Salesforce.com 2016 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2016 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

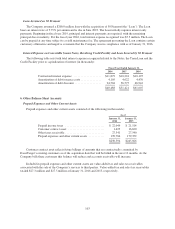

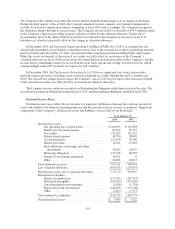

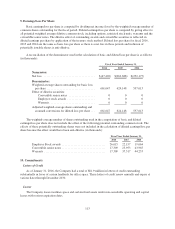

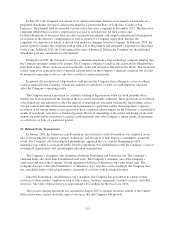

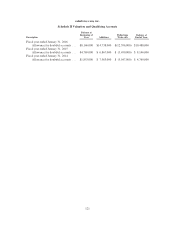

9. Earnings/Loss Per Share

Basic earnings/loss per share is computed by dividing net income (loss) by the weighted-average number of

common shares outstanding for the fiscal period. Diluted earnings/loss per share is computed by giving effect to

all potential weighted average dilutive common stock, including options, restricted stock units, warrants and the

convertible senior notes. The dilutive effect of outstanding awards and convertible securities is reflected in

diluted earnings per share by application of the treasury stock method. Diluted loss per share for fiscal 2016,

2015 and 2014 are the same as basic loss per share as there is a net loss in these periods and inclusion of

potentially issuable shares is anti-dilutive.

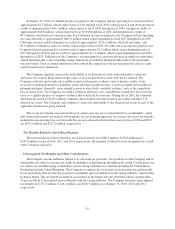

A reconciliation of the denominator used in the calculation of basic and diluted loss per share is as follows

(in thousands):

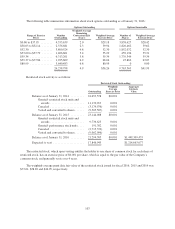

Fiscal Year Ended January 31,

2016 2015 2014

Numerator:

Net loss ................................... $(47,426) $(262,688) $(232,175)

Denominator:

Weighted-average shares outstanding for basic loss

per share ................................. 661,647 624,148 597,613

Effect of dilutive securities:

Convertible senior notes .................. 0 0 0

Employee stock awards ................... 0 0 0

Warrants ............................... 0 0 0

Adjusted weighted-average shares outstanding and

assumed conversions for diluted loss per share . . . 661,647 624,148 597,613

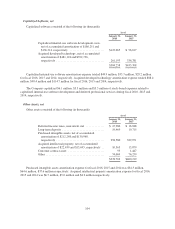

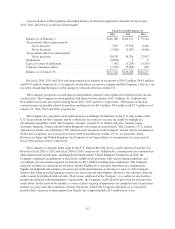

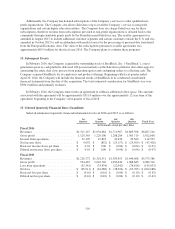

The weighted-average number of shares outstanding used in the computation of basic and diluted

earnings/loss per share does not include the effect of the following potential outstanding common stock. The

effects of these potentially outstanding shares were not included in the calculation of diluted earnings/loss per

share because the effect would have been anti-dilutive (in thousands):

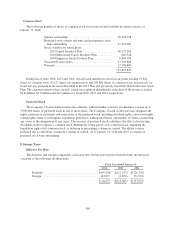

Fiscal Year Ended January 31,

2016 2015 2014

Employee Stock awards .............................. 26,615 22,157 19,664

Convertible senior notes .............................. 17,309 25,953 43,965

Warrants .......................................... 17,309 37,517 44,253

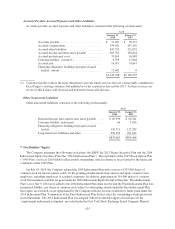

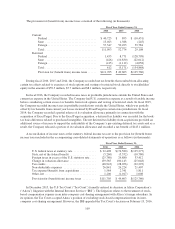

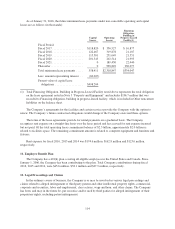

10. Commitments

Letters of Credit

As of January 31, 2016, the Company had a total of $81.9 million in letters of credit outstanding

substantially in favor of certain landlords for office space. These letters of credit renew annually and expire at

various dates through December 2030.

Leases

The Company leases facilities space and certain fixed assets under non-cancelable operating and capital

leases with various expiration dates.

113