Salesforce.com 2016 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2016 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.New Accounting Pronouncements

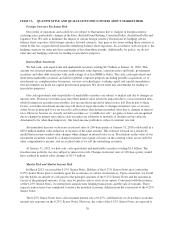

In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update

No. 2014-09, “Revenue from Contracts with Customers (Topic 606)” (“ASU 2014-09”), which amended the

existing FASB Accounting Standards Codification. This standard establishes a principle for recognizing revenue

upon the transfer of promised goods or services to customers, in an amount that reflects the expected

consideration received in exchange for those goods or services. The standard also provides guidance on the

recognition of costs related to obtaining and fulfilling customer contracts. The FASB deferred the effective date

for the new revenue reporting standard for entities reporting under U.S. GAAP for one year. In accordance with

the deferral, ASU 2014-09 will be effective for fiscal 2019, including interim periods within that reporting

period. We are currently in the process of assessing the adoption methodology, which allows the amendment to

be applied retrospectively to each prior period presented, or with the cumulative effect recognized as of the date

of initial application. We are also evaluating the impact of the adoption of ASU 2014-09 on our consolidated

financial statements and have not determined whether the effect will be material to either our revenue results or

our deferred commission balances.

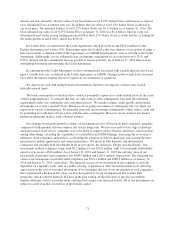

In September 2015, the FASB issued Accounting Standards Update No. 2015-16, “Simplifying the

Accounting for Measurement-Period Adjustments (Topic 805)” (“ASU 2015-16”) which eliminates the

requirement to restate prior period financial statements for measurement period adjustments in business

combinations. ASU 2015-16 requires that the cumulative impact of a measurement period adjustment (including

the impact on prior periods) be recognized in the reporting period in which the adjustment is identified. The new

standard is effective for interim and annual periods beginning after December 15, 2015 and early adoption is

permitted. We are evaluating the impact of the adoption of ASU 2015-16 on our consolidated financial

statements.

In February 2016, the FASB issued Accounting Standards Update No. 2016-02, “Leases (Topic 842)”

(“ASU 2016-02”), which requires lessees to put most leases on their balance sheets but recognize the expenses

on their income statements in a manner similar to current practice. ASU 2016-02 states that a lessee would

recognize a lease liability for the obligation to make lease payments and a right-to-use asset for the right to use

the underlying asset for the lease term. The new standard is effective for interim and annual periods beginning

after December 15, 2018 and early adoption is permitted. We are currently evaluating the impact to our

consolidated financial statements.

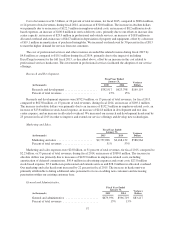

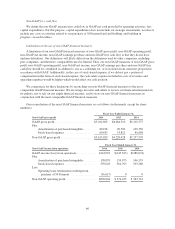

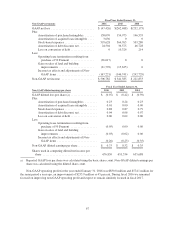

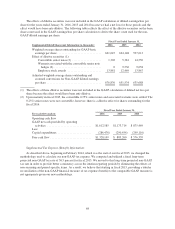

Non-GAAP Financial Measures for Statement of Operations and Sharecount Information

Regulation S-K Item 10(e), “Use of Non-GAAP Financial Measures in Commission Filings,” defines and

prescribes the conditions for use of non-GAAP financial information. Our measures of non-GAAP net income,

non-GAAP gross profit, non-GAAP operating profit, non-GAAP free cash flow, and non-GAAP earnings per

share each meet the definition of a non-GAAP financial measure. We use the below non-GAAP financial

measures to provide an additional view of operational performance by excluding expenses and benefits that are

not directly related to performance in any particular period. In addition to our GAAP measures, we use these

non-GAAP measures when planning, monitoring, and evaluating our performance. We believe that these non-

GAAP measures reflect our ongoing business in a manner that allows for meaningful period-to-period

comparisons and analysis of trends in our business, as they exclude certain expenses and benefits. These items

are excluded because the decisions which gave rise to them are not made to increase revenue in a particular

period, but are made for our long-term benefit over multiple periods and we are not able to change or affect these

items in any particular period.

63