Salesforce.com 2016 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2016 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

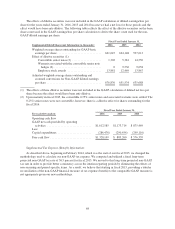

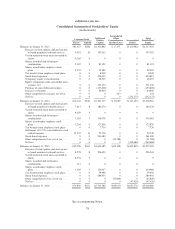

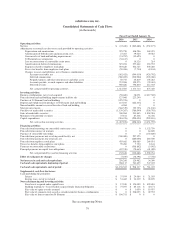

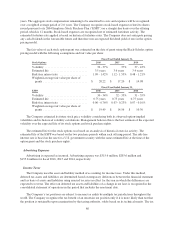

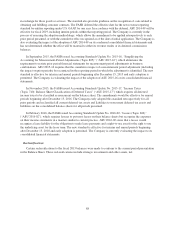

salesforce.com, inc.

Consolidated Statements of Stockholders’ Equity

(in thousands)

Common Stock Additional

Paid-in

Capital

Accumulated

Other

Comprehensive

Income/(Loss)

Accumulated

Deficit

Total

Stockholders’

EquityShares Amount

Balances at January 31, 2013 ............... 585,627 $586 $2,410,892 $ 17,137 $(110,982) $2,317,633

Exercise of stock options and stock grants

to board members for board services . . . 9,952 10 197,012 0 0 197,022

Vested restricted stock units converted to

shares ........................... 9,265 9 0 0 0 9

Shares issued related to business

combinations ...................... 2,367 2 81,191 0 0 81,193

Shares issued under employee stock

plans ............................ 2,932 3 92,482 0 0 92,485

Tax benefits from employee stock plans . . 0 0 8,048 0 0 8,048

Stock-based expenses ................. 0 0 494,615 0 0 494,615

Temporary equity reclassification ....... 0 0 26,907 0 0 26,907

Equity component of the convertible notes

issuance, net ...................... 0 0 121,230 0 0 121,230

Purchase of convertible note hedges ..... 0 0 (153,800) 0 0 (153,800)

Issuance of warrants .................. 0 0 84,800 0 0 84,800

Other comprehensive income, net of tax . . 0 0 0 543 0 543

Net loss ............................ 0 0 0 0 (232,175) (232,175)

Balances at January 31, 2014 ............... 610,143 $610 $3,363,377 $ 17,680 $(343,157) $3,038,510

Exercise of stock options and stock grants

to board members for board services . . . 7,413 8 182,270 0 0 182,278

Vested restricted stock units converted to

shares ........................... 9,259 9 0 0 0 9

Shares issued related to business

combinations ...................... 7,185 7 339,076 0 0 339,083

Shares issued under employee stock

plans ............................ 3,264 4 127,816 0 0 127,820

Tax benefits from employee stock plans . . 0 0 7,730 0 0 7,730

Settlement of 0.75% convertible notes and

related warrants .................... 13,332 13 22,736 0 0 22,749

Stock-based expenses ................. 0 0 561,480 0 0 561,480

Other comprehensive loss, net of tax ..... 0 0 0 (41,788) 0 (41,788)

Net loss ............................ 0 0 0 0 (262,688) (262,688)

Balances at January 31, 2015 ............... 650,596 $651 $4,604,485 $(24,108) $(605,845) $3,975,183

Exercise of stock options and stock grants

to board members for board services . . . 8,278 8 296,493 0 0 296,501

Vested restricted stock units converted to

shares ........................... 8,933 9 0 0 0 9

Shares issued related to business

combinations ...................... 117 0 0 0 0 0

Shares issued under employee stock

plans ............................ 3,005 3 154,957 0 0 154,960

Tax benefits from employee stock plans . . 0 0 59,496 0 0 59,496

Stock-based expenses ................. 0 0 589,955 0 0 589,955

Other comprehensive loss, net of tax ..... 0 0 0 (25,809) 0 (25,809)

Net loss ............................ 0 0 0 0 (47,426) (47,426)

Balances at January 31, 2016 ............... 670,929 $671 $5,705,386 $(49,917) $(653,271) $5,002,869

See accompanying Notes.

78