Salesforce.com 2016 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2016 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

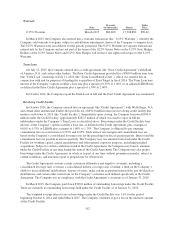

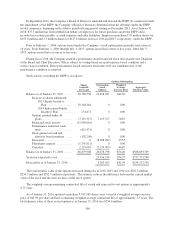

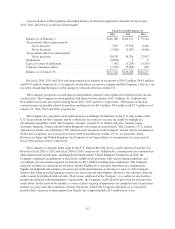

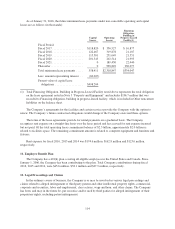

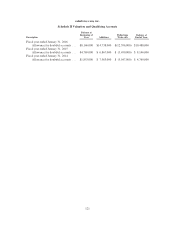

A reconciliation of the beginning and ending balance of total unrecognized tax benefits for fiscal years

2016, 2015 and 2014 is as follows (in thousands):

Fiscal Year Ended January 31,

2016 2015 2014

Balance as of February 1, ............................... $146,188 $102,275 $ 75,144

Tax positions taken in prior period:

Gross increases ................................... 7,456 17,938 8,420

Gross decreases .................................. (7,264) (1,967) (4,466)

Tax positions taken in current period:

Gross increases ................................... 38,978 34,226 27,952

Settlements .......................................... (8,684) 0 0

Lapse of statute of limitations ........................... (781) (1,224) (5,205)

Currency translation effect .............................. (3,152) (5,060) 430

Balance as of January 31, ............................... $172,741 $146,188 $102,275

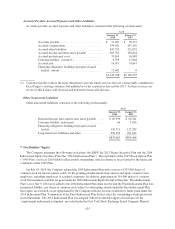

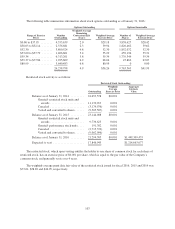

For fiscal 2016, 2015 and 2014 total unrecognized tax benefits in an amount of $56.2 million, $44.6 million

and $34.9 million, respectively, if recognized, would reduce income tax expense and the Company’s effective tax

rate after considering the impact of the change in valuation allowance in the U.S.

The Company recognizes accrued interest and penalties related to unrecognized tax benefits in the income

tax provision. The Company accrued penalties and interest in the amount of $1.3 million, $1.3 million and

$0.6 million in income tax expense during fiscal 2016, 2015 and 2014, respectively. The balance in the non-

current income tax payable related to penalties and interest was $6.3 million, $4.6 million and $3.3 million as of

January 31, 2016, 2015 and 2014, respectively.

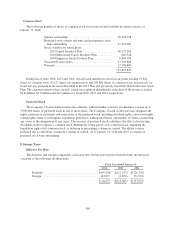

The Company has operations and taxable presence in multiple jurisdictions in the U.S. and outside of the

U.S. Tax positions for the Company and its subsidiaries are subject to income tax audits by multiple tax

jurisdictions around the world. The Company currently considers U.S. federal and state, Canada, Japan,

Australia, Germany, France and the United Kingdom to be major tax jurisdictions. The Company’s U.S. federal

and state tax returns since February 1999, which was the inception of the Company, remain open to examination.

With some exceptions, tax years prior to fiscal 2008 in jurisdictions outside of U.S. are generally closed.

However, in Japan and United Kingdom, the Company is no longer subject to examinations for years prior to

fiscal 2014 and fiscal 2011, respectively.

The Company is currently under audit by the U.S. Internal Revenue Service and California Franchise Tax

Board for fiscal 2011 to 2012 and fiscal 2009 to 2010, respectively. Additionally, examinations are conducted in

other international jurisdictions, including Switzerland and the United Kingdom. During fiscal 2016, the

Company completed examinations or effectively settled on tax positions with various taxing authorities and

accordingly, decreased unrecognized tax benefits by $8.7 million resulting from settlements. The Company

regularly evaluates its uncertain tax positions and the likelihood of outcomes from these tax examinations.

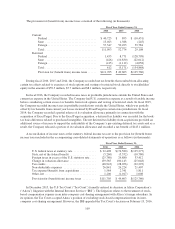

Significant judgment and estimates are necessary in the determination of income tax reserves. The Company

believes that it has provided adequate reserves for its income tax uncertainties. However, the outcome of the tax

audits cannot be predicted with certainty. If any issues addressed in the Company’s tax audits are resolved in a

manner inconsistent with management’s expectations, the Company could adjust its provision for income taxes

in the future. In the next twelve months, as some of these ongoing examinations are completed and tax positions

in these tax years meet the conditions of being effectively settled, the Company anticipates it is reasonably

possible that a decrease of unrecognized tax benefits up to approximately $15 million may occur.

112