Salesforce.com 2016 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2016 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

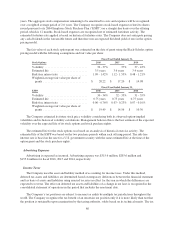

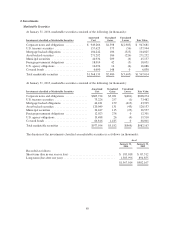

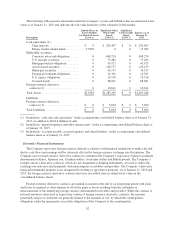

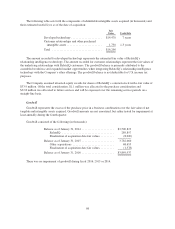

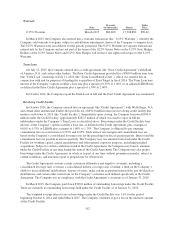

Details on outstanding foreign currency derivative contracts related primarily to intercompany receivables

and payables are presented below (in thousands):

As of January 31,

2016 2015

Notional amount of foreign currency derivative contracts ............ $1,274,515 $942,086

Fair value of foreign currency derivative contracts ................. $ (9,294) $ 4,917

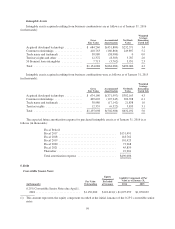

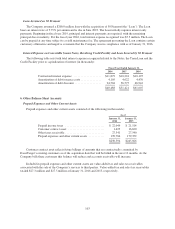

The fair value of the Company’s outstanding derivative instruments are summarized below (in thousands):

Fair Value of Derivative Instruments

As of January 31,

Balance Sheet Location 2016 2015

Derivative Assets

Derivatives not designated as hedging

instruments:

Foreign currency derivative

contracts .....................

Prepaid expenses and

other current assets $ 4,731 $10,611

Derivative Liabilities

Derivatives not designated as hedging

instruments:

Foreign currency derivative

contracts .....................

Accounts payable,

accrued expenses

and other liabilities $14,025 $ 5,694

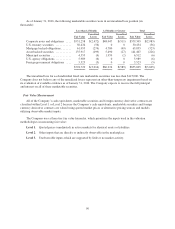

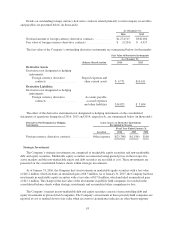

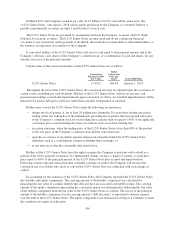

The effect of the derivative instruments not designated as hedging instruments on the consolidated

statements of operations during fiscal 2016, 2015 and 2014, respectively, are summarized below (in thousands):

Derivatives Not Designated as Hedging

Instruments

Gains (losses) on Derivative Instruments

Recognized in Income

Fiscal Year Ended January 31,

Location 2016 2015 2014

Foreign currency derivative contracts ............ Other expense $(25,786) $(1,186) $108

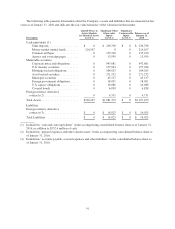

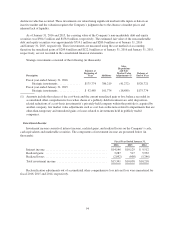

Strategic Investments

The Company’s strategic investments are comprised of marketable equity securities and non-marketable

debt and equity securities. Marketable equity securities are measured using quoted prices in their respective

active markets and the non-marketable equity and debt securities are recorded at cost. These investments are

presented on the consolidated balance sheets within strategic investments.

As of January 31, 2016, the Company had six investments in marketable equity securities with a fair value

of $16.2 million, which includes an unrealized gain of $8.5 million. As of January 31, 2015, the Company had four

investments in marketable equity securities with a fair value of $17.8 million, which included an unrealized gain

of $13.1 million. The change in the fair value of the investments in publicly held companies is recorded in the

consolidated balance sheets within strategic investments and accumulated other comprehensive loss.

The Company’s interest in non-marketable debt and equity securities consists of noncontrolling debt and

equity investments in privately held companies. The Company’s investments in these privately held companies are

reported at cost or marked down to fair value when an event or circumstance indicates an other-than-temporary

93