Salesforce.com 2016 Annual Report Download - page 118

Download and view the complete annual report

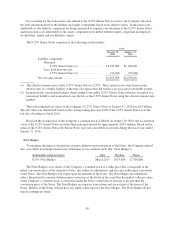

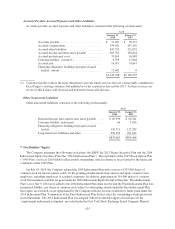

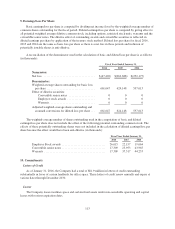

Please find page 118 of the 2016 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.At January 31, 2016, for federal income tax purposes, the Company had net operating loss carryforwards of

approximately $2.3 billion, which expire in fiscal 2021 through fiscal 2036, federal research and development tax

credits of approximately $146.3 million, which expire in fiscal 2020 through fiscal 2036, foreign tax credits of

approximately $26.8 million, which expire in fiscal 2019 through fiscal 2026, and minimum tax credits of

$0.7 million, which have no expiration date. For California income tax purposes, the Company had net operating

loss carryforwards of approximately $845.0 million which expire beginning in fiscal 2017 through fiscal 2036,

California research and development tax credits of approximately $124.2 million, which do not expire, and

$9.5 million of enterprise zone tax credits, which expire in fiscal 2025. For other states income tax purposes, the

Company had net operating loss carryforwards of approximately $1.1 billion which expire beginning in fiscal

2017 through fiscal 2036 and tax credits of approximately $11.1 million, which expire beginning in fiscal 2021

through fiscal 2026. Utilization of the Company’s net operating loss carryforwards may be subject to substantial

annual limitation due to the ownership change limitations provided by the Internal Revenue Code and similar

state provisions. Such an annual limitation could result in the expiration of the net operating loss and tax credit

carryforwards before utilization.

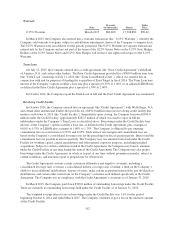

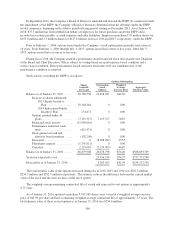

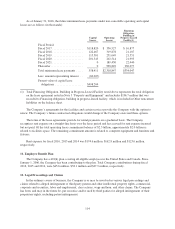

The Company regularly assesses the realizability of its deferred tax assets and establishes a valuation

allowance if it is more-likely-than-not that some or all of its deferred tax assets will not be realized. The

Company evaluates and weighs all available positive and negative evidence such as historic results, future

reversals of existing deferred tax liabilities, projected future taxable income, as well as prudent and feasible tax-

planning strategies. Generally, more weight is given to objectively verifiable evidence, such as the cumulative

loss in recent years. The Company recorded a valuation allowance as it considered its cumulative loss in recent

years as a significant piece of negative evidence that is difficult to overcome. During fiscal 2016, the valuation

allowance increased by $146.9 million, primarily due to federal and state research tax credits and other U.S

deferred tax assets. The Company will continue to assess the realizability of the deferred tax assets in each of the

applicable jurisdictions going forward.

The excess tax benefits associated with stock option exercises are recorded directly to stockholders’ equity

only when such benefits are realized following the tax law ordering approach. As a result, the excess tax benefits

included in net operating loss carryforwards but are not reflected in deferred tax assets for fiscal 2016 and 2015

are $623.2 million and $527.2 million, respectively.

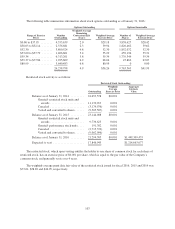

Tax Benefits Related to Stock-Based Expense

The total income tax benefit related to stock-based awards was $180.2 million, $170.8 million and

$147.8 million for fiscal 2016, 2015 and 2014, respectively, the majority of which was not recognized as a result

of the valuation allowance.

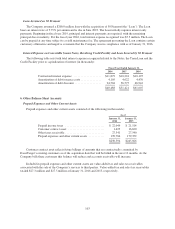

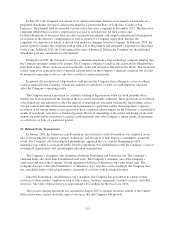

Unrecognized Tax Benefits and Other Considerations

The Company records liabilities related to its uncertain tax positions. Tax positions for the Company and its

subsidiaries are subject to income tax audits by multiple tax jurisdictions throughout the world. Certain prior year

tax returns are currently being examined by various taxing authorities in countries including the United States,

Switzerland and the United Kingdom. The Company recognizes the tax benefit of an uncertain tax position only

if it is more likely than not that the position is sustainable upon examination by the taxing authority, based on the

technical merits. The tax benefit recognized is measured as the largest amount of benefit which is greater than

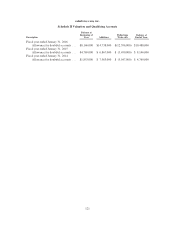

50 percent likely to be realized upon settlement with the taxing authority. The Company had gross unrecognized

tax benefits of $ 172.7 million, $ 146.2 million, and $102.3 million as of January 31, 2016, 2015 and 2014

respectively.

111