Salesforce.com 2016 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2016 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

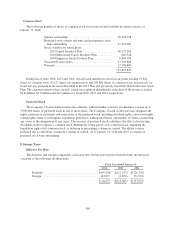

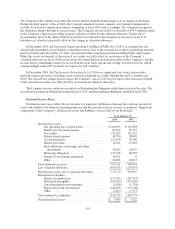

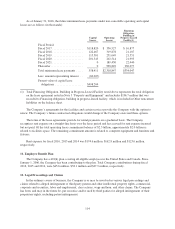

Additionally, the Company has donated subscriptions of the Company’s services to other qualified non-

profit organizations. The Company also allows Salesforce.org to resell the Company’s service to non-profit

organizations and certain higher education entities. The Company does not charge Salesforce.org for these

subscriptions, therefore revenue from subscriptions provided to non-profit organizations is donated back to the

community through charitable grants made by the Foundation and Salesforce.org. The reseller agreement was

amended in August 2015 to include additional customer segments and certain customers outside the U.S. and was

amended in October 2015 to add an addendum with model clauses for the processing of personal data transferred

from the European Economic Area. The value of the subscriptions pursuant to reseller agreements was

approximately $69.9 million for the fiscal year 2016. The Company plans to continue these programs.

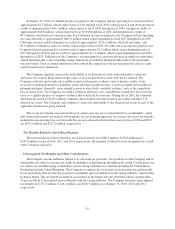

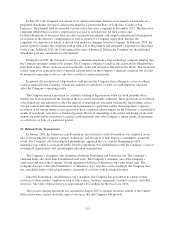

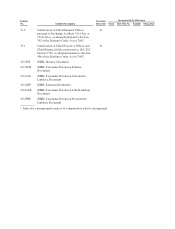

14. Subsequent Events

In February 2016, the Company acquired the outstanding stock of SteelBrick, Inc. (“SteelBrick”), a next

generation quote-to-cash platform, delivered 100 percent natively on the Salesforce platform, that offers apps for

automating the entire deal close process-from generating quotes and configuring orders to collecting cash. The

Company acquired SteelBrick for its employees and product offerings. Beginning with fiscal quarter ended

April 30, 2016, the Company will include the financial results of SteelBrick in its condensed consolidated

financial statements from the date of the acquisition. The total estimated consideration for SteelBrick was over

$300.0 million and primarily in shares.

In February 2016, the Company entered into an agreement to sublease additional office space. The amounts

associated with the agreement will be approximately $311.0 million over the approximately 12 year term of the

agreement, beginning in the Company’s first quarter of fiscal 2018.

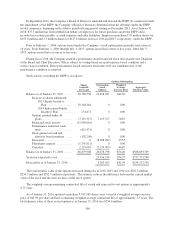

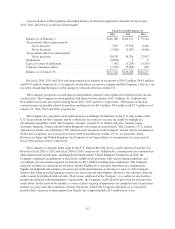

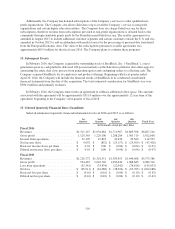

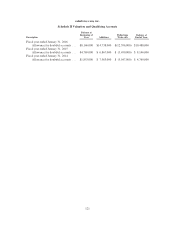

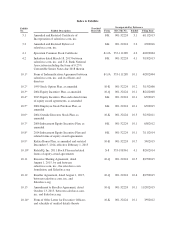

15. Selected Quarterly Financial Data (Unaudited)

Selected summarized quarterly financial information for fiscal 2016 and 2015 is as follows:

1st

Quarter

2nd

Quarter

3rd

Quarter

4th

Quarter Fiscal Year

(in thousands, except per share data)

Fiscal 2016

Revenues ............................ $1,511,167 $1,634,684 $1,711,967 $1,809,398 $6,667,216

Gross profit .......................... 1,129,365 1,229,300 1,288,284 1,365,719 5,012,668

Income from operations ................ 31,105 19,824 43,434 20,560 114,923

Net income (loss) ..................... $ 4,092 $ (852) $ (25,157) $ (25,509) $ (47,426)

Basic net income (loss) per share ......... $ 0.01 $ 0.00 $ (0.04) $ (0.04) $ (0.07)

Diluted net income (loss) per share ........ $ 0.01 $ 0.00 $ (0.04) $ (0.04) $ (0.07)

Fiscal 2015

Revenues ............................ $1,226,772 $1,318,551 $1,383,655 $1,444,608 $5,373,586

Gross profit .......................... 934,467 1,010,720 1,050,444 1,088,685 4,084,316

Loss from operations ................... (55,341) (33,434) (22,042) (34,816) (145,633)

Net loss ............................. $ (96,911) $ (61,088) $ (38,924) $ (65,765) $ (262,688)

Basic net loss per share ................. $ (0.16) $ (0.10) $ (0.06) $ (0.10) $ (0.42)

Diluted net loss per share ............... $ (0.16) $ (0.10) $ (0.06) $ (0.10) $ (0.42)

116