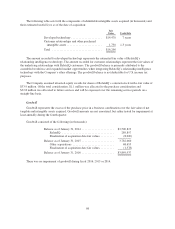

Building

In December 2013, the Company entered into a lease agreement for approximately 445,000 rentable square

feet of office space at 350 Mission Street in San Francisco, California. The space rented is for the total office space

available in the building, which is in the process of being constructed. As a result of the Company’s involvement

during the construction period, the Company is considered for accounting purposes to be the owner of the

construction project. As of January 31, 2016, the Company had capitalized $174.6 million of construction costs,

based on the construction costs incurred to date by the landlord, and recorded a corresponding current and

noncurrent financing obligation liability of $15.4 million and $196.7 million, respectively. As of January 31, 2015,

95